Edda Customer Deep Dive: Satgana

We sat down with Anil Maguru, Partner at Satgana to learn more about how Edda has helped Satgana’s growth.

Satgana is a next generation Climate Tech Venture Capital firm based in Paris, whose mission is to invest in the future of the earth.

In Sanskrit, ‘Satgana’ means ‘a good company’. Following a career in finance, Anil partnered with entrepreneur Romain Diaz to build Satgana: a VC firm which was purpose-driven and impactful. Anil and Romain focused on next-generation investments to help solve one of the biggest challenges faced by society – the climate crisis – believing that this challenge also presented a wealth of opportunity. These founding principles are shared by Edda, which is why it is the perfect partner platform for Satgana.

€10million

Fund

1500+

Opportunities

13

Portfolio companies

40%

Under-represented Founders

“Satgana is on a mission to use businesses as a force for good, by investing to create a fairer, more sustainable and regenerative future. We are founded on an ethos of integrity, transparency, humility, inclusion, empathy and ambition.”

Anil Maguru - Partner - Satgana

Satgana invests in food and agriculture, energy, transportation, industry and buildings, carbon removal and circular economy. They invest in any portfolio between pre-seed and seed with an average ticket between €100k and €200k, keeping some reserves to re-invest into their portfolios. As well as capital, they also support portfolios with marketing, HR and technology. They have a target to invest into 30 start-ups with a global scalability potential and a planet-positive impact across Europe and Africa.

Energy

Food & Agriculture

Circular Economy

“It’s important for us to build bridges between European and African countries.”

