Insightful Portfolio

Complete with detailed, user-friendly, performance reviews and reporting, Portfolio is your single source of truth.

Investors in 40+ countries manage $170B in assets on Edda

See the dimension of your investments

Discover Edda Portfolio’s tools to fundamentally simplify portfolio management

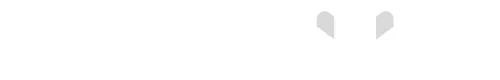

Portfolio Monitoring

Portfolio monitoring is comprehensive and clear with overviews including portfolio value and performance, KPIs like IRR and unrealized IRR, and fund value. Seamlessly extract reports and tracking metrics from your dashboard.

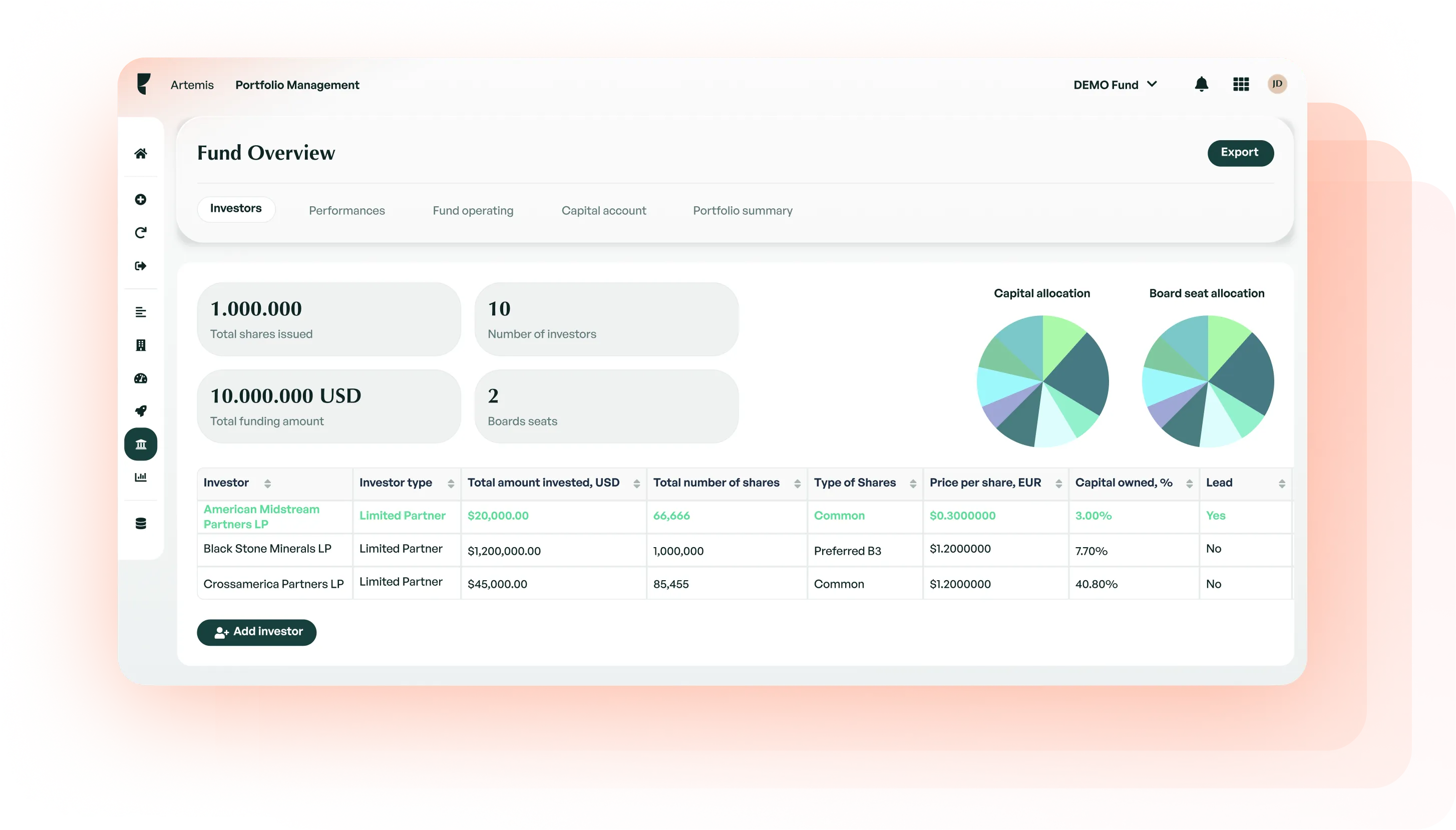

Fund Overview and Automated LP Reports

Edda provides intuitive visibility for your fund’s investors, performance, and portfolio composition. Easily generate reports for your LPs from any section of your fund overview.

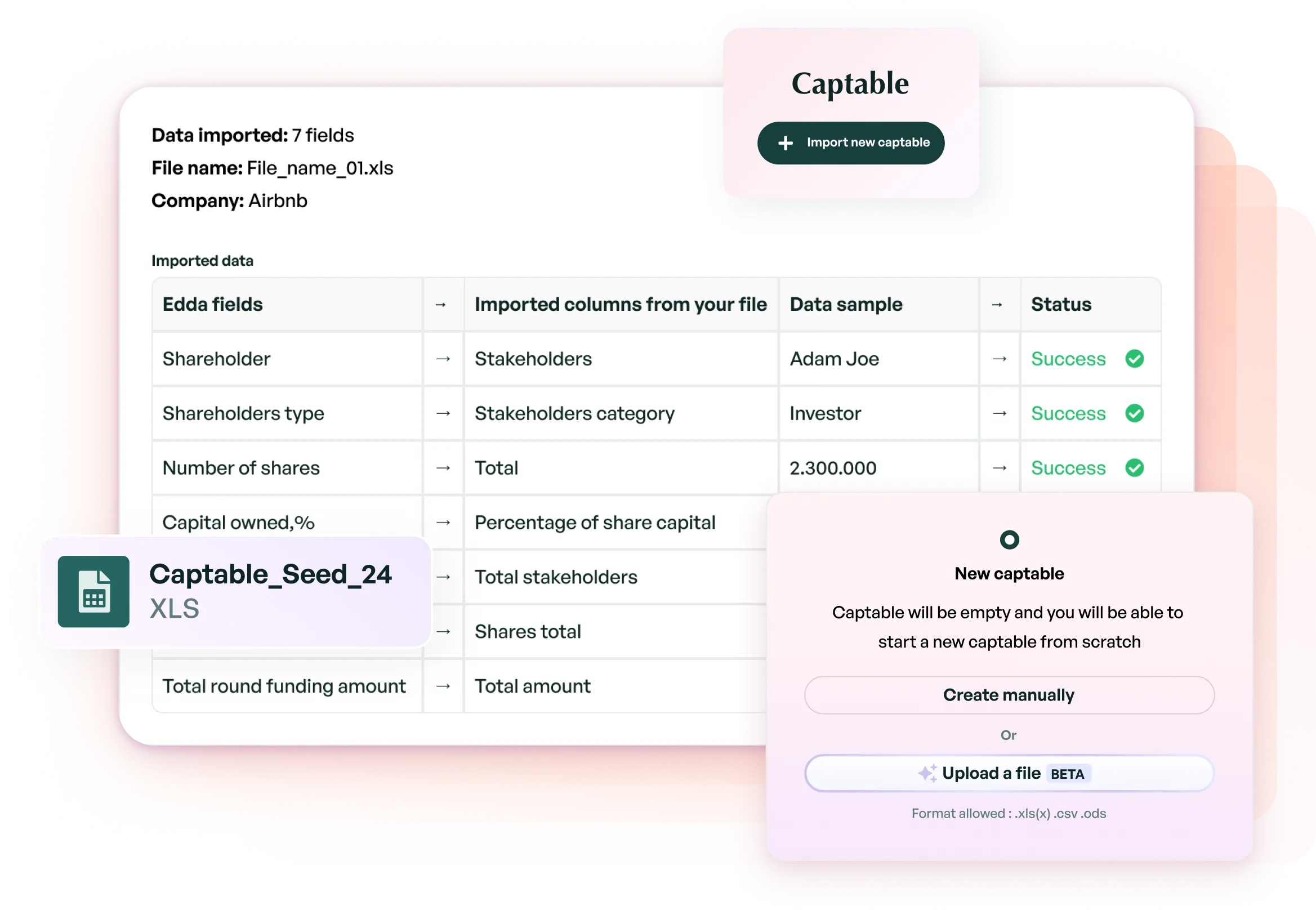

HERA.I Captable Importer  HERA.I

HERA.I

Unlock ultimate convenience in cap table management and make better-informed decisions with our AI-powered Cap Table Importer.

