Connect with Contacts

Elevate your client management with Edda's smart CRM, capturing every opportunity for the modern investor.

Investors in 40+ countries manage $170B in assets on Edda

Contact management with the modern investor in mind

Automate contact management

Edda’s contact management automation saves hours of manual work and eliminates errors with precise contact updates.

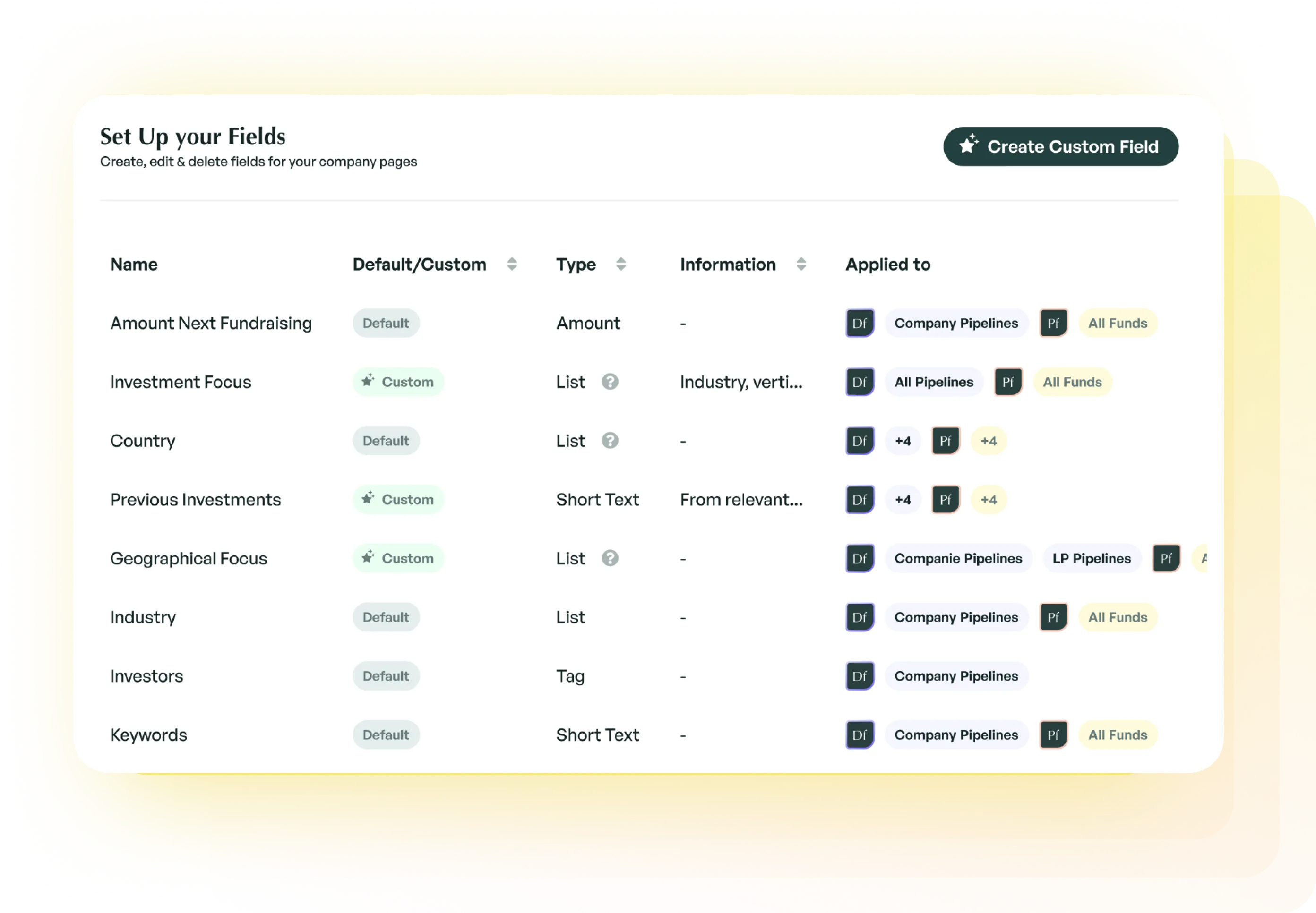

Go deeper with custom fields

Tailor your contact management with what’s most important to your team. Custom fields are displayed with each contact, allowing you to keep the key details close.