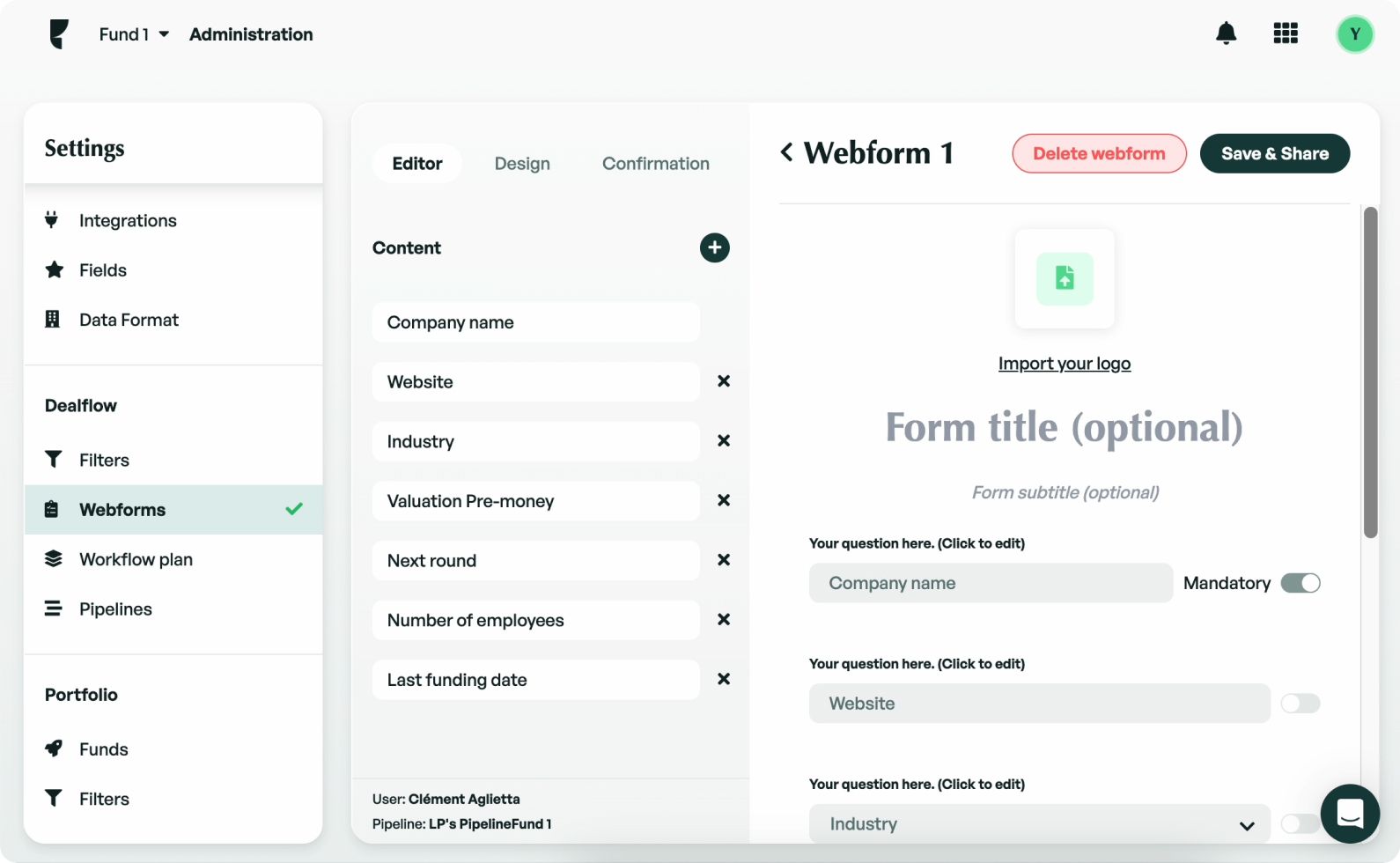

Deal Data Collection

“Firstly, it has allowed us to find the right tool which is able to collect all the different deals we were receiving. We receive between 60 to 80 pitches a week, so it was important for us to find one tool which can collect such a large amount of data, and to provide a clear vision of the landscape.”

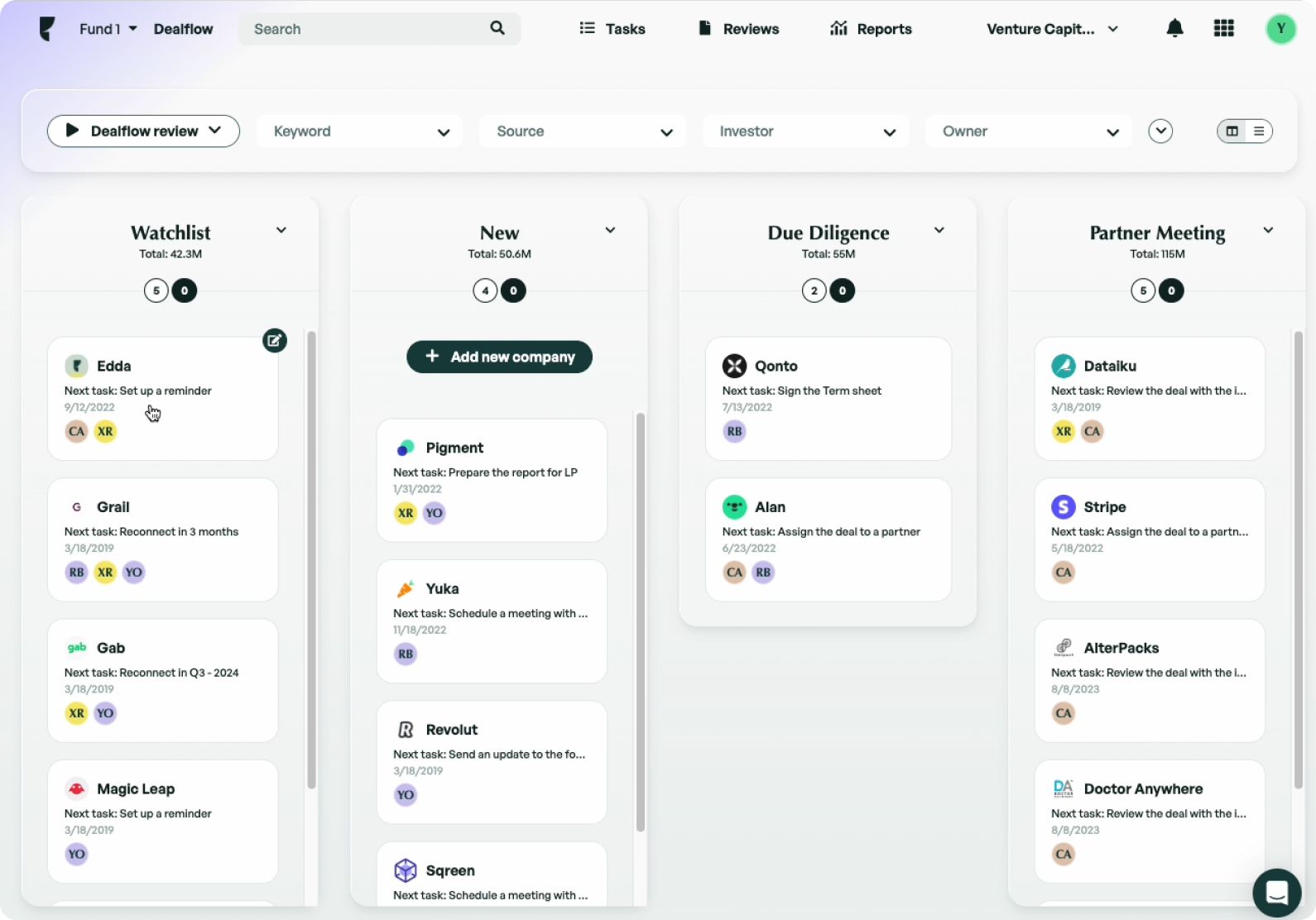

Managing Deal Flow

“Edda is also extremely useful for us to manage our workforce. We use Edda for all due diligence and for our deal flow meeting. All deal flow information is in one place – so we can clearly see which are ‘no-go’s’, which are to be discussed further, which we are proceeding with. We can also collect all the information we need about a company into the platform – so in one place we have the pitch deck, all our notes on the start-up, and we can track all email correspondence. It’s a really powerful tool.”

