Discover HERA.I

Boost your workflow with AI-driven efficiency

Discover HERA.I

Boost your workflow with AI-driven efficiency Industry-Leading Dealflow

Our collaborative, intelligent Dealflow software is a pillar of top investors tech stack.

Investors in 40+ countries manage $170B in assets on Edda

Watch ideas flourish with your team

Discover Edda Dealflow’s tools to boost efficiency and clarity for your investments

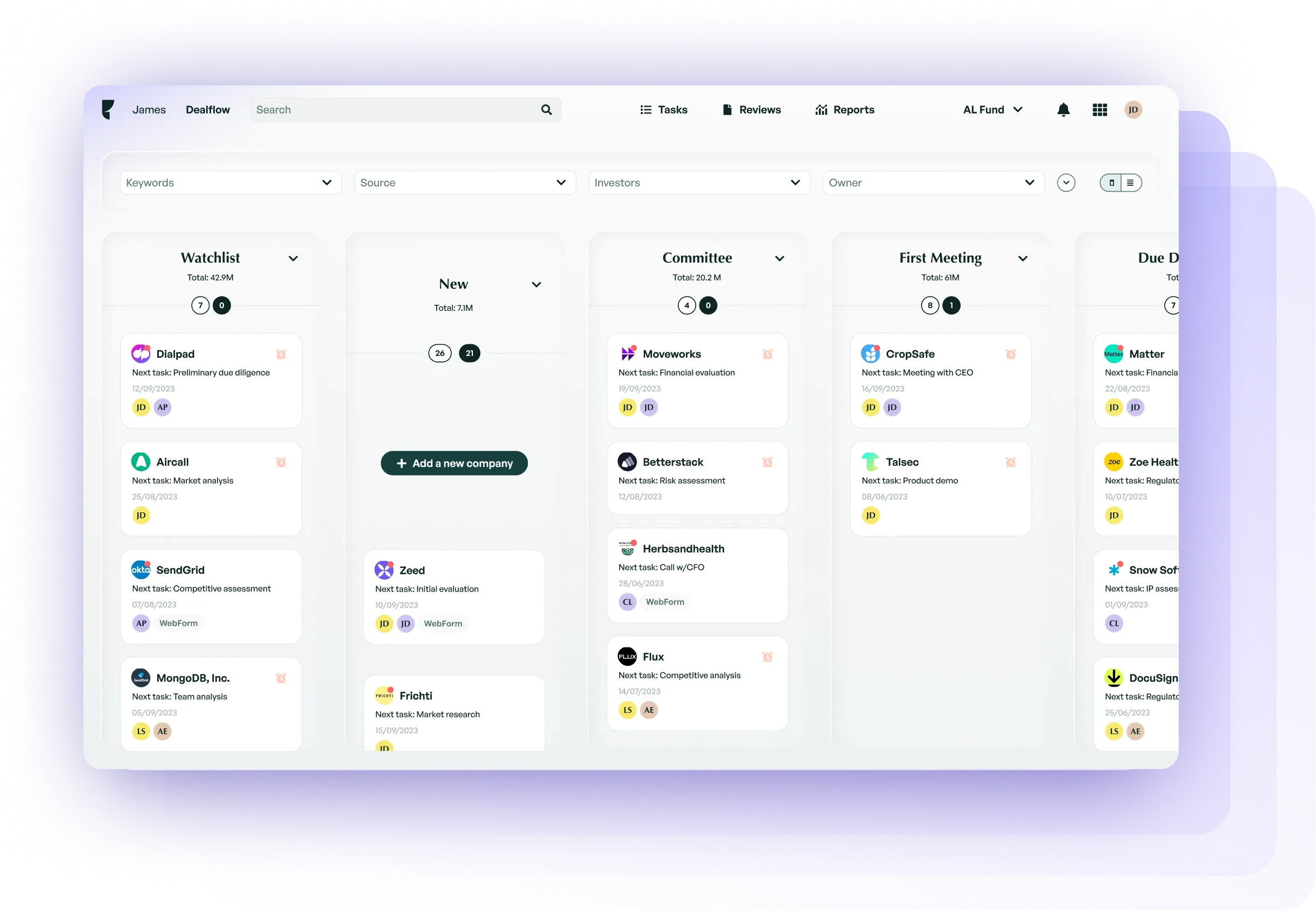

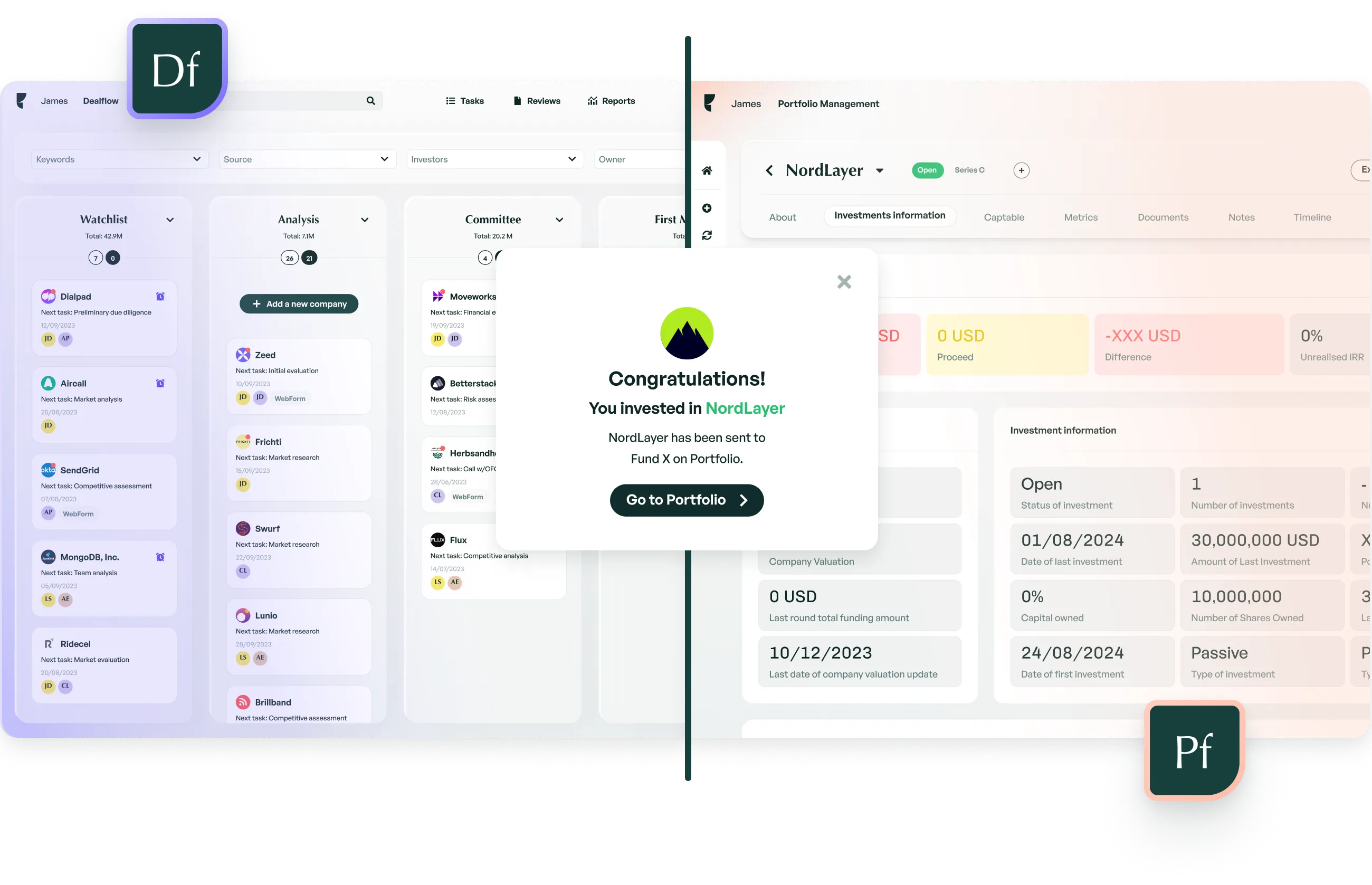

Intuitive Flexible Pipeline

Our dealflow fosters productivity by design. Experience unparalleled clarity with our pipeline workspace, completely customizable to your needs.

HERA.I Pitchdeck Importer  HERA.I

HERA.I

A game-changer in accelerating sourcing, this tool from our AI suite makes your screening process significantly more efficient and smooth.

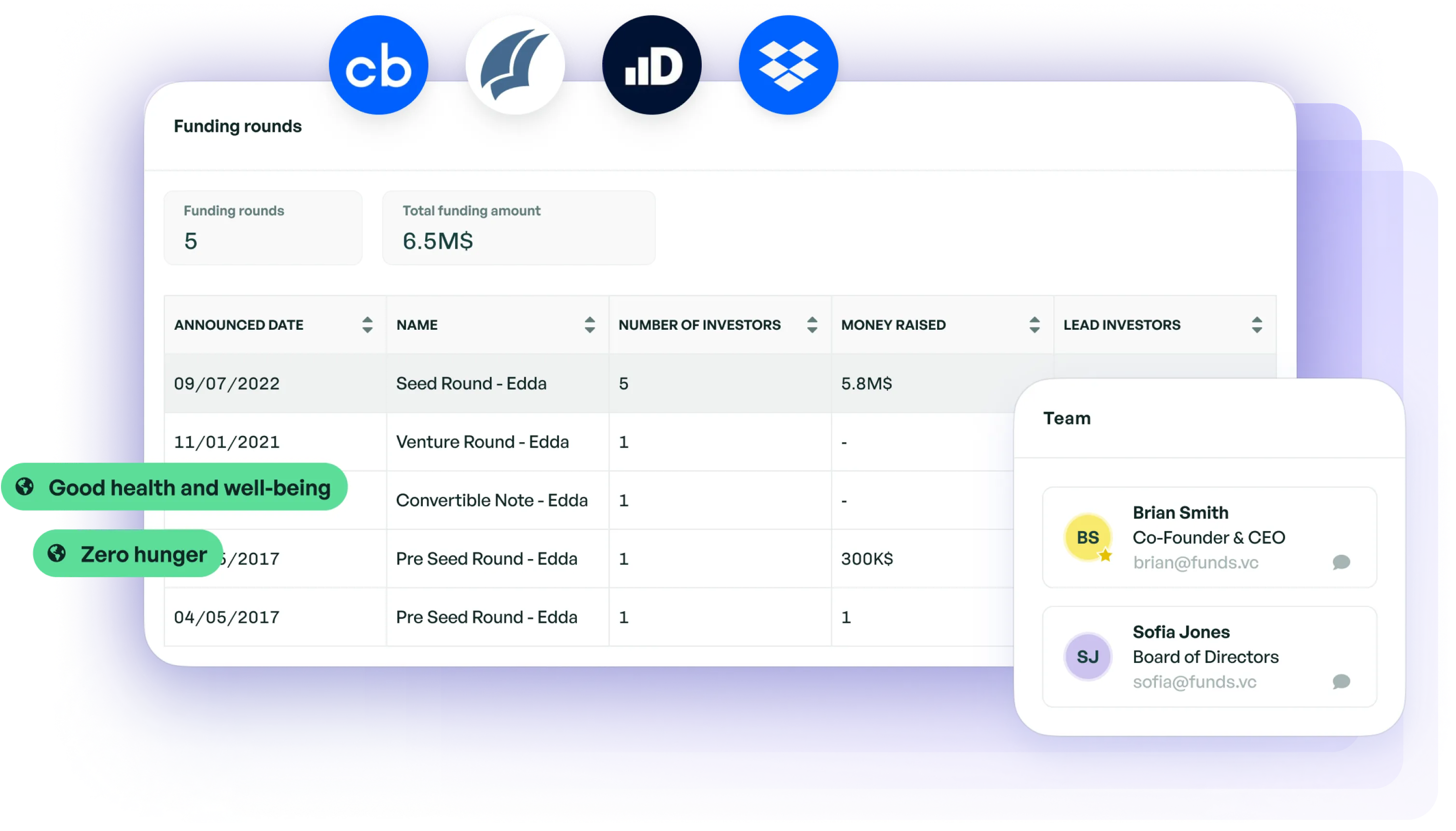

Strengthen and simplify due diligence

Due diligence research is smooth and thorough thanks to our integrations with Dealroom.co, Crunchbase, and Pitchbook. Effortlessly bolster your company profiles by importing data from our connected sources.