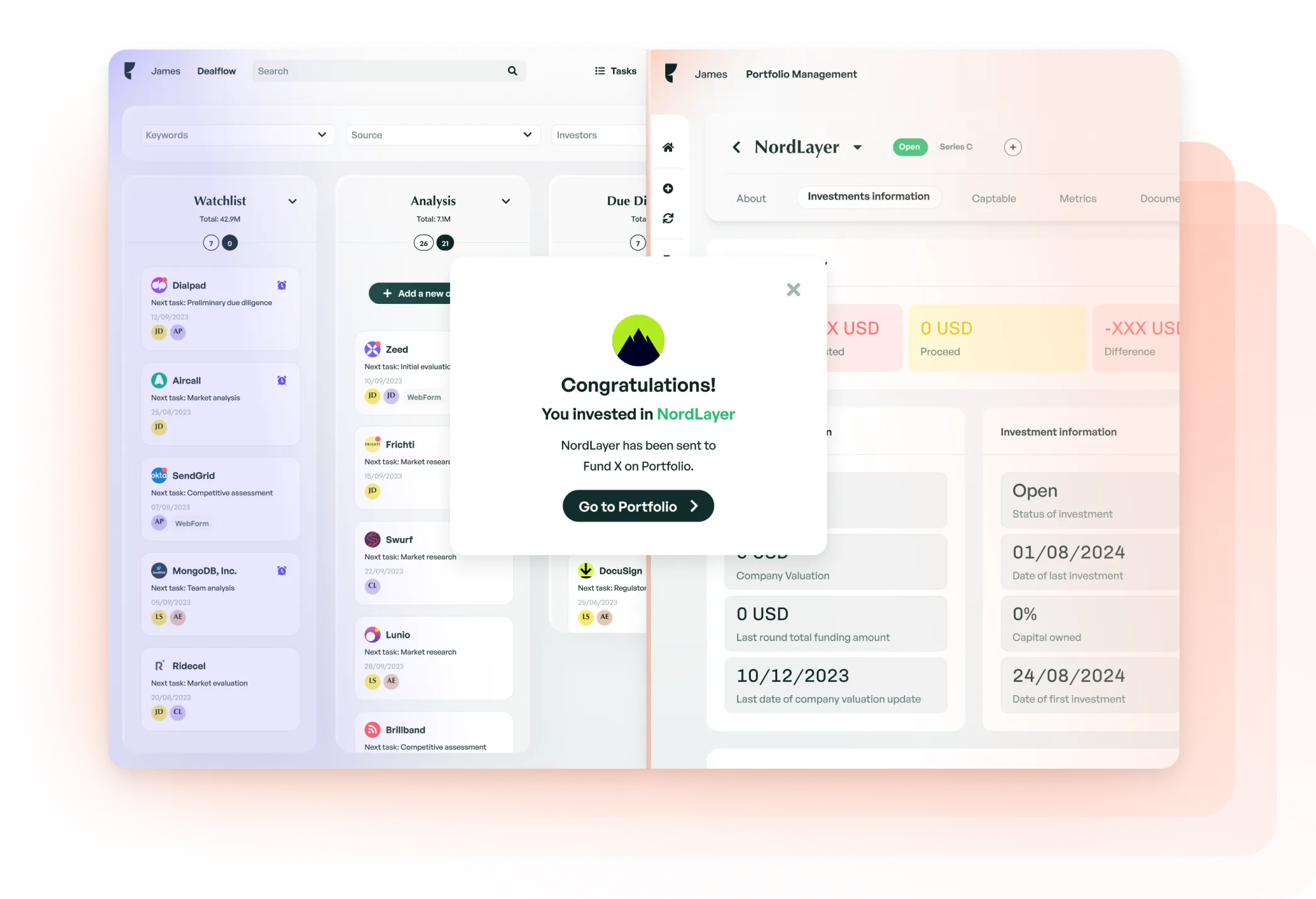

Dealflow to Portfolio

Once your Dealflow companies move to the “Invested” stage, their data is automatically transferred to your Portfolio - ready to manage immediately.