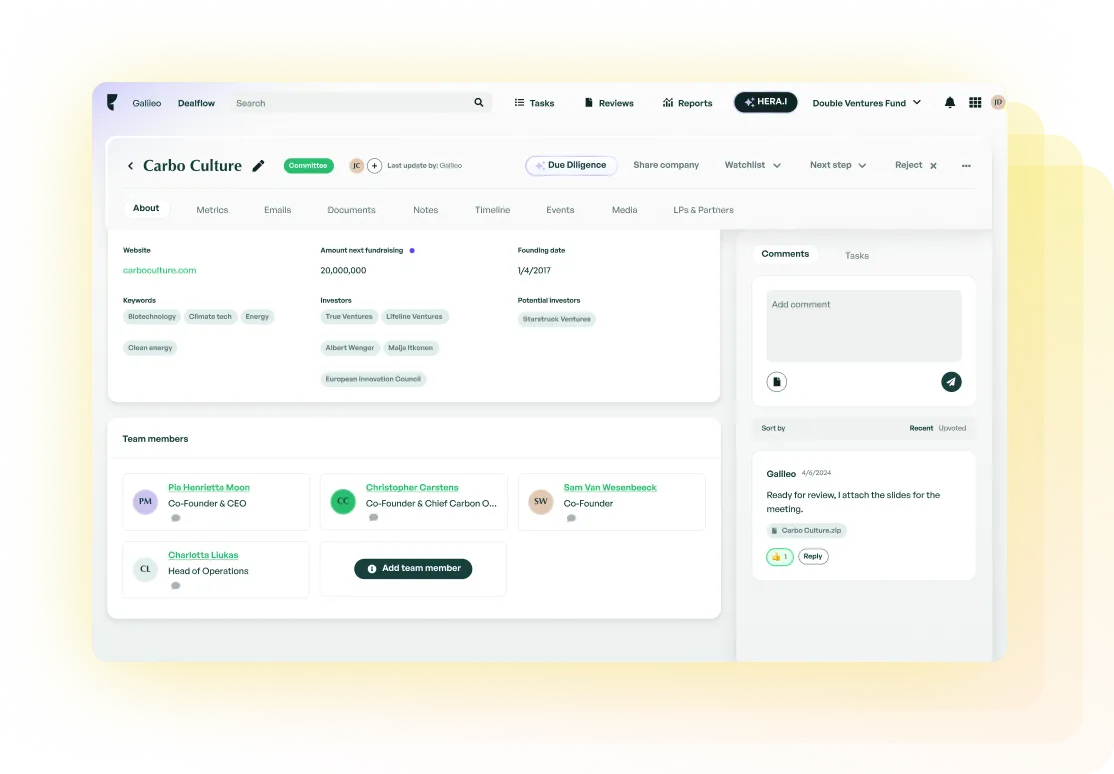

Streamline Dealflow management

Tailor your contact management with what’s most important to your team. Custom fields are displayed with each contact, allowing you to keep the key details close.

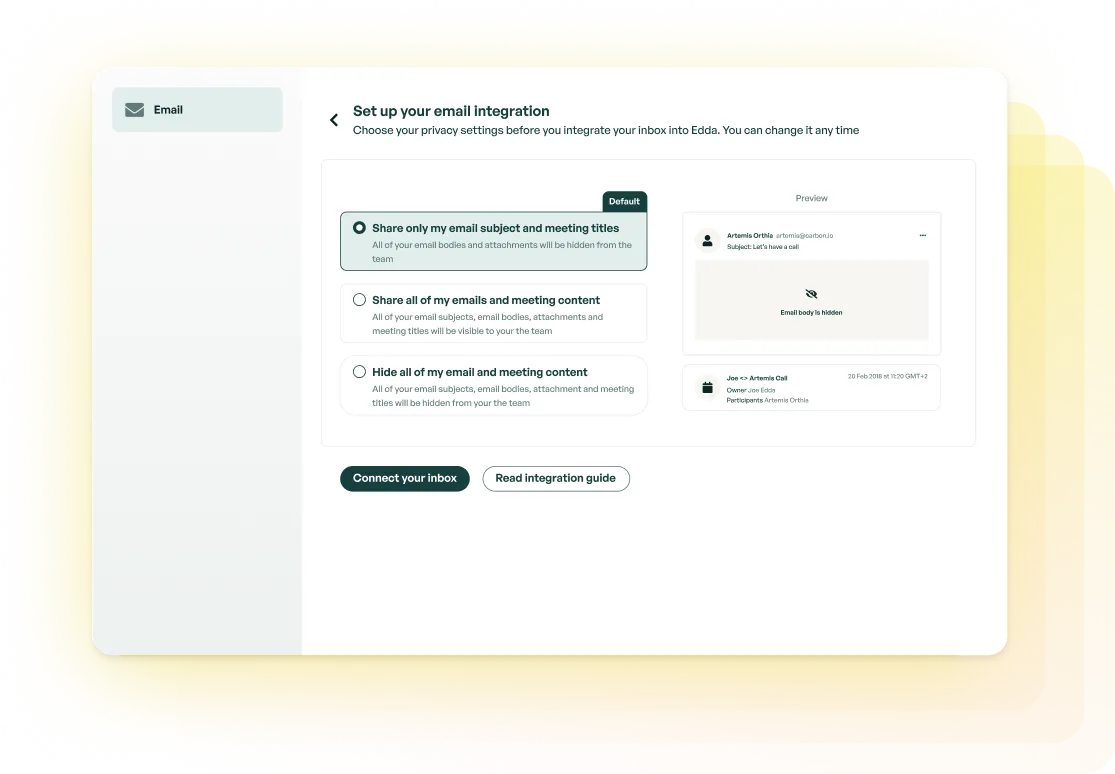

Enhance team collaboration

Share every interaction effortlessly and accelerate decision-making with up-to-date information. Keep everyone in the loop with streamlined communication.