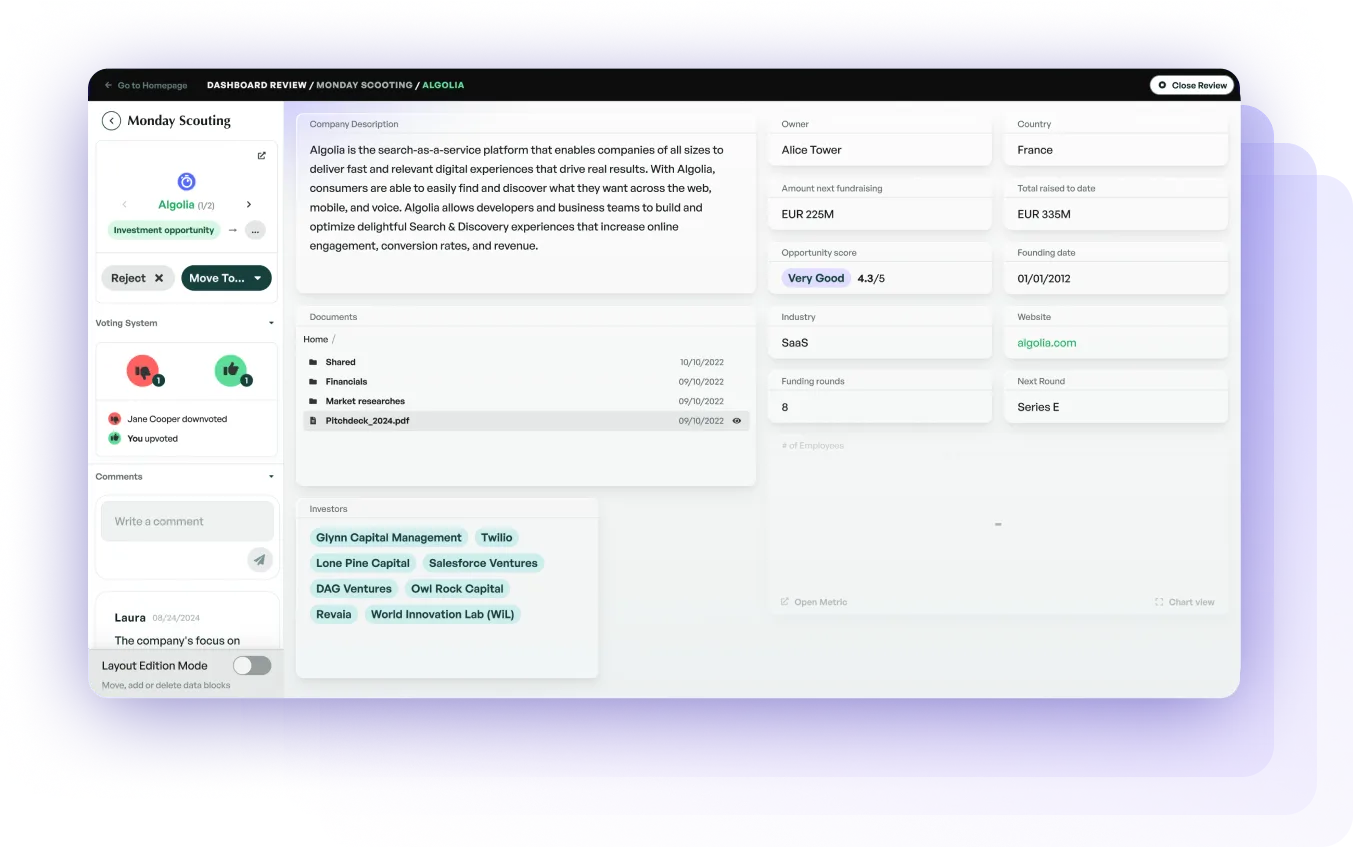

Seamlessly Collaborative Review

Easily share visibility of your Dealflow with your team and partners. Get a complete perspective using our collaborative Dealflow Review and Company Scoring features.