Portfolio Management

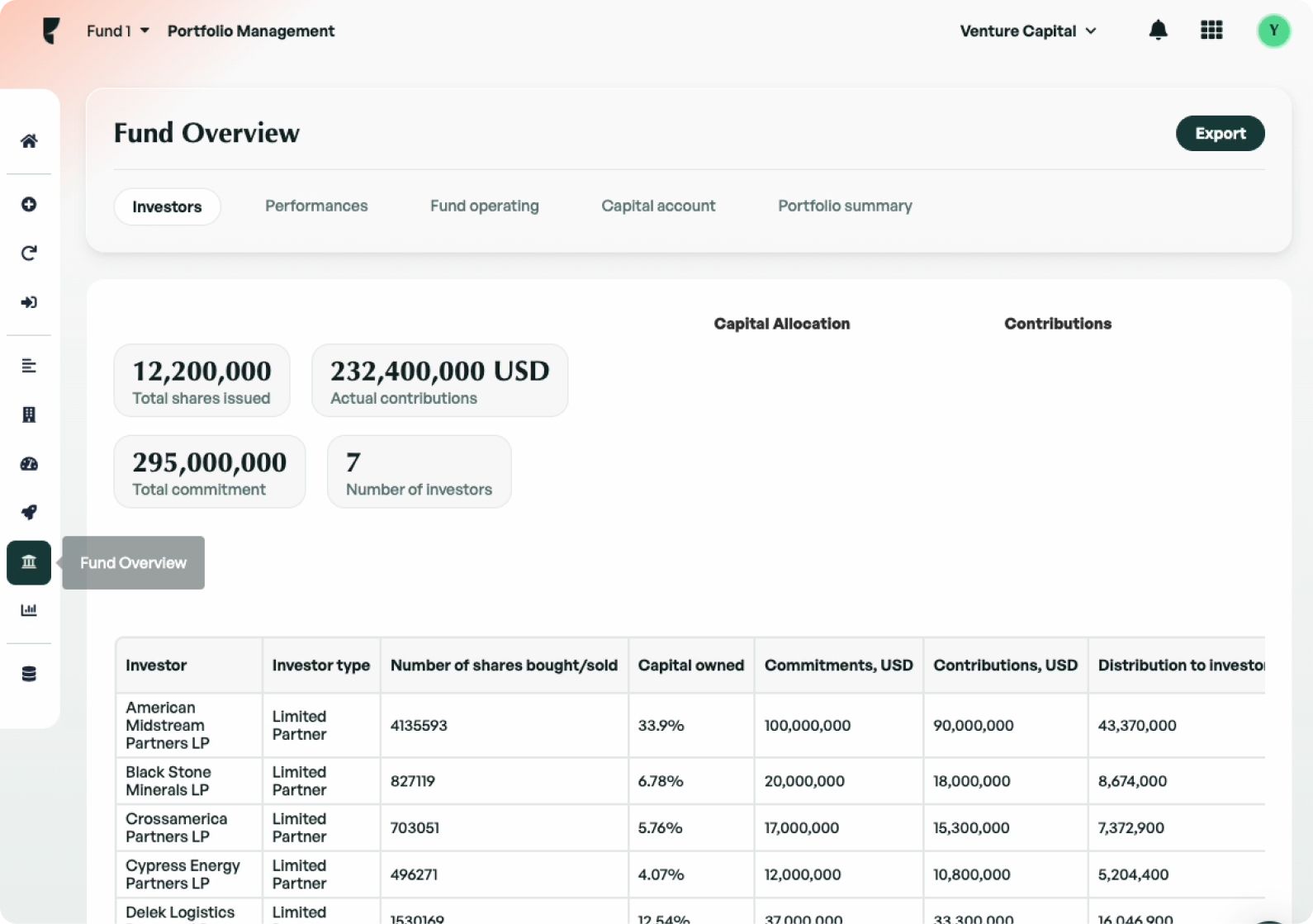

“After we have worked through the whole deal flow, we also use Edda to manage our portfolios. We can track everything – from capital to KPIs – which is vitally important for the next stage of investment. It’s a brilliant tool for communication. We can grant access to LPs so they can see at any time, in real time, the latest updates. LPs can access a report any time they want – whether they’re on a laptop or a smartphone.”

Finally, we wanted to get Anil’s insights into the future of the Climate Tech VC landscape

“If you look at the trajectory of Climate Tech, it is a relatively recent vertical and has boomed in the last three years. The climate funding gap remains huge, but despite the current VC market downturn, we think that the alignment of all sectors of the economy towards net zero goals makes climate investments a 30-year mega-trend. We need to invest both in scaling existing proven models as well as in bringing breakthrough technologies to market”

Switch your perspective. Get deeper insights. Create new worlds. Make your investments matter.

Related Blogs

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.