Push your investments to the next level

What our users say about us

“We are truly happy with Edda and how the platform enables us to better monitor our performance and report to our stakeholders. Our Edda team also provides exceptional customer service and support, something we highly value.”

Lise Fulland

Startup lab - Norway

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.

Discover more about Edda

Unlock the power of your network with Edda’s smart deal flow CRM

Designed with the modern investor in mind, Edda’s customizable smart CRM transforms how you manage client relationships, ensuring you capture every opportunity in your network.

Automate contact management

Save hours by automating contact updates.

Eliminate errors with precise data automation.

Focus on what matters with less manual work.

Enhance team collaboration

Share every interaction effortlessly.

Accelerate decision-making with up-to-date information.

Keep everyone in the loop with streamlined communication.

Streamline dealflow management

Merge contact management & deal tracking seamlessly.

Spot & seize opportunities with organized data.

Accelerate workflows, merging contact, deal, & portfolio management.

What is Deal Flow CRM Software?

Deal flow CRM software strengthens the connection between your firm and your investors. It captures and organizes the full scope of investor data—spanning contact information, transaction histories, queries, and communications across platforms. This convergence of data paints a comprehensive portrait of each investor.

But the capabilities extend far beyond data compilation. A CRM for investors streamlines your firm’s workflow with absolute precision. It allows your teams to track investor activity, identify prime moments for outreach, and refine messaging. With rapid access to an investor's background, your teams can provide swift, informed, and relevant support—this responsiveness heightens investor trust and reinforces their commitment.

Implementing CRM investment software demonstrates your firm's dedication to prioritizing investor relationships as a fundamental aspect of your operational ethos. It champions a savvy, data-enriched engagement model where personalized attention nurtures trust and loyalty.

How to Choose the Best CRM for Private Equity & Venture Capital

Selecting the right venture capital (VC) or private equity CRM software is key to unlocking the potential of every client interaction. A top-tier CRM system acts as your firm’s command center, offering not just oversight but foresight. Comprehensive analytics and reporting features are vital for tracking performance, identifying trends, and making informed decisions.

Scalability is essential; you want a CRM for VCs or private equity (PE) that expands with your firm, so you can effortlessly manage new challenges as your enterprise blossoms. You need a system that keeps pace with your ambitions, ensuring that your expanding portfolio and growing network of investors don't outgrow the tools at your disposal.

Look for a CRM that integrates with your existing tools like email, calendar, and deal flow management systems. This seamless integration synchronizes your data, reducing the need to switch between platforms and minimizing the risk of information loss. Opt for collaboration tools that enhance team coordination by providing shared access to communication histories and real-time updates. This transparency keeps everyone on the same page, improving decision-making and efficiency.

Your CRM should offer secure storage, easy import/export options, and compliance with data protection regulations to safeguard your information while keeping it easily accessible. Automation of repetitive tasks like data entry and follow-ups is a must, as it saves time and reduces errors, allowing your team to focus on high-value activities.

Imagine a PE CRM that meshes so smoothly with your operations that it feels custom-crafted for your firm. An intuitive, user-friendly interface is a catalyst for collaboration, empowering your team to thrive in investor relations. This kind of CRM makes adoption painless. You’ll need mobile access to your CRM so you can manage contacts and deals on the go, maintaining productivity whether you're at an event or away from your desk.

Selecting your CRM is a strategic commitment to the core of your firm’s operations. It’s about laying down a resilient and supportive infrastructure that evolves in sync, enhancing every investor interaction and fortifying every engagement along the way. Don’t settle for a PE or VC CRM that merely logs interactions; choose one that actively nurtures your firm's growth and success.

Why Use Investor CRM Software in Your Firm?

Investment management hinges on your firm’s ability to go beyond maintaining investor relationships to actively energizing them.

While traditional methods like spreadsheets and disjointed communication systems have been the mainstay, they fall short of creating meaningful engagement. Investor CRM software consolidates all investor-related data and interactions, a transformative step from the norm to a more intelligent, personalized mode of investor engagement.

By adopting an investment CRM, you'll enjoy a more organized approach to investor data, seamless communication flows, and outreach that hits the mark every time, guided by rich insights into investor activities and interests. The result? A deeper connection with your investors, increased satisfaction levels, and a solid foundation for future investments.