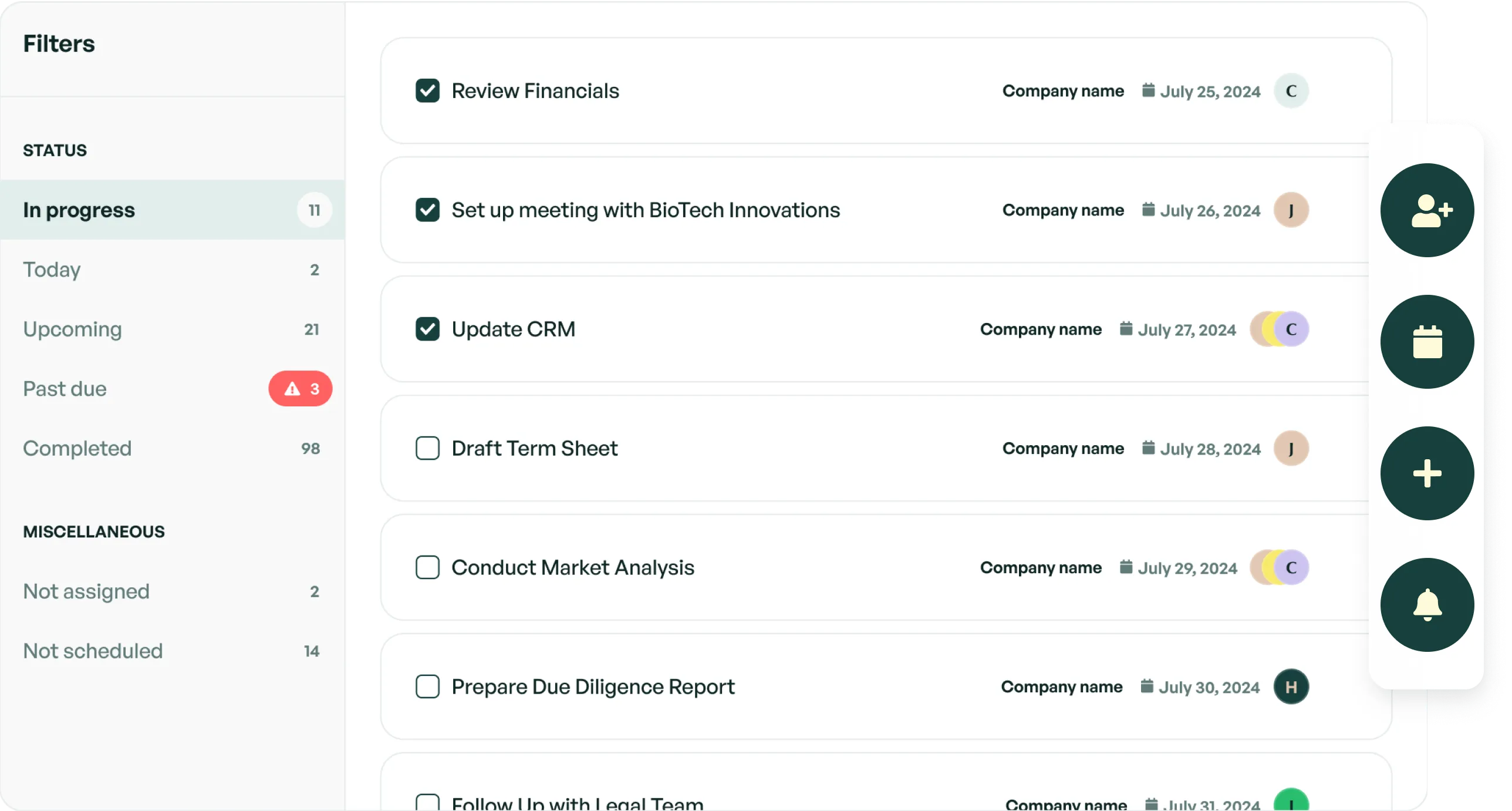

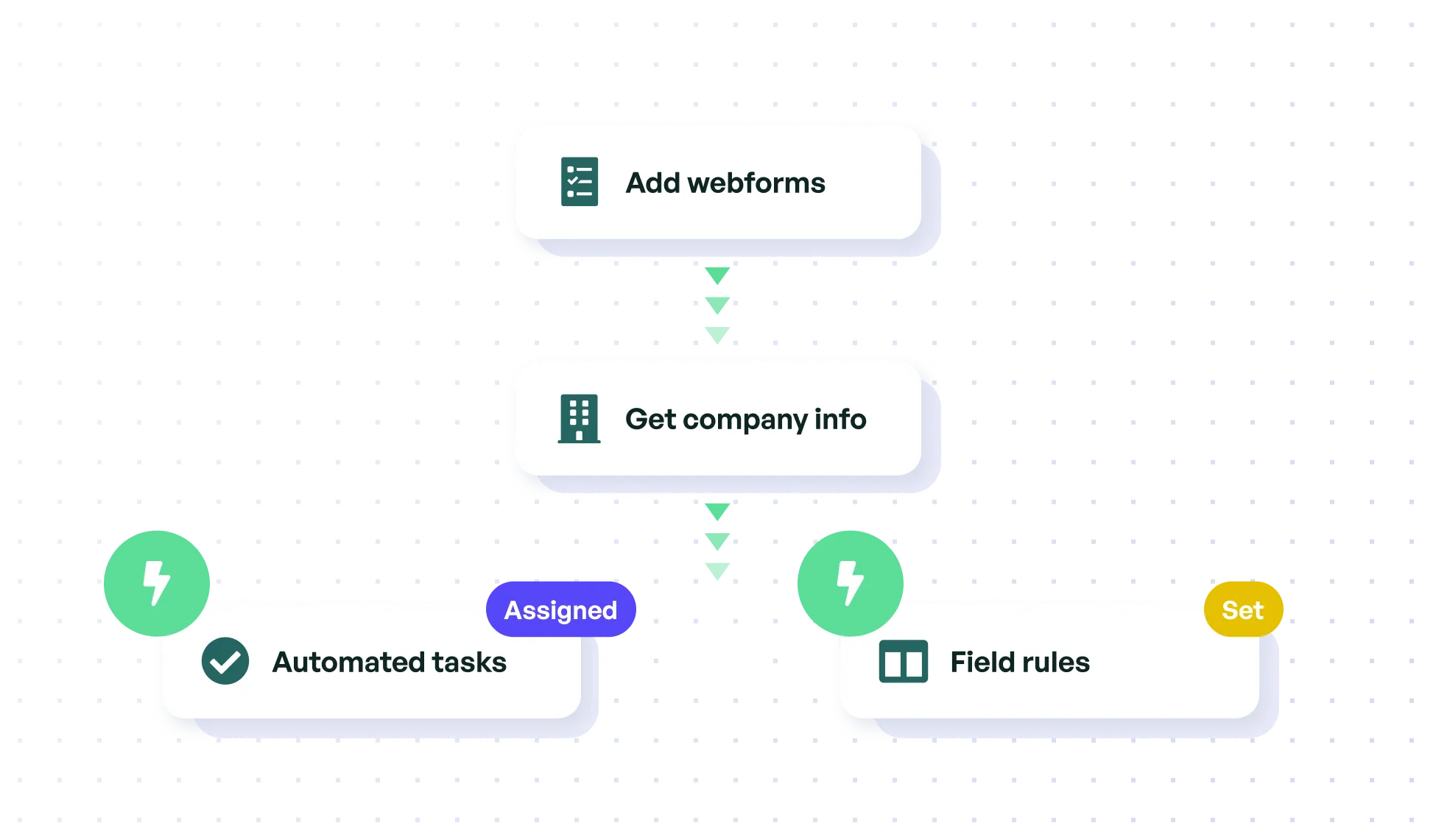

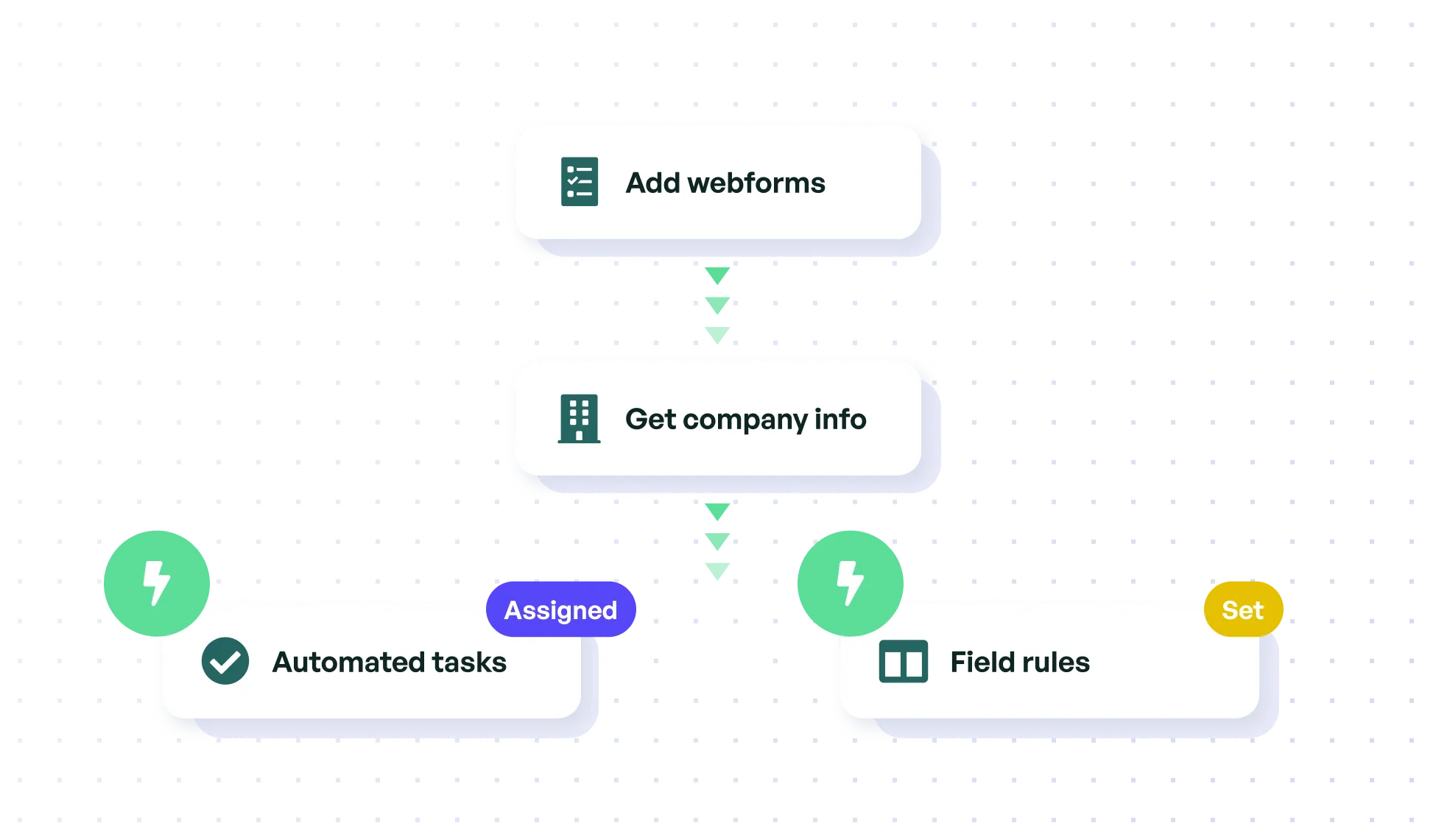

Streamline your entire workflow

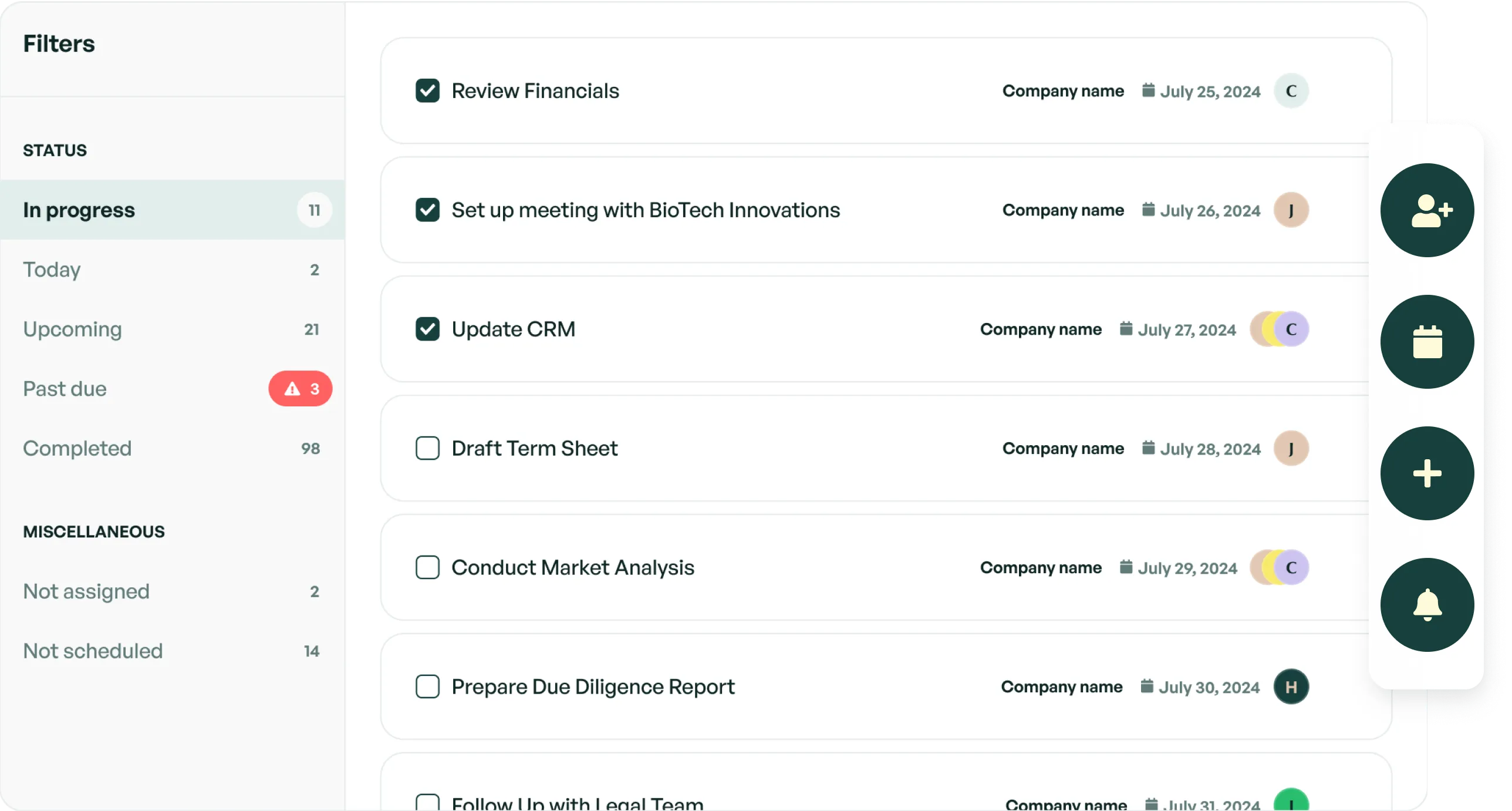

Record tasks and reminders

Your next steps are always visible in the right place. Record necessary actions with a company, assign them to your team, and view them throughout your Dealflow.

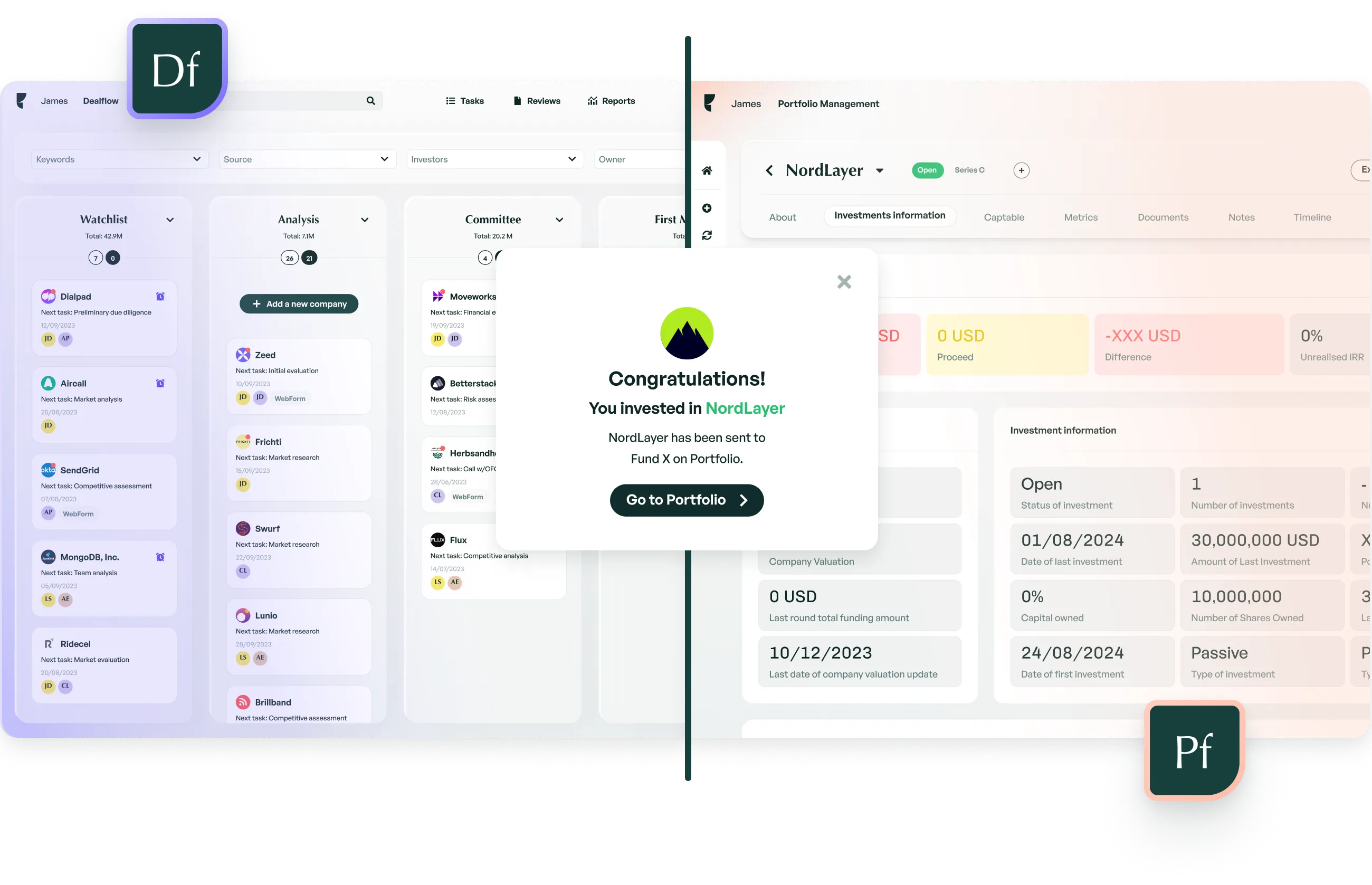

Seamless Dealflow to Portfolio

Once your Dealflow companies move to the “Invested” stage, their data is automatically transferred to your Portfolio - ready to manage immediately.