Your single source of truth, made simple

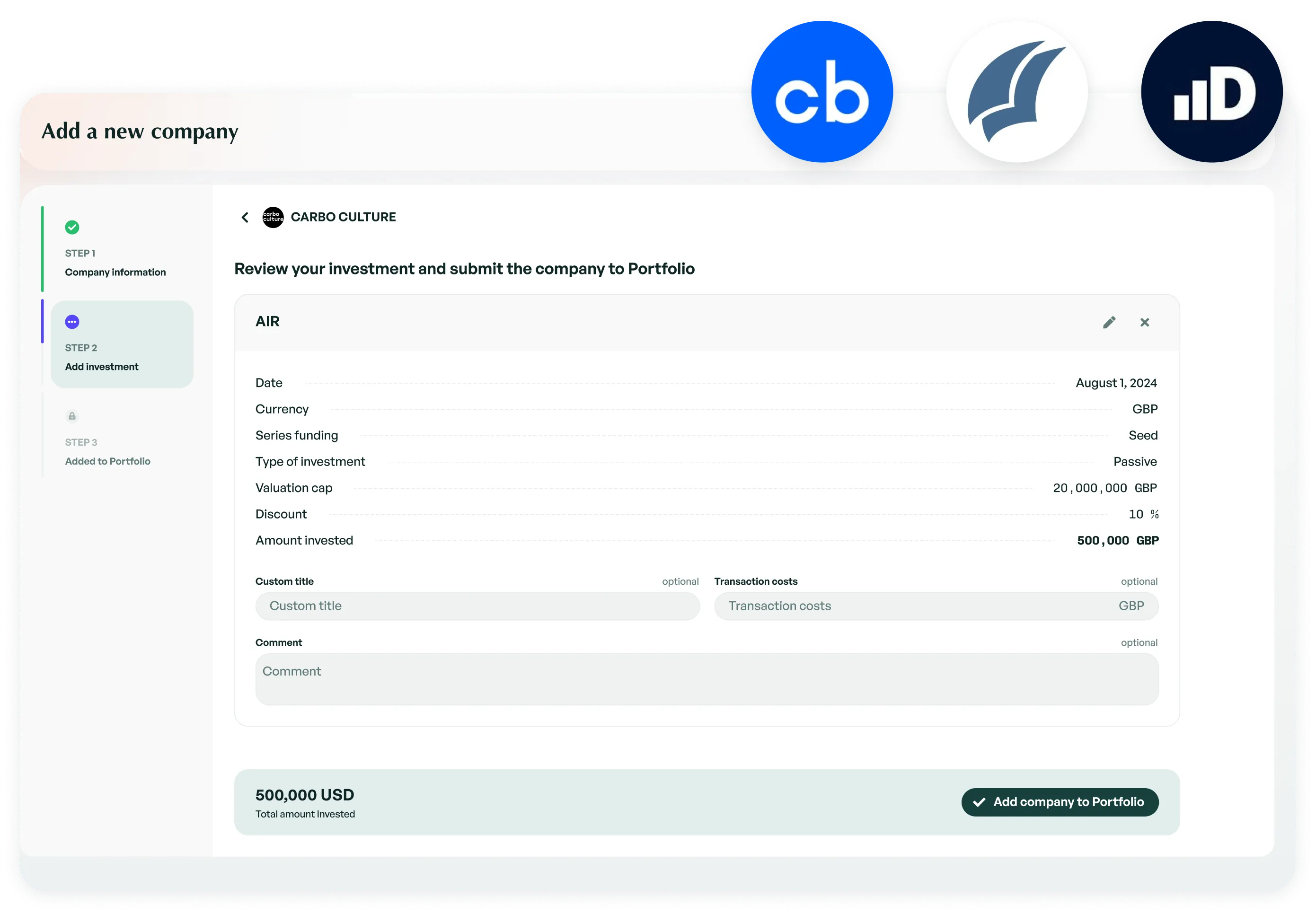

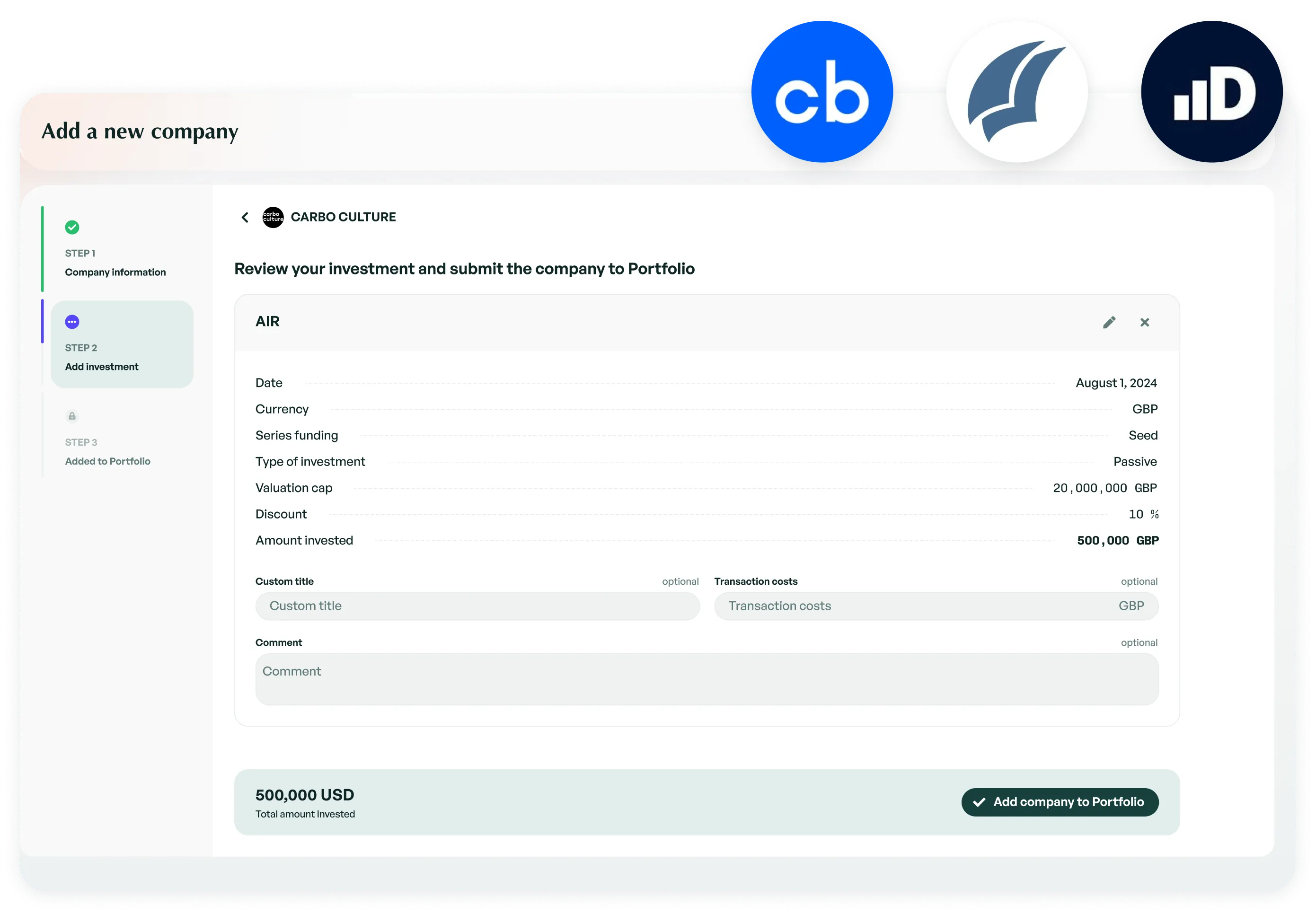

Effortlessly add a new company

Save time adding companies to your portfolio using Edda’s integrations with leading data providers, Dealroom, Crunchbase, and Pitchbook.