CRM investment banking software is indispensable for firms looking to refine and elevate their investor relations. It equips firms to transcend traditional barriers, paving the way for a more unified, enlightened, and strategic investor relations journey.

Centralized Data Management

Centralized data management ensures your team has immediate access to crucial client and deal details, preventing missed opportunities and misalignment among your teams.

CRM venture capital software enables firms to:

Ensure unified access to client and deal information.

Foster teamwork and coherent decision-making.

Reduce data discrepancies and errors.

Streamline information retrieval processes.

Enhance data security and integrity.

Personalized Client Engagement

Tailoring interactions with client-specific insights enhances connections and retention, avoiding the pitfalls of generic communications.

A CRM for investment banks enables firms to:

Tailor interactions to individual client profiles.

Strengthen trust and loyalty with personalized service.

Improve client engagement and communication.

Facilitate a deeper understanding of client needs.

Identify opportunities for targeted investments.

Streamlined Deal Flow

A streamlined deal pipeline paves the way for smooth deal closures, preventing delays and mismanagement from derailing potential deals.

Private equity CRM solutions enable firms to:

Accelerate deal progression and closures.

Minimize manual intervention in the deal pipeline.

Increase visibility into deal status and milestones.

Enhance responsiveness to deal-related changes.

Reduce the risk of missed opportunities.

Next-Level Data Intelligence

Advanced analytics in venture capital CRM software unlock valuable insights from data, ensuring firms make informed decisions without relying on outdated or incomplete data.

An investment bank CRM enables firms to:

Provide insights for informed strategic decision-making.

Identify trends and patterns in client behavior and market dynamics.

Support data-driven opportunity identification.

Enable performance tracking and benchmarking.

Facilitate forecasting and predictive analysis.

Increased Operational Efficiency

Automating routine tasks through a CRM reallocates human capital to higher-value activities. A lack of automation can lead to operational congestion, stifling growth and agility.

A CRM for venture capital enables firms to:

Automate routine tasks, freeing up resources for strategic work.

Reduce operational costs through process optimization.

Enhance team productivity and efficiency.

Support scalability without proportional increases in overhead.

Improve time management and prioritization.

Higher Client Retention & Satisfaction

CRM-driven, personalized client interactions are essential for ensuring satisfaction and creating positive experiences. Neglecting this can lead to higher turnover and harm the firm's reputation.

A CRM for investment banking enables firms to:

Deliver consistent and relevant client experiences.

Foster long-term client relationships and loyalty.

Reduce churn through higher satisfaction rates.

Encourage positive client testimonials and referrals.

Strengthen brand reputation and client trust.

What Features Should You Look for in a Venture Capital CRM?

When scouting for a CRM designed for investment management, it's vital to zero in on features that streamline operations and deepen investor engagement. In venture capital, private equity, and similar sectors, a CRM investor relations platform must go beyond generalist tools to cater to the specialized needs of investor relations.

Here are the critical features investment firms should consider indispensable in CRM private equity and venture capital software:

Centralized Investment Ecosystem

This feature acts as the core of the CRM, providing a unified platform where all aspects of the investment process converge. From tracking initial leads to managing ongoing investor relations, this ecosystem ensures that every piece of critical information is just a click away. CRM data hygiene enables teams to maintain a holistic view of their operations, ensuring that nothing is overlooked and all data is relevant.

Relationship Mapping

Relationship mapping links your contacts to the appropriate companies and tracks the sources connected to those companies. CRM relationship intelligence also identifies which team member has exchanged the most emails with a contact and who was the most recent to engage. This feature helps you maintain an organized view of your network, ensuring that key connections are easily accessible and up-to-date.

Intuitive Deal Flow Navigation

An intuitive interface designed for efficiency makes navigating through the stages of deal management easy. Users can easily track the progress of various deals, from initial contact through due diligence to final investment, all within a single, user-friendly deal flow CRM dashboard. This feature maintains momentum in deal progression and ensures timely actions and follow-ups.

Dynamic Portfolio Oversight

Offering a comprehensive suite of analytics and monitoring tools, this feature provides investment firms real-time insights into their portfolio's performance. From financial metrics to industry trends impacting portfolio companies, dynamic portfolio oversight empowers users to make data-driven decisions, support their investments proactively, and ultimately drive enhanced returns.

Streamlined Due Diligence Process

This feature simplifies one of investment management's most critical and time-consuming aspects. By aggregating essential data, facilitating document exchange, and providing analytical tools, the streamlined due diligence process accelerates the evaluation of potential investments, ensuring thoroughness and efficiency.

LP Engagement Portal

Designed to foster transparency and communication with LPs, this portal offers a dedicated space for sharing updates, reports, and key performance indicators. It enhances the investor experience by providing clear, concise, and regular insights into fund performance and strategic decisions, reinforcing trust and alignment with the firm's goals.