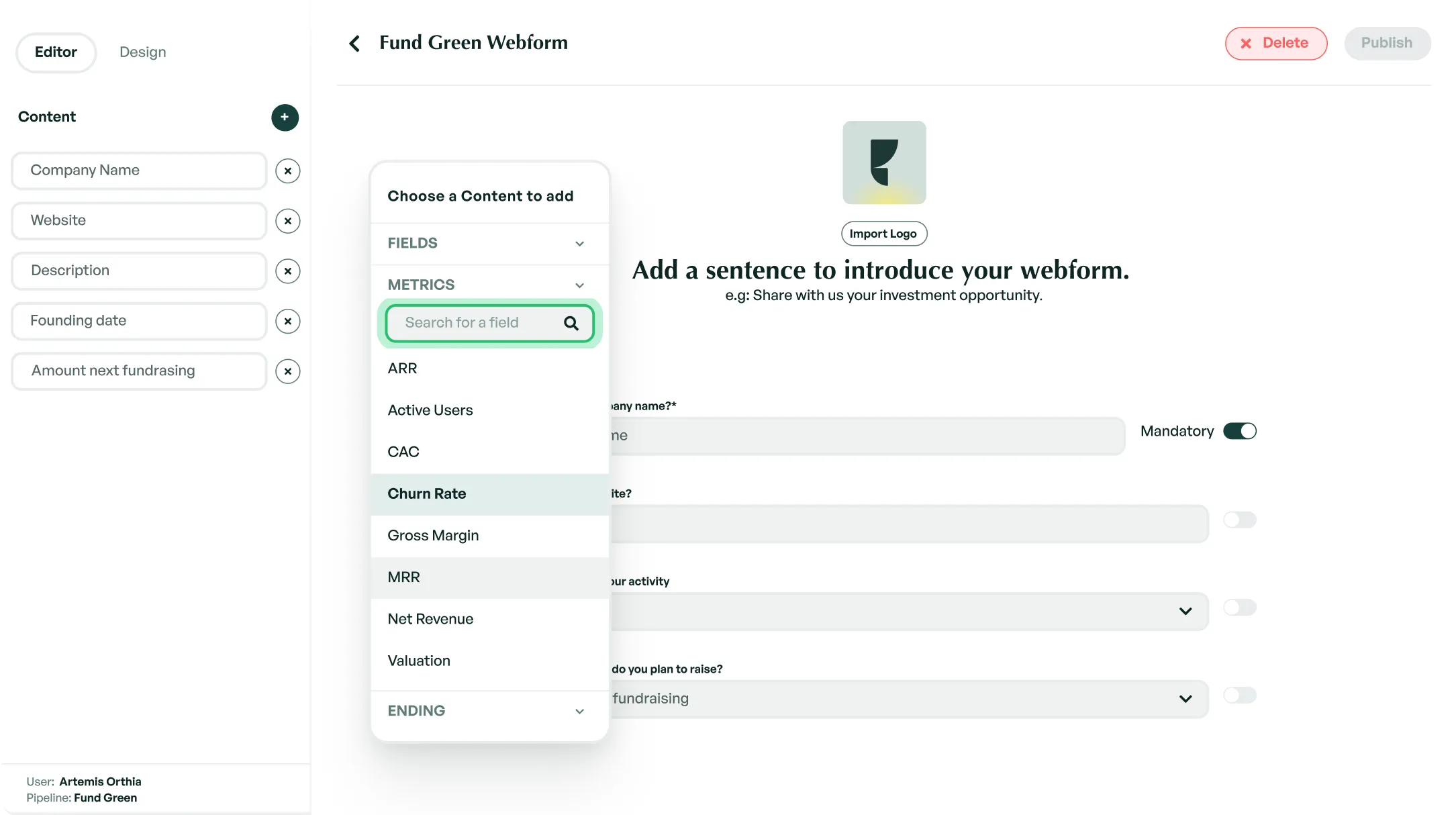

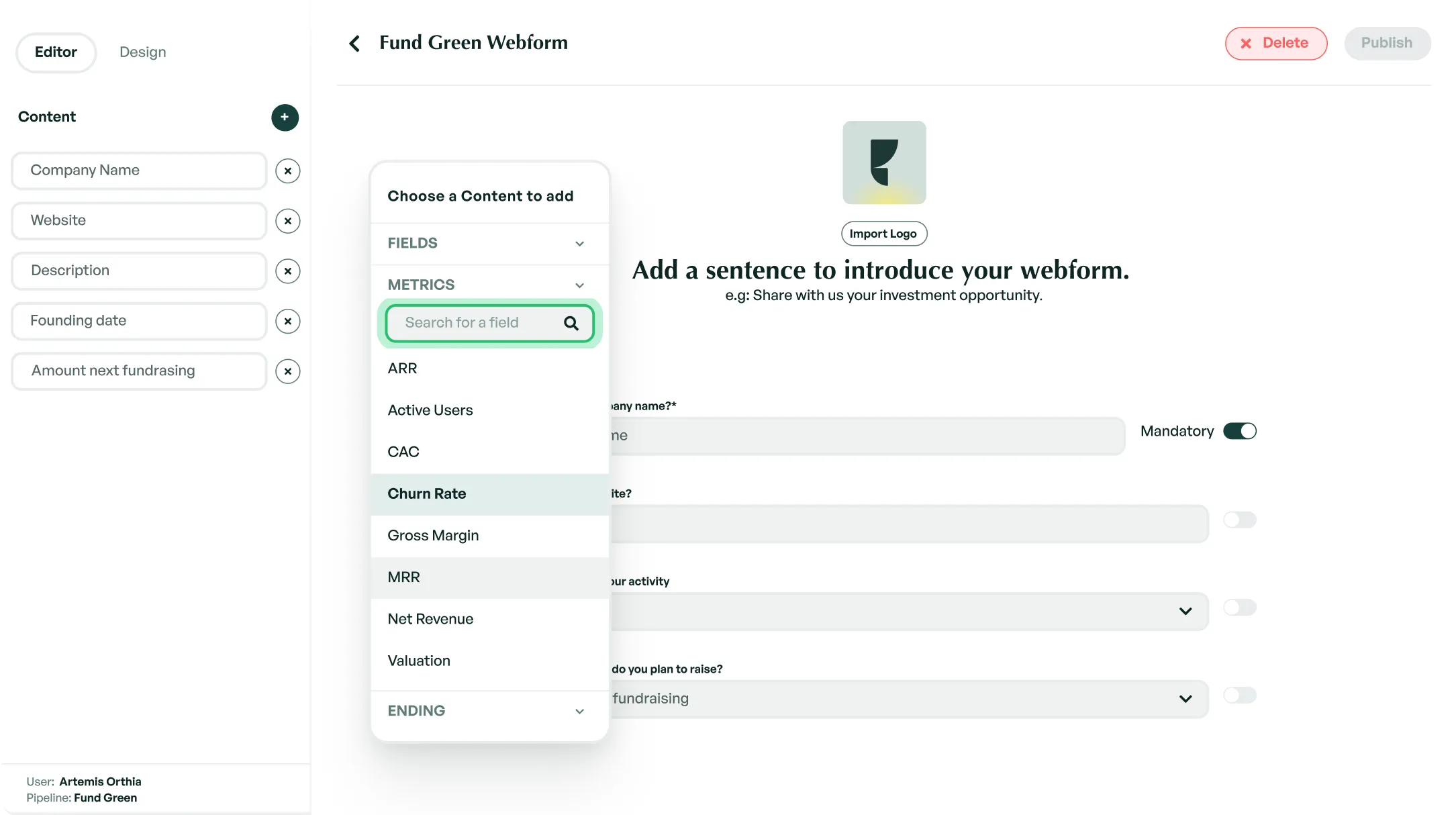

Smoother startup applications

Processing startup applications is clean and simple with Edda's embeddable custom webforms. Automatically receive submissions in your Dealflow that are ready to evaluate.

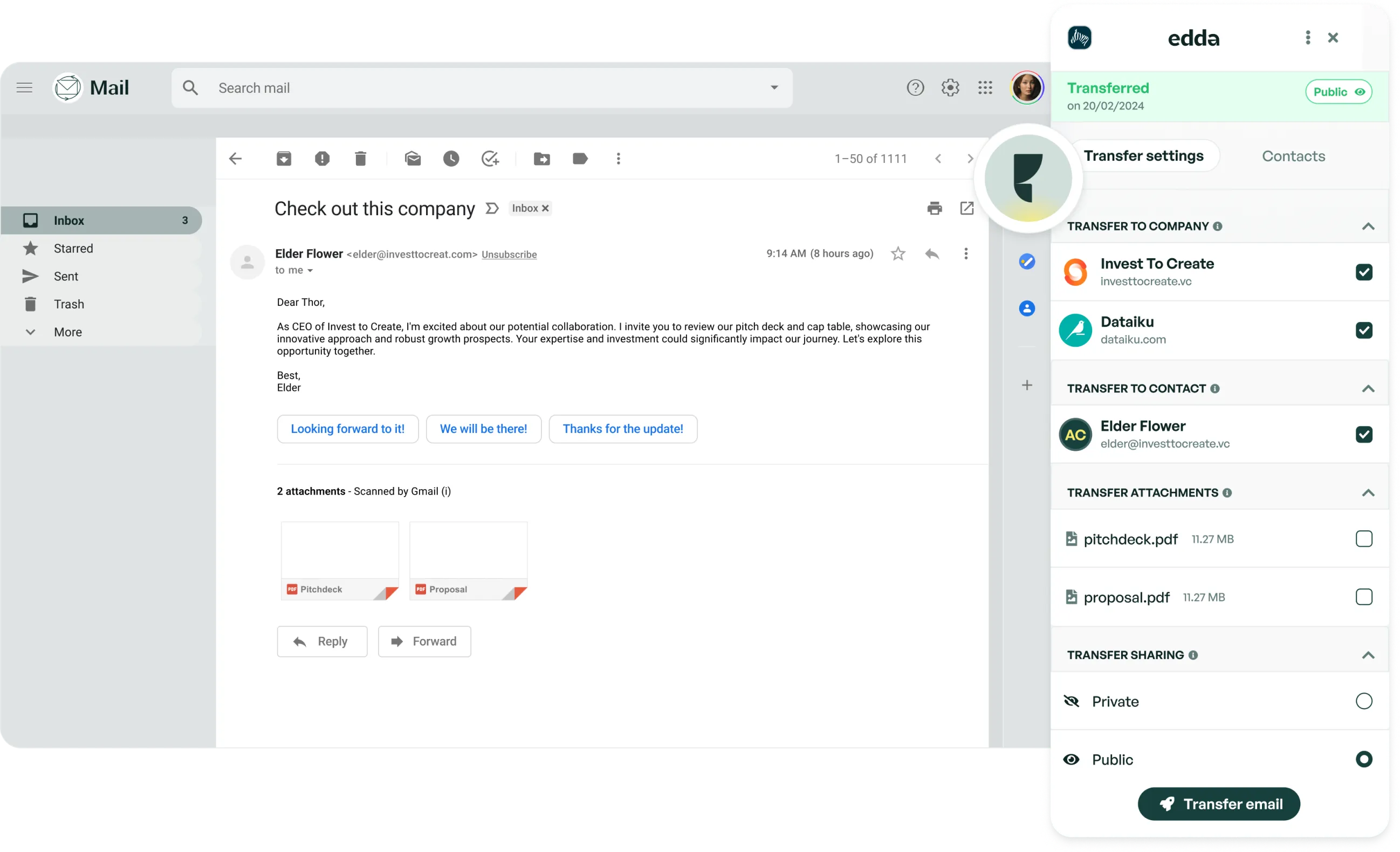

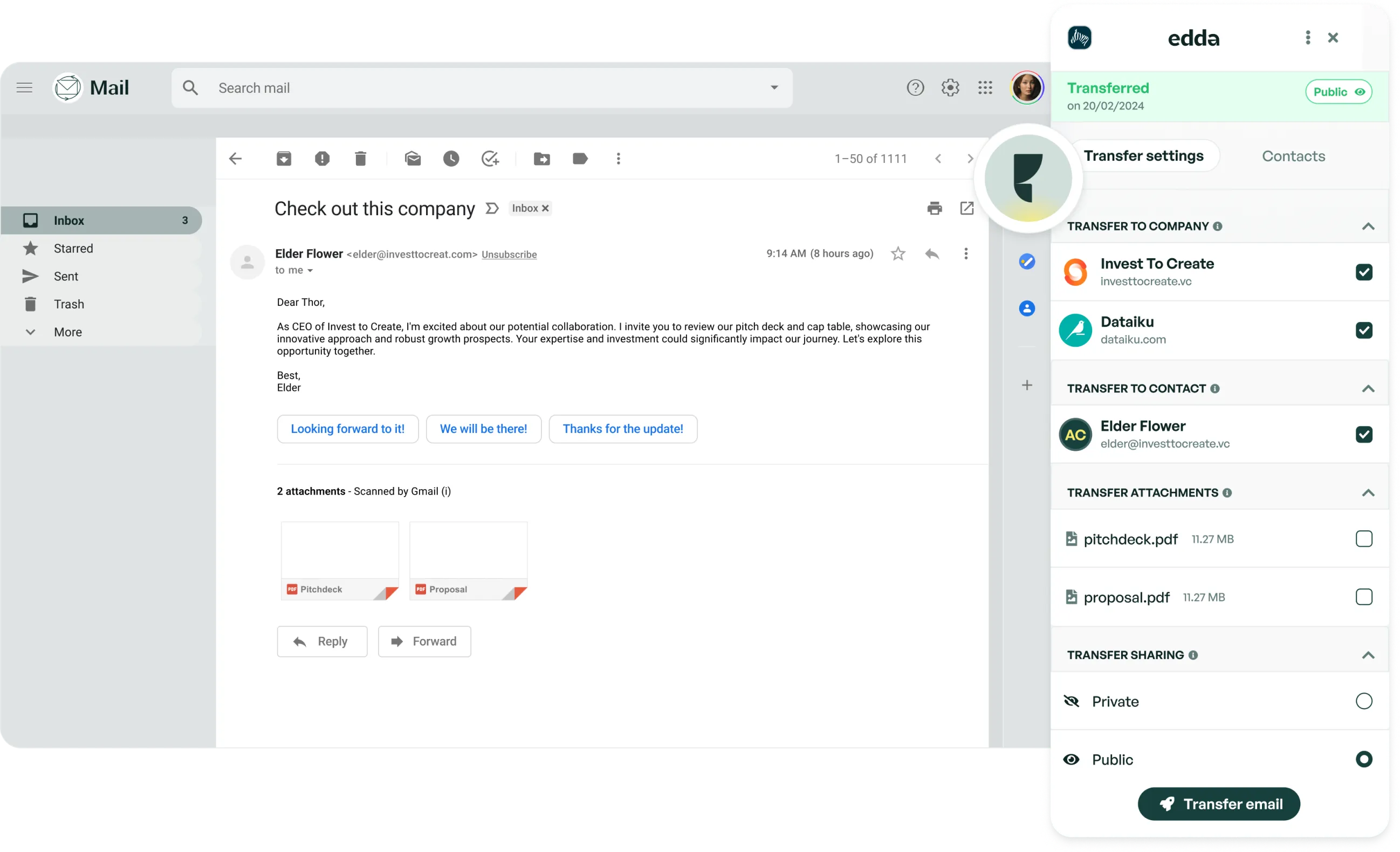

Never lose track of key emails

Link relevant emails to their corresponding company profiles using Edda’s in-platform inbox or Gmail & Outlook plugins. Our plugins allows you to select these emails from within your normal inbox.

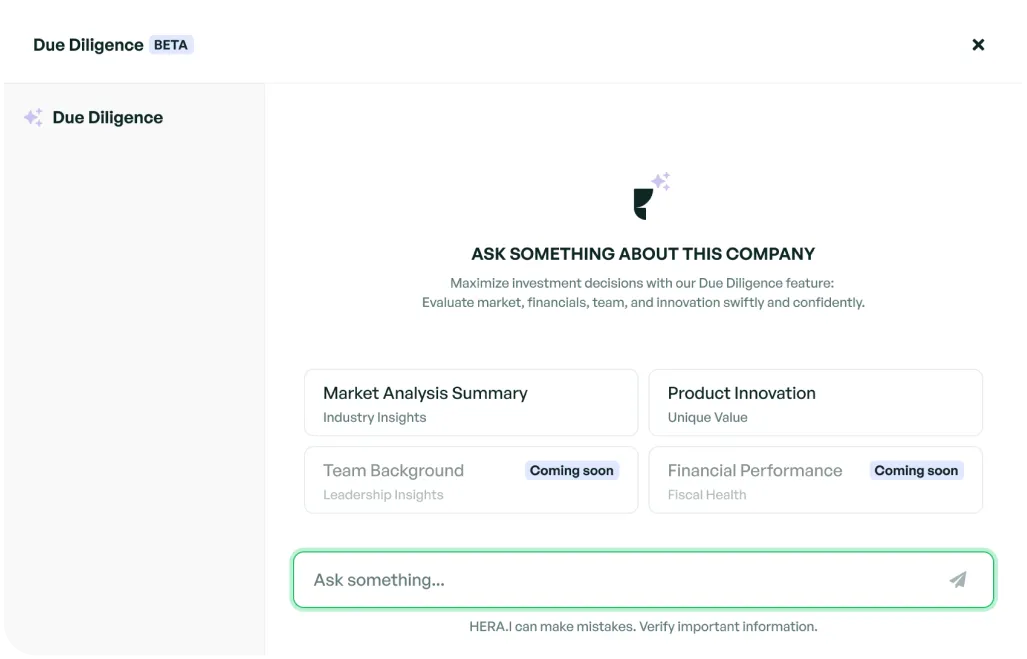

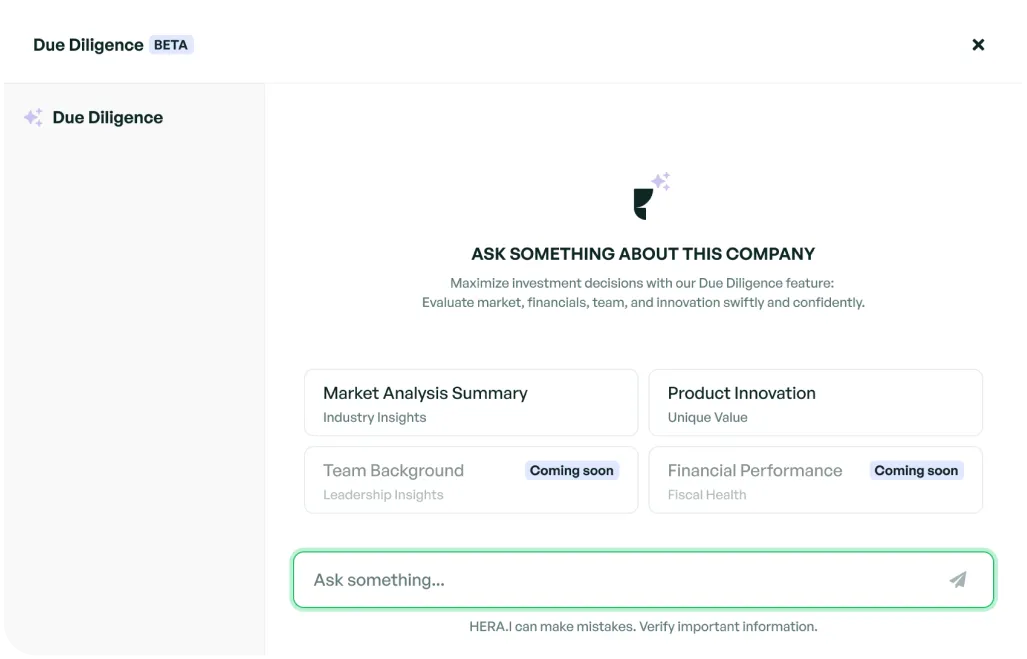

AI-powered Due Diligence

HERA.I Due Diligence Assistant enhances investment decisions with the power of AI. This chat is specifically optimized to offer insights and answers on any company in your Dealflow.

Record tasks and reminders

Your next steps are always visible in the right place. Record necessary actions with a company, assign them to your team, and view them throughout your Dealflow.

Seamless Dealflow to Portfolio

Once your Dealflow companies move to the “Invested” stage, their data is automatically transferred to your Portfolio - ready to manage immediately.

Smoother startup applications

Processing startup applications is clean and simple with Edda's embeddable custom webforms. Automatically receive submissions in your Dealflow that are ready to evaluate.

Never lose track of key emails

Link relevant emails to their corresponding company profiles using Edda’s in-platform inbox or Gmail & Outlook plugins. Our plugins allows you to select these emails from within your normal inbox.

AI-powered Due Diligence

HERA.I Due Diligence Assistant enhances investment decisions with the power of AI. This chat is specifically optimized to offer insights and answers on any company in your Dealflow.

Push your investments to the next level

Personalized onboarding and data importation

We guarantee a successful transition onto Edda by offering comprehensive data importation from any platform and personal onboarding with experts from our Customer Success team.

All data on Edda is secured and private

Our platform is built to international information security standards. Edda is SOC2 compliant and are audited regularly by cyber security experts.

Built by industry experts

Our tools target common obstacles in the investment process, offering solutions precisely tailored for the workflow of VC and PE investors.

Dealflow made to support everyone on your team

PARTNER AND GP

Simplified comprehensive reporting

PRINCIPALS

Score companies collaboratively

ANALYST

Automate tasks with top integrations

HEAD OF PLATFORM

Fully flexible pipeline

Seamless and powerful collaboration

Our review section is built to promote clarity between partners. Refine your communication with your LPs by providing them Edda-generated reports and visibility into your real-time Dealflow.