Comprehensive Data Integration

With the ability to integrate with external data sources and internal repositories, this CRM data entry and integration feature ensures that investment teams have access to a wealth of information. From market trends and industry reports to specific company data, comprehensive data integration supports a deep analytical approach. This CRM data quality drives more informed decision-making and strategic planning.

Collaboration-Driven Workflow

This feature emphasizes the power of teamwork by providing shared spaces, communication tools, and project management capabilities. It encourages the exchange of ideas, facilitates effective collaboration on deals and projects, and ensures that all team members are aligned and informed, enhancing the firm's collective efficiency and effectiveness.

Security & Compliance

In the sensitive world of investment management, safeguarding data is non-negotiable. This feature ensures that the investment banking CRM adheres to the highest security and regulatory compliance standards, protecting sensitive information from unauthorized access and ensuring that the firm's operations align with industry regulations and best practices.

The Best CRM Solution Available Today

Top investor CRM solutions today are designed to simplify complex investment workflows, providing powerful tools for deal management and strategic relationship building. These CRMs seamlessly integrate with other business tools, boosting operational efficiency and ensuring data security. The true value of investment CRM software lies in its ability to deliver strategic insights and nurture meaningful investor relations, making it essential for firms aiming to stay competitive in the investment arena.

The best CRMs for investment banking are those that manage relationships and data and actively contribute to the firm's strategic goals and operational excellence.

Edda’s Smart CRM for Private Equity & Venture Capital: The Premier Solution for Investment Relationship Management

Edda's venture capital and private equity CRM is at the vanguard of investment management, overseeing an impressive $170 billion for PE and VC firms in over 40 countries. Central to Edda's ethos is ensuring complete visibility across the investment lifecycle, facilitating real-time insights into relationships, deal statuses, and portfolio valuations. This depth of insight is a must for making well-informed strategic decisions.

Designed as an all-encompassing platform, Edda’s PE and venture capital CRM integrates the dimensions of investment firm operations, from deal origination and pipeline management to due diligence and investor communications. It stands out for its adaptability to different firms' methodologies, presenting a unified solution customized for diverse investment management needs.

Edda's commitment to innovation is highlighted by its mobile app offering, catering to the needs of today’s investors who demand immediate access to information and functionality. This dedication to providing a responsive and comprehensive tool makes Edda the best CRM for venture capital and private equity, ensuring that vital data and relationship management tools are always within reach.

Top Features:

Deal Pipeline Management

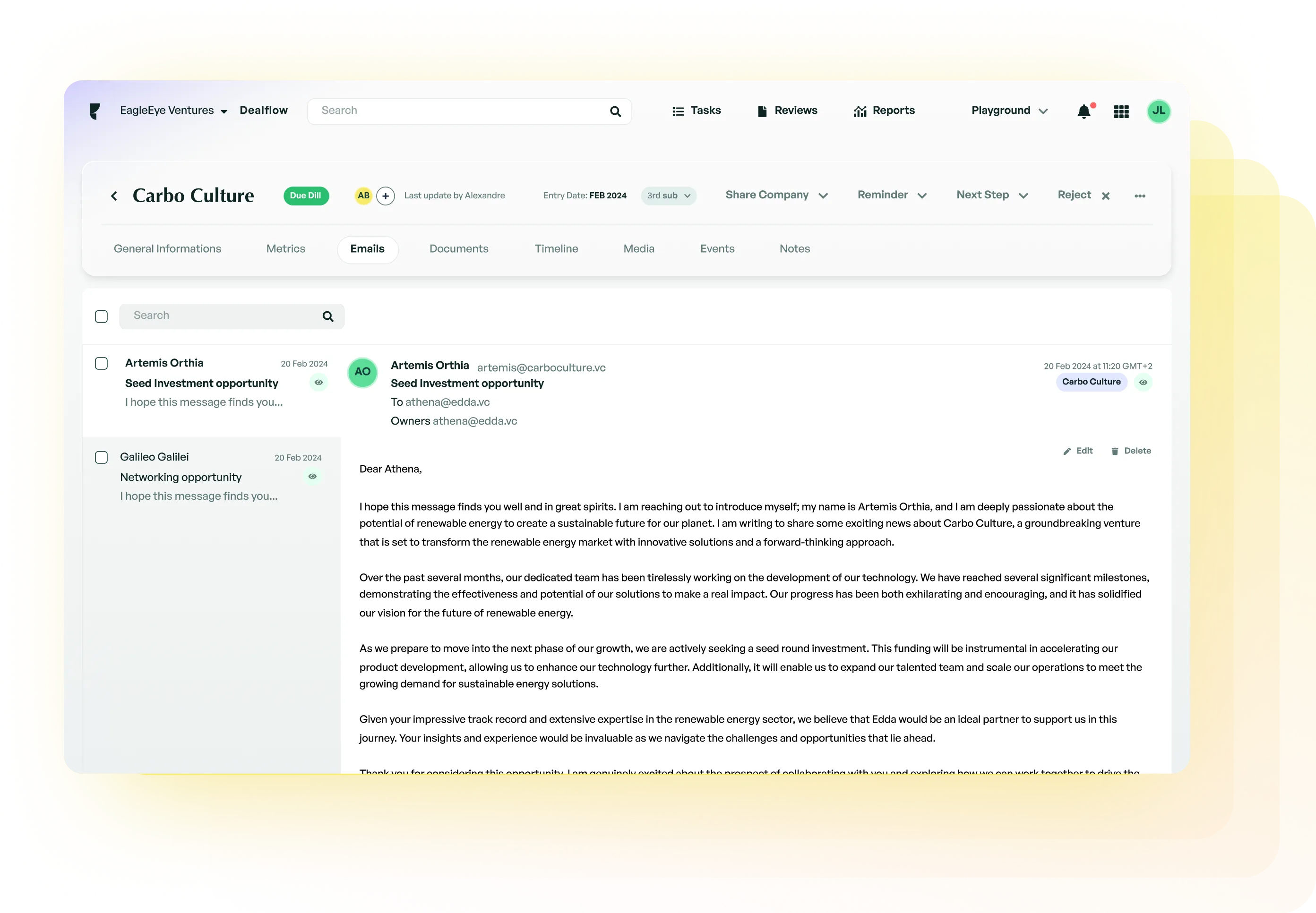

Communication Management

Customizable Contact Lists

Advanced Analytics & Reporting

Document Management & Collaboration

Regulatory Compliance & Security

Investor Relations Management

Customizable Workflows

Enhanced Email Integration

Reinvigorate Your Investment Strategy with Edda's Investment Banking CRM Software

Operating an investment firm without a sophisticated capital markets CRM like Edda places you at a competitive disadvantage. Edda's CRM for investment bankers is more than a tool; it enhances investment strategy across the board by streamlining deal flow, refining the due diligence process, augmenting portfolio management, fortifying relationships, and maximizing fundraising efficiency. It takes the building blocks of investment management to new heights.

Adopting dynamic investment banking CRM software like Edda is indispensable for VC funds or PE firms aiming to stand out and attract limited partners (LPs). Modern investors are in pursuit of superior deal flow and returns, but they also value a seamless experience underpinned by trust and transparency. Edda's VC and private equity CRM tools are engineered to deliver precisely this, so your firm meets and exceeds the expectations of today's discerning investors.

Unlock the power of your network with Edda’s smart deal flow CRM

Designed with the modern investor in mind, Edda’s customizable smart CRM transforms how you manage client relationships, ensuring you capture every opportunity in your network.

Automate contact management

Save hours by automating contact updates.

Eliminate errors with precise data automation.

Focus on what matters with less manual work.

Enhance team collaboration

Share every interaction effortlessly.

Accelerate decision-making with up-to-date information.

Keep everyone in the loop with streamlined communication.

Streamline dealflow management

Merge contact management & deal tracking seamlessly.

Spot & seize opportunities with organized data.

Accelerate workflows, merging contact, deal, & portfolio management.

What is Deal Flow CRM Software?

Deal flow CRM software strengthens the connection between your firm and your investors. It captures and organizes the full scope of investor data—spanning contact information, transaction histories, queries, and communications across platforms. This convergence of data paints a comprehensive portrait of each investor.

But the capabilities extend far beyond data compilation. A CRM for investors streamlines your firm’s workflow with absolute precision. It allows your teams to track investor activity, identify prime moments for outreach, and refine messaging. With rapid access to an investor's background, your teams can provide swift, informed, and relevant support—this responsiveness heightens investor trust and reinforces their commitment.

Implementing CRM investment software demonstrates your firm's dedication to prioritizing investor relationships as a fundamental aspect of your operational ethos. It champions a savvy, data-enriched engagement model where personalized attention nurtures trust and loyalty.

How to Choose the Best CRM for Private Equity & Venture Capital

Selecting the right venture capital (VC) or private equity CRM software is key to unlocking the potential of every client interaction. A top-tier CRM system acts as your firm’s command center, offering not just oversight but foresight. Comprehensive analytics and reporting features are vital for tracking performance, identifying trends, and making informed decisions.

Scalability is essential; you want a CRM for VCs or private equity (PE) that expands with your firm, so you can effortlessly manage new challenges as your enterprise blossoms. You need a system that keeps pace with your ambitions, ensuring that your expanding portfolio and growing network of investors don't outgrow the tools at your disposal.

Look for a CRM that integrates with your existing tools like email, calendar, and deal flow management systems. This seamless integration synchronizes your data, reducing the need to switch between platforms and minimizing the risk of information loss. Opt for collaboration tools that enhance team coordination by providing shared access to communication histories and real-time updates. This transparency keeps everyone on the same page, improving decision-making and efficiency.