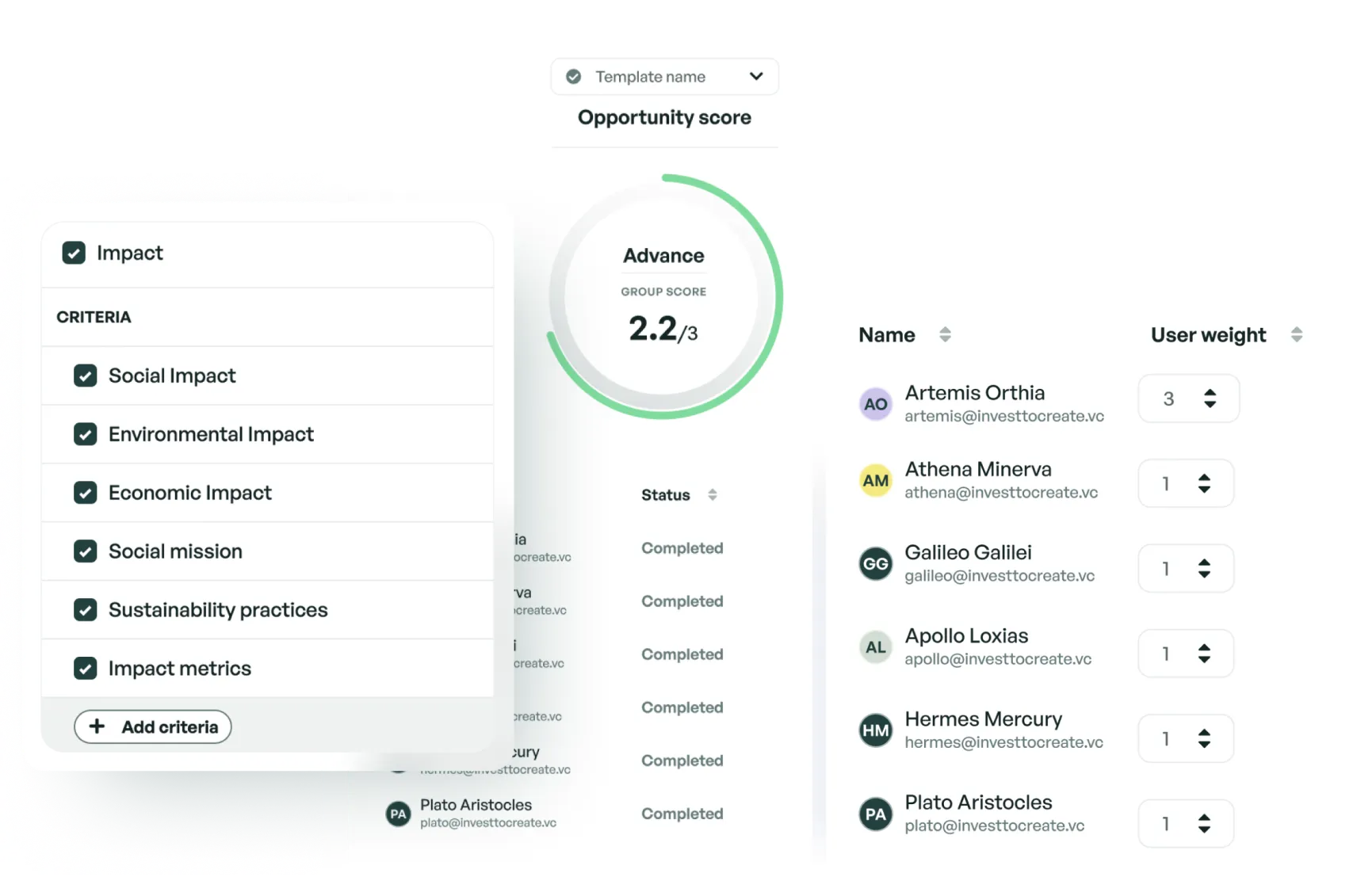

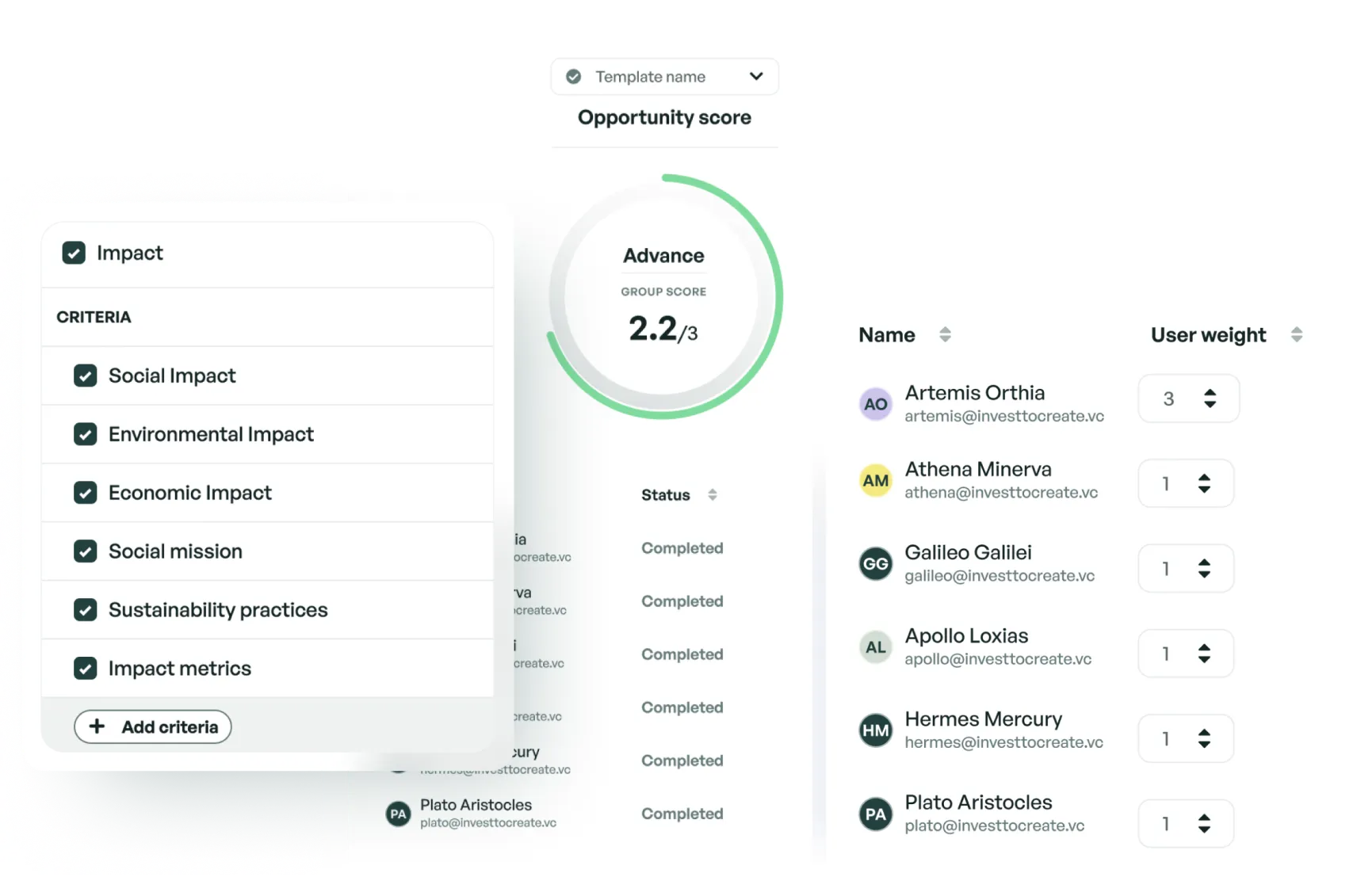

Identify top opportunities

Gain deep insights on your investment decisions with Company Scoring. Invite your team or collaborators to evaluate your deals using customizable scorecards and assign different weights to individuals.

Eliminate tedious tasks

Boost your workflow at every step with Edda’s integrations. Databases Dealroom, Crunchbase, and Pitchbook allow for new deals to be added in a click, while Dropbox and email provide visibility for key individual information.

Create your perfect workflow

Our intuitive Dealflow is fully flexible to your needs: customize your pipeline’s structure, augment it with top integrations, and identify the responsibilities of your team.

PARTNER AND GP

Simplified comprehensive reporting

Seamless and powerful collaboration

Our review section is built to promote clarity between partners. Refine your communication with your LPs by providing them Edda-generated reports and visibility into your real-time Dealflow.

PRINCIPALS

Score companies collaboratively

Identify top opportunities

Gain deep insights on your investment decisions with Company Scoring. Invite your team or collaborators to evaluate your deals using customizable scorecards and assign different weights to individuals.

ANALYST

Automate tasks with top integrations

Eliminate tedious tasks

Boost your workflow at every step with Edda’s integrations. Databases Dealroom, Crunchbase, and Pitchbook allow for new deals to be added in a click, while Dropbox and email provide visibility for key individual information.

HEAD OF PLATFORM

Fully flexible pipeline

Create your perfect workflow

Our intuitive Dealflow is fully flexible to your needs: customize your pipeline’s structure, augment it with top integrations, and identify the responsibilities of your team.

What our users say about us

“Edda is also extremely useful for us to manage our workforce. We use Edda for all due diligence and for our deal flow meeting. All deal flow information is in one place – so we can clearly see which are ‘no-go’s’, which are to be discussed further, which we are proceeding with.”

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.

Discover more about Edda

How to Choose the Best Dealflow Management Software to Simplify Your Dealflow and Close Deals Faster in 2026

As an investor, there’s a lot riding on the deals you make—and the ones you turn down. Your LPs have placed their trust in you—and they have big expectations. So, when it comes to investing, every tool, tactic or technique that can give you a competitive edge must be on the table. In today’s tech-driven world, deal management software can do just that, by helping you identify more deals and close them sooner on better terms.

Incredibly in today’s modern investment world, many funds invest billions yet still rely on Excel spreadsheets and hacked together systems. To put it simply, managing your firm without a deal flow solution is like plowing a field by hand, while everyone else is using a combine harvester.

But, as we’re sure you’ve discovered, there’s a lot to consider when it comes to choosing VCand PE portfolio management tools. After all, you have to be able to trust them with potentially billions of investor dollars.

In this comprehensive guide, you’ll learn how to choose the right venture capital software for your firm, so you can source more deals, manage your due diligence process, improve your decision-making, more easily manage your portfolio, strengthen relationships with your investors, and more.

What is Deal Flow Management Software?

As the name suggests, deal management software is purpose-built technology that helps private equity and venture capital firms more effectively and efficiently organize dealflow, manage the due diligence process and close deals on better terms.

As any investor knows, investing is a complex, non-linear and time-consuming process. It’s multifaceted, data-rich and critically reliant on decision making. Deal software acts as the backbone for your firm’s deal management process. It makes it more structured, informed and accurate, so that investors can source better deals, optimize the due diligence process and make better decisions.

A deal flow management tool is an all-in-one solution that allows firms to manage all the different stages of investment deals, including deal sourcing, pipeline and portfolio management, sales management, fundraising, due diligence, and more.

Why Use Deal Management Software in Your VC Fund?

There are few operations as complex as managing an investment firm. It depends on countless data points, relationships, decisions and sophisticated financial modeling and management.

Surprisingly, much of the industry still takes a legacy approach that involves endless Excel spreadsheets, emails, phone calls, calendar reminders and overly stretched human capital. A deal flow solution takes this highly manual, time-consuming approach and converts it into a systematized process that connects the full investment life cycle and firm management from top to bottom.

Is it possible to manage your firm without deal management software? Yes. But it’s also possible to get to the otherside of the world by ship in 3 weeks instead of a plane overnight, but why would you? So here are the top benefits of using deal management in your firm.

Manage Dealflow & Deal Sourcing in Real-time

Your dealflow is the lifeblood of your firm. Investor funds flow to funds with the best dealflow. Deal software enshrines the steps of your dealflow and deal sourcing processes into a systematized, repeated formula, eliminating the reliance on ad hoc processes, spreadsheets and emails.

Deal flow software helps you better manage your dealflow, enabling you to:

Build a more collaborative deal origination team

Increase visibility across departments and teams

Codify and implement your attractive deal signals

More accurately assess deal opportunities

Make faster, more informed decisions

Seamless Pipeline Management

Your deal pipeline contains multiple, distinct steps. Each with the potential to make or break a deal. Deal flow pipeline software increases the odds of reaching the end goal you set for each deal by, once again, systematizing the identification, evaluation and management of the deals you source.

In doing so, you’ll increase the discipline behind your decisions, removing emotions and uniformed hypotheses from the process. Dealflow software improves the management of the entire pipeline lifecycle, from sourcing right through to your ultimate investment decision.

More Effective Fundraising

It doesn’t matter the quality of the deals you see if you don’t have the requisite capital to invest. As an investor, you know that the art of fundraising is reliant on relationships, past success and your ability to sell your fund’s vision. With all its moving parts, the fundraising process can quickly become messy and convoluted.e. Deal flow management software moves the fundraising process out of inboxes, scribbled notes and spreadsheets, converting it to a highly optimized, methodical approach.

Managing fundraising using deal software enables you to:

Clearly define your fund strategy to attract investors who align with it

Get clear on your target investors based on preferences, risk appetite and investment capacity

Consolidate marketing materials for a more organized pitch process

Establish and update fundraising timelines to track progress

Set your fund’s legal structure and terms and conditions

Track funding coming into your fund and close it once fully subscribed

Improved Due Diligence

Your firm’s due diligence process is multifaceted and fundamental to your success. Deal software enables you to undertake all forms of due diligence—financial, commercial, operational, legal, tax, ESG, and others—so you can assess more deals in less time with higher accuracy.

Consolidated research and analysis

Assessment against defined investment criteria

Market and industry research, competitive benchmarking

Legal and regulatory documentation

Collaboration with external advisors

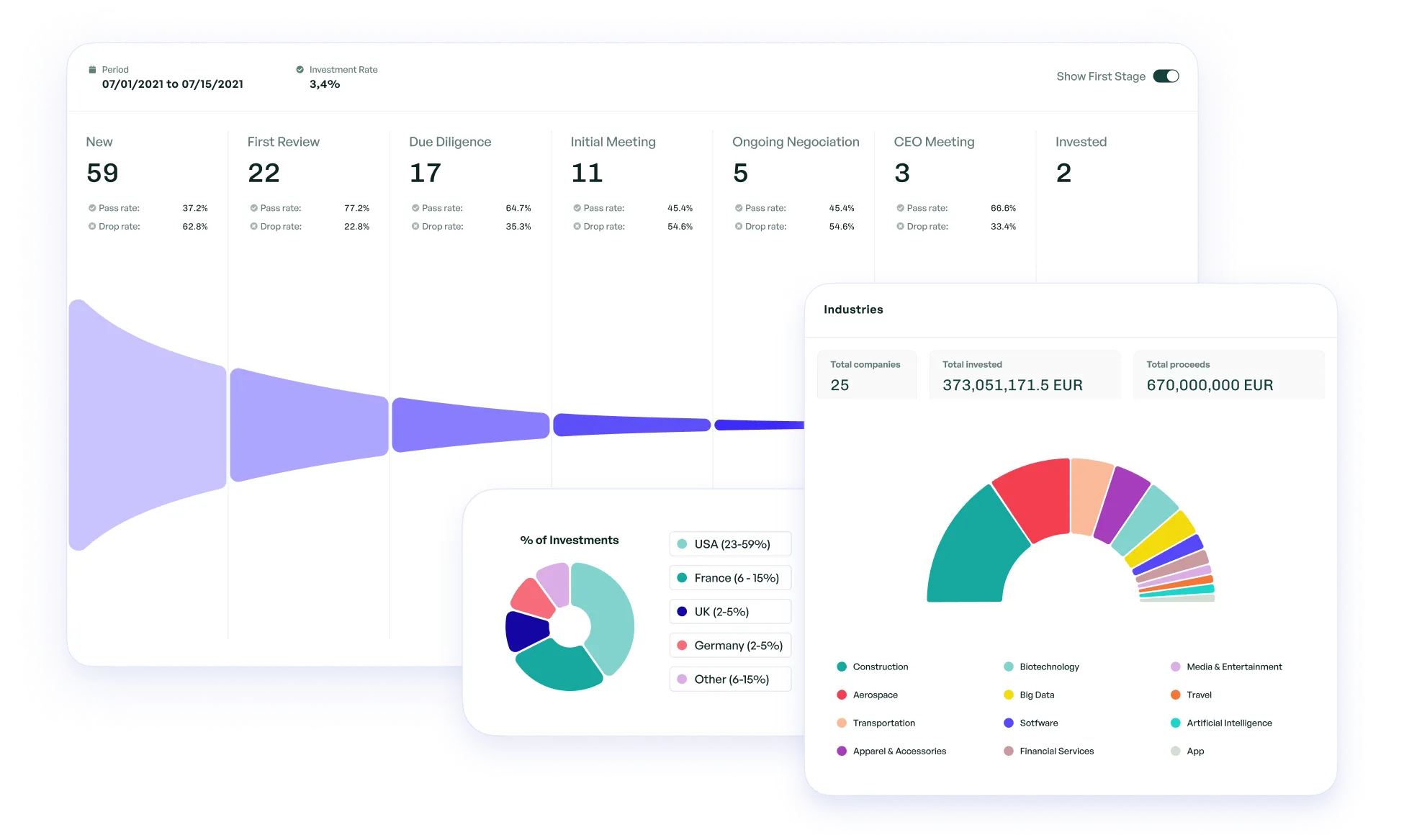

Optimized Portfolio Management

Once you hand over the check, then comes the task of managing your portfolio so you and your LPs have clear insights into company and fund performance. Robust portfolio management functionality makes this process more efficient and effective. The best portfolio management platforms enable your to:

Monitor portfolio value and track performance based on detailed metrics

See how your current portfolio aligns with your investment focus

Calculate IRR of funds and companies

Simplify valuations and compare portfolio companies side-by-side

Automatically calculate your NAV, DPI, TVPI

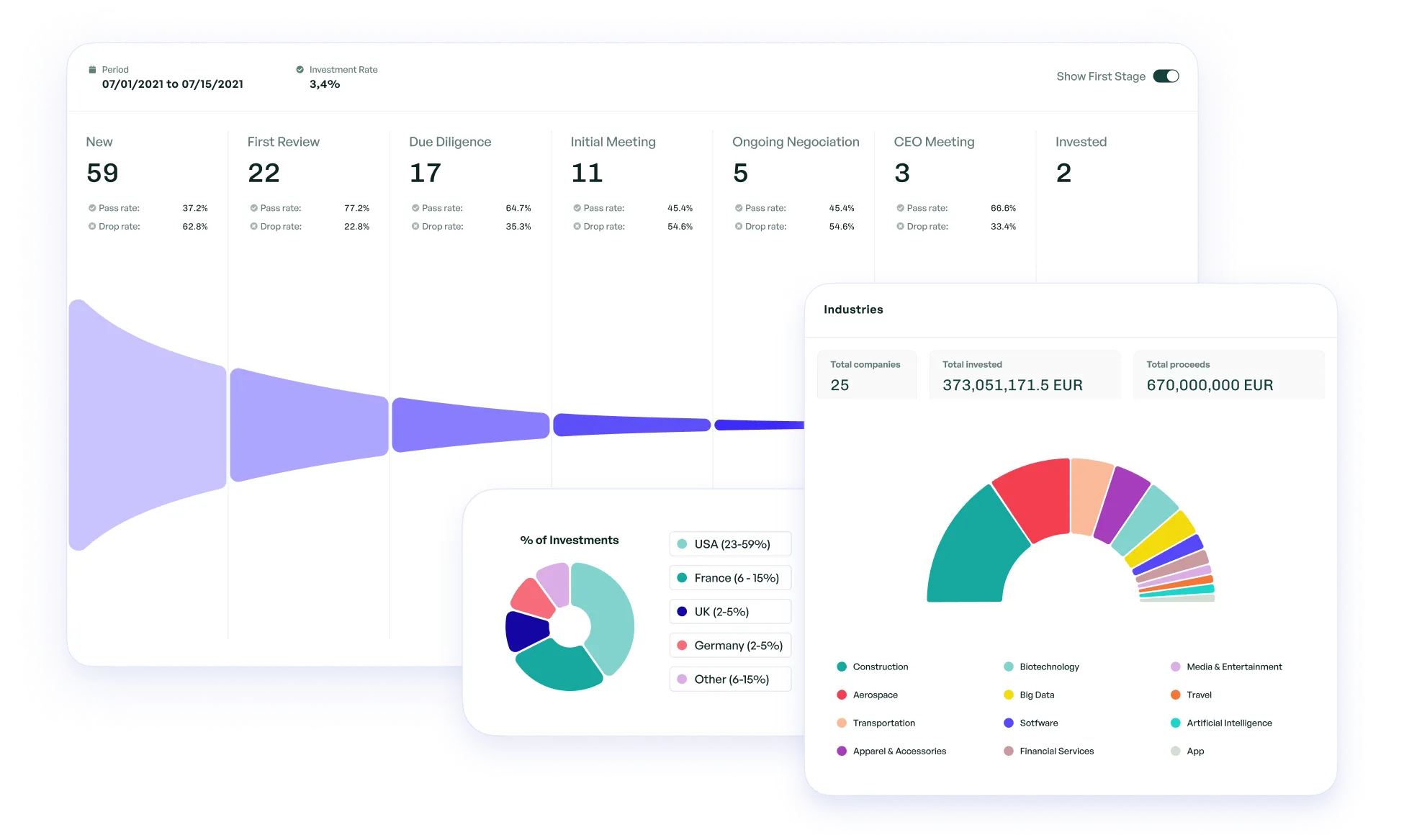

Simplified, In-Depth Reporting

With the push-button insights it provides, deal flow software makes reporting the status of your fund far more simple—internally with your team and externally with LPs and GPs. Get real-time updates on key aspects like invested amounts, share of ownership, operational KPIs and the latest board output.

As a firm that provides clear, in-depth reporting to your investors, you’ll offer an uncommon level or transparency that breeds trust with your LPs and GPs. Simplified reporting enables your to:

Use real-time investment metrics to provide detail-rich investor updates

Easily communicate fund performance, investment activities, and all material developments.

More easily compile quarterly and annual financial reports.

Make meetings with investors and committees more informed through in-depth data

What Features Should You Look for in Deal Management Software?

Deal software comes in many shapes. There’s venture capital deal flow software. Then there’s private equity deal management software. And then you’ll also find all-in-one PE and venture capital software solutions that cater to the complexities of all forms of investing.

As a VC firm, there are core features the deal flow pipeline software you choose must have. Let’s take a look at them…

Dealflow Management

As any serious investor knows, managing your dealflow can get messy. And it only gets worse the more deals that land in your inbox. So, intuitive, seamless dealfow management functionality is a must-have. A software-backed deal process enables you to more effectively manage your deal lifecycle, see your deal pipeline in real-time, prioritize and track deals, and monitor deal progress and follow-up as required.

Collaboration Features

Slack, teams, text messages, email… collaborating within your firm can quickly become overwhelming. Deal software with robust collaboration features helps keep your team connected and streamlines information flow on deals. Centralizing collaboration in this way saves time, improves decision-making and makes sure no detail is ever lost. Simply, it can be the difference between winning or losing a deal.

A Partner Portal

Your LPs and GPs shouldn’t have to sit in the dark and email you to get updates. A partner portal gives them transparency and streamlines communication. A portal provides a real-time line of sight into where their money is going, and how it’s performing. This is like a real-time data room for your LPs and GPs.

Document Management

Investing comes with a whole lot of paperwork. It can get overwhelming for all involved. That’s why it’s vital your deal software is equipped with in-built, secure document sharing functionality. A way that you can easily share investor updates, contracts, reports and every other piece of vital information with your partners.

Integrations

All modern teams run on multiple software tools. That’s why it’s critical that your deal flow solution makes integrations with other tools simple. Your deal software must seamlessly integrate with the tools you use daily to connect your data end-to-end and provide a smooth user experience.

Compliance and Security

Needless to say that when you’re managing millions of dollars and sensitive data, security is paramount. At a minimum, your deal software must be ISO 27001, SOC2 and GDPR compliant. The most secure deal management solutions will also undergo routine, third-party code audits from security experts to prevent data breaches.

Relationship Management (CRM)

There’s no getting around it: the success of your firm relies on the quality of your relationships. And strong relationships are built on the back of having a dependable customer relationship process in place, which requires a dedicated deal flow CRM platform.

Many PE firms will rely on generic CRM software. But the reality is that while these are solid relationship management tools, they don’t properly cater to the needs and nuances of investor relations. Your deal flow CRM software needs to be geared toward the more complex, protracted and relationship-based nature of investing.

Project & Workflow Management

As you know, VC firm workflows are complex, require disparate data inputs and don’t always follow a straight line - deals can move sideways and backwards, as often as they do forwards.

Workflow management features automate and streamline your deal workflows, and dramatically reduce potential for deal-compromising errors or omissions. Simpy, workflow management functionality acts as your single source of truth. It consolidates information, avoids silos, tracks deal lifecycles, automates workflows with tasks and reminders, and more.

Customization

Just like that custom suit you put on for meetings with big LPs, your deal management software must be customizable. It should be configurable to your firm's processes, structures and preferences. The reality is that rigid solutions can be like trying to fit a square peg in a round hole. Simply, if your deal software isn’t customizable to your team’s needs, adoption will be stunted and you won’t get the full streamlining effects.

The Best Deal Management Software Solutions Available Today

There are a handful of robust deal management solutions available. And no two are alike. As mentioned earlier, there’s VC portfolio management software and private equity deal flow software, each of which can come with subtle differences.

So when making a decision about adopting deal software in your firm, it’s important that you know the functionality you need and which solution can deliver on it. You need to be sure that you have the right deal management software for your firm’s investment approach. --

Edda - The Most Complete Dealflow Management Software

With $170 billion managed through its platform in 40+ countries, it’s clear why Edda is the deal software of choice for many leading firms. Edda is built on the core principle of enhanced visibility at all stages of the investment process. This unparalleled transparency allows you to see the status, impact and value of your investments in real-time.

Edda is truly an end-to-end solution for investment firms that unifies your team and operations. Where Edda also stands out is the fact that it’s designed as one of the few platforms that is both private equity and venture capital deal flow software.