Your CRM should offer secure storage, easy import/export options, and compliance with data protection regulations to safeguard your information while keeping it easily accessible. Automation of repetitive tasks like data entry and follow-ups is a must, as it saves time and reduces errors, allowing your team to focus on high-value activities.

Imagine a PE CRM that meshes so smoothly with your operations that it feels custom-crafted for your firm. An intuitive, user-friendly interface is a catalyst for collaboration, empowering your team to thrive in investor relations. This kind of CRM makes adoption painless. You’ll need mobile access to your CRM so you can manage contacts and deals on the go, maintaining productivity whether you're at an event or away from your desk.

Selecting your CRM is a strategic commitment to the core of your firm’s operations. It’s about laying down a resilient and supportive infrastructure that evolves in sync, enhancing every investor interaction and fortifying every engagement along the way. Don’t settle for a PE or VC CRM that merely logs interactions; choose one that actively nurtures your firm's growth and success.

Why Use Investor CRM Software in Your Firm?

Investment management hinges on your firm’s ability to go beyond maintaining investor relationships to actively energizing them.

While traditional methods like spreadsheets and disjointed communication systems have been the mainstay, they fall short of creating meaningful engagement. Investor CRM software consolidates all investor-related data and interactions, a transformative step from the norm to a more intelligent, personalized mode of investor engagement.

By adopting an investment CRM, you'll enjoy a more organized approach to investor data, seamless communication flows, and outreach that hits the mark every time, guided by rich insights into investor activities and interests. The result? A deeper connection with your investors, increased satisfaction levels, and a solid foundation for future investments.

CRM investment banking software is indispensable for firms looking to refine and elevate their investor relations. It equips firms to transcend traditional barriers, paving the way for a more unified, enlightened, and strategic investor relations journey.

Centralized Data Management

Centralized data management ensures your team has immediate access to crucial client and deal details, preventing missed opportunities and misalignment among your teams.

CRM venture capital software enables firms to:

Ensure unified access to client and deal information.

Foster teamwork and coherent decision-making.

Reduce data discrepancies and errors.

Streamline information retrieval processes.

Enhance data security and integrity.

Personalized Client Engagement

Tailoring interactions with client-specific insights enhances connections and retention, avoiding the pitfalls of generic communications.

A CRM for investment banks enables firms to:

Tailor interactions to individual client profiles.

Strengthen trust and loyalty with personalized service.

Improve client engagement and communication.

Facilitate a deeper understanding of client needs.

Identify opportunities for targeted investments.

Streamlined Deal Flow

A streamlined deal pipeline paves the way for smooth deal closures, preventing delays and mismanagement from derailing potential deals.

Private equity CRM solutions enable firms to:

Accelerate deal progression and closures.

Minimize manual intervention in the deal pipeline.

Increase visibility into deal status and milestones.

Enhance responsiveness to deal-related changes.

Reduce the risk of missed opportunities.

Next-Level Data Intelligence

Advanced analytics in venture capital CRM software unlock valuable insights from data, ensuring firms make informed decisions without relying on outdated or incomplete data.

An investment bank CRM enables firms to:

Provide insights for informed strategic decision-making.

Identify trends and patterns in client behavior and market dynamics.

Support data-driven opportunity identification.

Enable performance tracking and benchmarking.

Facilitate forecasting and predictive analysis.

Increased Operational Efficiency

Automating routine tasks through a CRM reallocates human capital to higher-value activities. A lack of automation can lead to operational congestion, stifling growth and agility.

A CRM for venture capital enables firms to:

Automate routine tasks, freeing up resources for strategic work.

Reduce operational costs through process optimization.

Enhance team productivity and efficiency.

Support scalability without proportional increases in overhead.

Improve time management and prioritization.

Higher Client Retention & Satisfaction

CRM-driven, personalized client interactions are essential for ensuring satisfaction and creating positive experiences. Neglecting this can lead to higher turnover and harm the firm's reputation.

A CRM for investment banking enables firms to:

Deliver consistent and relevant client experiences.

Foster long-term client relationships and loyalty.

Reduce churn through higher satisfaction rates.

Encourage positive client testimonials and referrals.

Strengthen brand reputation and client trust.

What Features Should You Look for in a Venture Capital CRM?

When scouting for a CRM designed for investment management, it's vital to zero in on features that streamline operations and deepen investor engagement. In venture capital, private equity, and similar sectors, a CRM investor relations platform must go beyond generalist tools to cater to the specialized needs of investor relations.

Here are the critical features investment firms should consider indispensable in CRM private equity and venture capital software:

Centralized Investment Ecosystem

This feature acts as the core of the CRM, providing a unified platform where all aspects of the investment process converge. From tracking initial leads to managing ongoing investor relations, this ecosystem ensures that every piece of critical information is just a click away. CRM data hygiene enables teams to maintain a holistic view of their operations, ensuring that nothing is overlooked and all data is relevant.