Edda’s PE and VC portfolio management tools bring deal origination, the due diligence process, portfolio management, partner communications, and every other aspect of deal-making into a single all-in-one solution. Better yet, Edda is one of the few platforms that provides a mobile app, catering to the increased reliance on smartphones in today’s investment world.

Top Features:

Dealflow & portfolio management

Relationship management CRM

Workflow automations

Accelerated due diligence

LP Portal

Mobile App

Simple integrations

Enterprise-grade security (SOC2)

Keep Your Dealroom Humming with a Deal Flow Management Tool

The reality is if you choose to run your firm without a deal flow management tool, you are placing yourself at a significant disadvantage. That’s because deal flow management software improves dealflow, optimizes your due diligence process, enhances portfolio management, strengthens relationships and optimizes fundraising. In short, deal software takes all the core principles of investing and elevates them.

If you want to be a VC fund or PEfirm that LPs want to work with, then a deal management platform is non-negotiable in today’s modern investment world. Today’s investors want not just the best dealflow and highest returns but a good experience that’s built on trust and transparency. And that’s exactly what PE and venture capital software tools deliver.

Say goodbye to error-prone spreadsheets and messy deal management with edda.

Try edda for free today.

How to Choose the Best Dealflow Management Software to Simplify Your Dealflow and Close Deals Faster in 2026

As an investor, there’s a lot riding on the deals you make—and the ones you turn down. Your LPs have placed their trust in you—and they have big expectations. So, when it comes to investing, every tool, tactic or technique that can give you a competitive edge must be on the table. In today’s tech-driven world, deal management software can do just that, by helping you identify more deals and close them sooner on better terms.

Incredibly in today’s modern investment world, many funds invest billions yet still rely on Excel spreadsheets and hacked together systems. To put it simply, managing your firm without a deal flow solution is like plowing a field by hand, while everyone else is using a combine harvester.

But, as we’re sure you’ve discovered, there’s a lot to consider when it comes to choosing VCand PE portfolio management tools. After all, you have to be able to trust them with potentially billions of investor dollars.

In this comprehensive guide, you’ll learn how to choose the right venture capital software for your firm, so you can source more deals, manage your due diligence process, improve your decision-making, more easily manage your portfolio, strengthen relationships with your investors, and more.

What is Deal Flow Management Software?

As the name suggests, deal management software is purpose-built technology that helps private equity and venture capital firms more effectively and efficiently organize dealflow, manage the due diligence process and close deals on better terms.

As any investor knows, investing is a complex, non-linear and time-consuming process. It’s multifaceted, data-rich and critically reliant on decision making. Deal software acts as the backbone for your firm’s deal management process. It makes it more structured, informed and accurate, so that investors can source better deals, optimize the due diligence process and make better decisions.

A deal flow management tool is an all-in-one solution that allows firms to manage all the different stages of investment deals, including deal sourcing, pipeline and portfolio management, sales management, fundraising, due diligence, and more.

Why Use Deal Management Software in Your VC Fund?

There are few operations as complex as managing an investment firm. It depends on countless data points, relationships, decisions and sophisticated financial modeling and management.

Surprisingly, much of the industry still takes a legacy approach that involves endless Excel spreadsheets, emails, phone calls, calendar reminders and overly stretched human capital. A deal flow solution takes this highly manual, time-consuming approach and converts it into a systematized process that connects the full investment life cycle and firm management from top to bottom.

Is it possible to manage your firm without deal management software? Yes. But it’s also possible to get to the otherside of the world by ship in 3 weeks instead of a plane overnight, but why would you? So here are the top benefits of using deal management in your firm.

Manage Dealflow & Deal Sourcing in Real-time

Your dealflow is the lifeblood of your firm. Investor funds flow to funds with the best dealflow. Deal software enshrines the steps of your dealflow and deal sourcing processes into a systematized, repeated formula, eliminating the reliance on ad hoc processes, spreadsheets and emails.

Deal flow software helps you better manage your dealflow, enabling you to:

Build a more collaborative deal origination team

Increase visibility across departments and teams

Codify and implement your attractive deal signals

More accurately assess deal opportunities

Make faster, more informed decisions

Seamless Pipeline Management

Your deal pipeline contains multiple, distinct steps. Each with the potential to make or break a deal. Deal flow pipeline software increases the odds of reaching the end goal you set for each deal by, once again, systematizing the identification, evaluation and management of the deals you source.

In doing so, you’ll increase the discipline behind your decisions, removing emotions and uniformed hypotheses from the process. Dealflow software improves the management of the entire pipeline lifecycle, from sourcing right through to your ultimate investment decision.

More Effective Fundraising

It doesn’t matter the quality of the deals you see if you don’t have the requisite capital to invest. As an investor, you know that the art of fundraising is reliant on relationships, past success and your ability to sell your fund’s vision. With all its moving parts, the fundraising process can quickly become messy and convoluted.e. Deal flow management software moves the fundraising process out of inboxes, scribbled notes and spreadsheets, converting it to a highly optimized, methodical approach.

Managing fundraising using deal software enables you to:

Clearly define your fund strategy to attract investors who align with it

Get clear on your target investors based on preferences, risk appetite and investment capacity

Consolidate marketing materials for a more organized pitch process

Establish and update fundraising timelines to track progress

Set your fund’s legal structure and terms and conditions

Track funding coming into your fund and close it once fully subscribed

Improved Due Diligence

Your firm’s due diligence process is multifaceted and fundamental to your success. Deal software enables you to undertake all forms of due diligence—financial, commercial, operational, legal, tax, ESG, and others—so you can assess more deals in less time with higher accuracy.

Consolidated research and analysis

Assessment against defined investment criteria

Market and industry research, competitive benchmarking

Legal and regulatory documentation

Collaboration with external advisors

Optimized Portfolio Management

Once you hand over the check, then comes the task of managing your portfolio so you and your LPs have clear insights into company and fund performance. Robust portfolio management functionality makes this process more efficient and effective. The best portfolio management platforms enable your to:

Monitor portfolio value and track performance based on detailed metrics

See how your current portfolio aligns with your investment focus

Calculate IRR of funds and companies

Simplify valuations and compare portfolio companies side-by-side

Automatically calculate your NAV, DPI, TVPI

Simplified, In-Depth Reporting

With the push-button insights it provides, deal flow software makes reporting the status of your fund far more simple—internally with your team and externally with LPs and GPs. Get real-time updates on key aspects like invested amounts, share of ownership, operational KPIs and the latest board output.

As a firm that provides clear, in-depth reporting to your investors, you’ll offer an uncommon level or transparency that breeds trust with your LPs and GPs. Simplified reporting enables your to:

Use real-time investment metrics to provide detail-rich investor updates

Easily communicate fund performance, investment activities, and all material developments.

More easily compile quarterly and annual financial reports.

Make meetings with investors and committees more informed through in-depth data

What Features Should You Look for in Deal Management Software?

Deal software comes in many shapes. There’s venture capital deal flow software. Then there’s private equity deal management software. And then you’ll also find all-in-one PE and venture capital software solutions that cater to the complexities of all forms of investing.

As a VC firm, there are core features the deal flow pipeline software you choose must have. Let’s take a look at them…

Dealflow Management

As any serious investor knows, managing your dealflow can get messy. And it only gets worse the more deals that land in your inbox. So, intuitive, seamless dealfow management functionality is a must-have. A software-backed deal process enables you to more effectively manage your deal lifecycle, see your deal pipeline in real-time, prioritize and track deals, and monitor deal progress and follow-up as required.

Collaboration Features

Slack, teams, text messages, email… collaborating within your firm can quickly become overwhelming. Deal software with robust collaboration features helps keep your team connected and streamlines information flow on deals. Centralizing collaboration in this way saves time, improves decision-making and makes sure no detail is ever lost. Simply, it can be the difference between winning or losing a deal.

A Partner Portal

Your LPs and GPs shouldn’t have to sit in the dark and email you to get updates. A partner portal gives them transparency and streamlines communication. A portal provides a real-time line of sight into where their money is going, and how it’s performing. This is like a real-time data room for your LPs and GPs.

Document Management

Investing comes with a whole lot of paperwork. It can get overwhelming for all involved. That’s why it’s vital your deal software is equipped with in-built, secure document sharing functionality. A way that you can easily share investor updates, contracts, reports and every other piece of vital information with your partners.

Integrations

All modern teams run on multiple software tools. That’s why it’s critical that your deal flow solution makes integrations with other tools simple. Your deal software must seamlessly integrate with the tools you use daily to connect your data end-to-end and provide a smooth user experience.

Compliance and Security

Needless to say that when you’re managing millions of dollars and sensitive data, security is paramount. At a minimum, your deal software must be ISO 27001, SOC2 and GDPR compliant. The most secure deal management solutions will also undergo routine, third-party code audits from security experts to prevent data breaches.

Relationship Management (CRM)

There’s no getting around it: the success of your firm relies on the quality of your relationships. And strong relationships are built on the back of having a dependable customer relationship process in place, which requires a dedicated deal flow CRM platform.

Many PE firms will rely on generic CRM software. But the reality is that while these are solid relationship management tools, they don’t properly cater to the needs and nuances of investor relations. Your deal flow CRM software needs to be geared toward the more complex, protracted and relationship-based nature of investing.

Project & Workflow Management

As you know, VC firm workflows are complex, require disparate data inputs and don’t always follow a straight line - deals can move sideways and backwards, as often as they do forwards.

Workflow management features automate and streamline your deal workflows, and dramatically reduce potential for deal-compromising errors or omissions. Simpy, workflow management functionality acts as your single source of truth. It consolidates information, avoids silos, tracks deal lifecycles, automates workflows with tasks and reminders, and more.

Customization

Just like that custom suit you put on for meetings with big LPs, your deal management software must be customizable. It should be configurable to your firm's processes, structures and preferences. The reality is that rigid solutions can be like trying to fit a square peg in a round hole. Simply, if your deal software isn’t customizable to your team’s needs, adoption will be stunted and you won’t get the full streamlining effects.

The Best Deal Management Software Solutions Available Today

There are a handful of robust deal management solutions available. And no two are alike. As mentioned earlier, there’s VC portfolio management software and private equity deal flow software, each of which can come with subtle differences.

So when making a decision about adopting deal software in your firm, it’s important that you know the functionality you need and which solution can deliver on it. You need to be sure that you have the right deal management software for your firm’s investment approach. --

Edda - The Most Complete Dealflow Management Software

With $170 billion managed through its platform in 40+ countries, it’s clear why Edda is the deal software of choice for many leading firms. Edda is built on the core principle of enhanced visibility at all stages of the investment process. This unparalleled transparency allows you to see the status, impact and value of your investments in real-time.

Edda is truly an end-to-end solution for investment firms that unifies your team and operations. Where Edda also stands out is the fact that it’s designed as one of the few platforms that is both private equity and venture capital deal flow software.

Edda’s PE and VC portfolio management tools bring deal origination, the due diligence process, portfolio management, partner communications, and every other aspect of deal-making into a single all-in-one solution. Better yet, Edda is one of the few platforms that provides a mobile app, catering to the increased reliance on smartphones in today’s investment world.

Top Features:

Dealflow & portfolio management

Relationship management CRM

Workflow automations

Accelerated due diligence

LP Portal

Mobile App

Simple integrations

Enterprise-grade security (SOC2)

Keep Your Dealroom Humming with a Deal Flow Management Tool

The reality is if you choose to run your firm without a deal flow management tool, you are placing yourself at a significant disadvantage. That’s because deal flow management software improves dealflow, optimizes your due diligence process, enhances portfolio management, strengthens relationships and optimizes fundraising. In short, deal software takes all the core principles of investing and elevates them.

If you want to be a VC fund or PEfirm that LPs want to work with, then a deal management platform is non-negotiable in today’s modern investment world. Today’s investors want not just the best dealflow and highest returns but a good experience that’s built on trust and transparency. And that’s exactly what PE and venture capital software tools deliver.

Say goodbye to error-prone spreadsheets and messy deal management with edda.

Try edda for free today.