Relationship Mapping

Relationship mapping links your contacts to the appropriate companies and tracks the sources connected to those companies. CRM relationship intelligence also identifies which team member has exchanged the most emails with a contact and who was the most recent to engage. This feature helps you maintain an organized view of your network, ensuring that key connections are easily accessible and up-to-date.

Intuitive Deal Flow Navigation

An intuitive interface designed for efficiency makes navigating through the stages of deal management easy. Users can easily track the progress of various deals, from initial contact through due diligence to final investment, all within a single, user-friendly deal flow CRM dashboard. This feature maintains momentum in deal progression and ensures timely actions and follow-ups.

Dynamic Portfolio Oversight

Offering a comprehensive suite of analytics and monitoring tools, this feature provides investment firms real-time insights into their portfolio's performance. From financial metrics to industry trends impacting portfolio companies, dynamic portfolio oversight empowers users to make data-driven decisions, support their investments proactively, and ultimately drive enhanced returns.

Streamlined Due Diligence Process

This feature simplifies one of investment management's most critical and time-consuming aspects. By aggregating essential data, facilitating document exchange, and providing analytical tools, the streamlined due diligence process accelerates the evaluation of potential investments, ensuring thoroughness and efficiency.

LP Engagement Portal

Designed to foster transparency and communication with LPs, this portal offers a dedicated space for sharing updates, reports, and key performance indicators. It enhances the investor experience by providing clear, concise, and regular insights into fund performance and strategic decisions, reinforcing trust and alignment with the firm's goals.

Comprehensive Data Integration

With the ability to integrate with external data sources and internal repositories, this CRM data entry and integration feature ensures that investment teams have access to a wealth of information. From market trends and industry reports to specific company data, comprehensive data integration supports a deep analytical approach. This CRM data quality drives more informed decision-making and strategic planning.

Collaboration-Driven Workflow

This feature emphasizes the power of teamwork by providing shared spaces, communication tools, and project management capabilities. It encourages the exchange of ideas, facilitates effective collaboration on deals and projects, and ensures that all team members are aligned and informed, enhancing the firm's collective efficiency and effectiveness.

Security & Compliance

In the sensitive world of investment management, safeguarding data is non-negotiable. This feature ensures that the investment banking CRM adheres to the highest security and regulatory compliance standards, protecting sensitive information from unauthorized access and ensuring that the firm's operations align with industry regulations and best practices.

The Best CRM Solution Available Today

Top investor CRM solutions today are designed to simplify complex investment workflows, providing powerful tools for deal management and strategic relationship building. These CRMs seamlessly integrate with other business tools, boosting operational efficiency and ensuring data security. The true value of investment CRM software lies in its ability to deliver strategic insights and nurture meaningful investor relations, making it essential for firms aiming to stay competitive in the investment arena.

The best CRMs for investment banking are those that manage relationships and data and actively contribute to the firm's strategic goals and operational excellence.

Edda’s Smart CRM for Private Equity & Venture Capital: The Premier Solution for Investment Relationship Management

Edda's venture capital and private equity CRM is at the vanguard of investment management, overseeing an impressive $170 billion for PE and VC firms in over 40 countries. Central to Edda's ethos is ensuring complete visibility across the investment lifecycle, facilitating real-time insights into relationships, deal statuses, and portfolio valuations. This depth of insight is a must for making well-informed strategic decisions.

Designed as an all-encompassing platform, Edda’s PE and venture capital CRM integrates the dimensions of investment firm operations, from deal origination and pipeline management to due diligence and investor communications. It stands out for its adaptability to different firms' methodologies, presenting a unified solution customized for diverse investment management needs.

Edda's commitment to innovation is highlighted by its mobile app offering, catering to the needs of today’s investors who demand immediate access to information and functionality. This dedication to providing a responsive and comprehensive tool makes Edda the best CRM for venture capital and private equity, ensuring that vital data and relationship management tools are always within reach.

Top Features:

Deal Pipeline Management

Communication Management

Customizable Contact Lists

Advanced Analytics & Reporting

Document Management & Collaboration

Regulatory Compliance & Security

Investor Relations Management

Customizable Workflows

Enhanced Email Integration

Reinvigorate Your Investment Strategy with Edda's Investment Banking CRM Software

Operating an investment firm without a sophisticated capital markets CRM like Edda places you at a competitive disadvantage. Edda's CRM for investment bankers is more than a tool; it enhances investment strategy across the board by streamlining deal flow, refining the due diligence process, augmenting portfolio management, fortifying relationships, and maximizing fundraising efficiency. It takes the building blocks of investment management to new heights.

Adopting dynamic investment banking CRM software like Edda is indispensable for VC funds or PE firms aiming to stand out and attract limited partners (LPs). Modern investors are in pursuit of superior deal flow and returns, but they also value a seamless experience underpinned by trust and transparency. Edda's VC and private equity CRM tools are engineered to deliver precisely this, so your firm meets and exceeds the expectations of today's discerning investors.