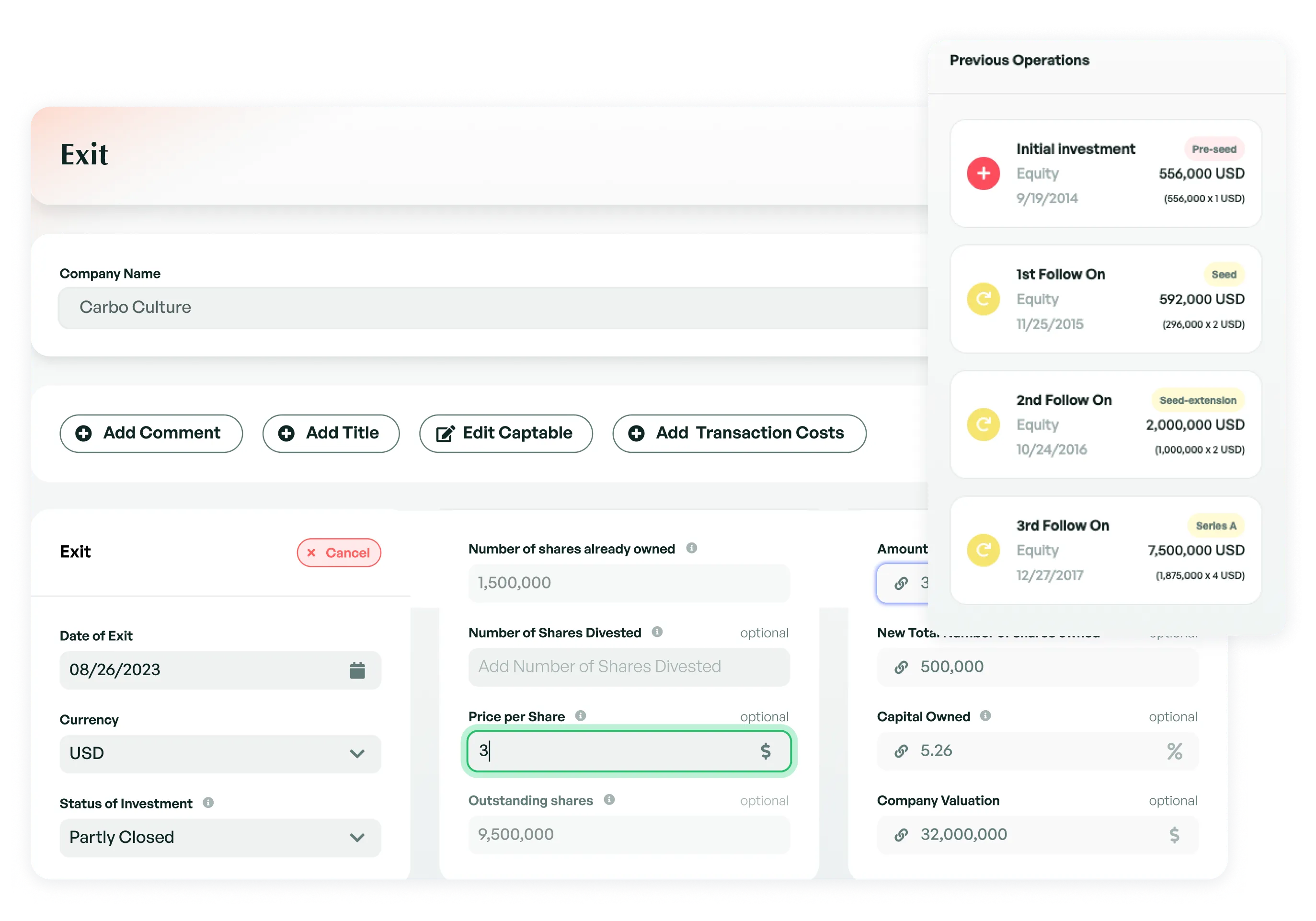

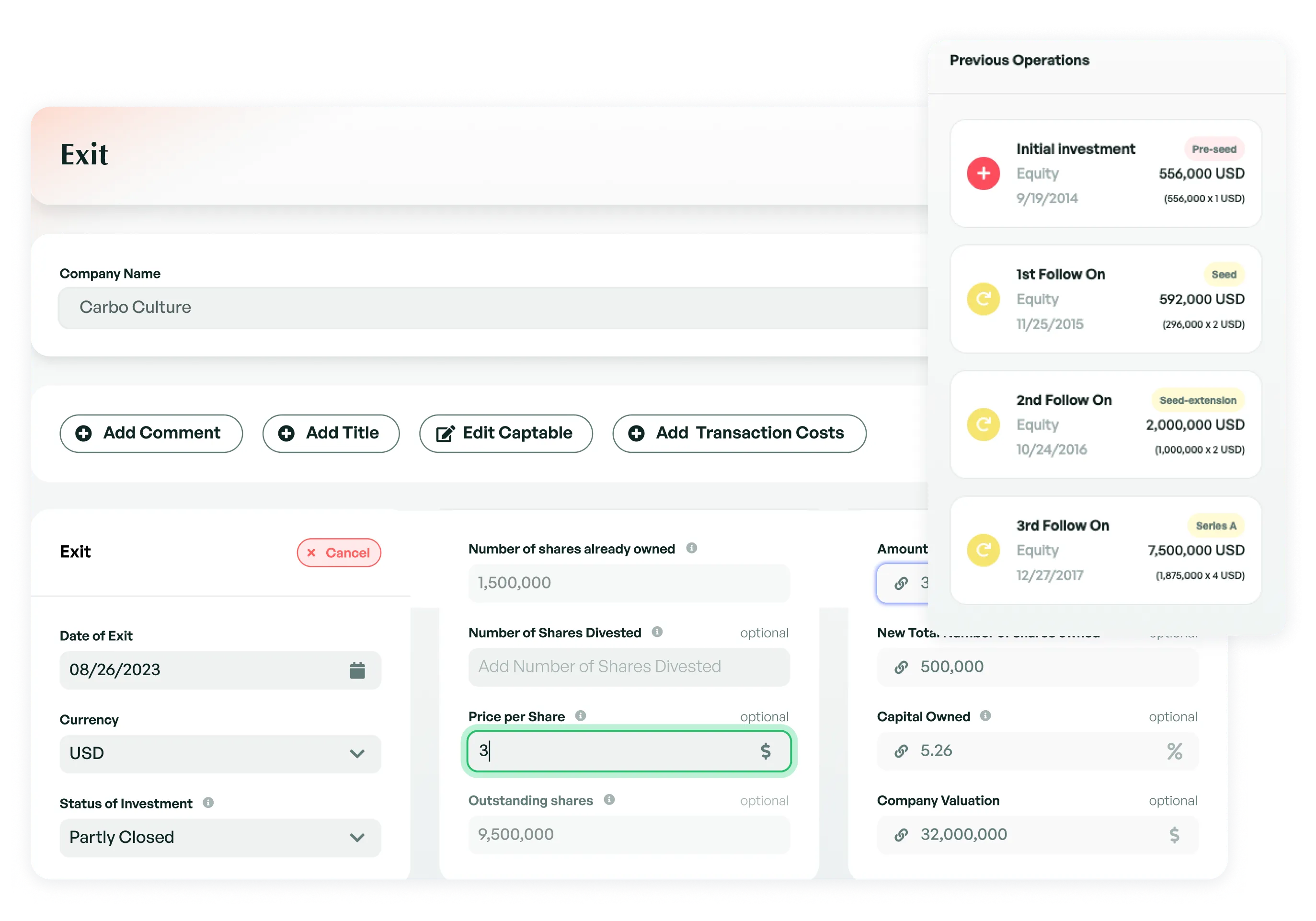

Manage exits mindfully

Edda’s Exit Manager provides clarity and context to your divestments. Get auto-calculated share values based on real-time FX rates available for 33 currencies.

Comprehensive company profiles

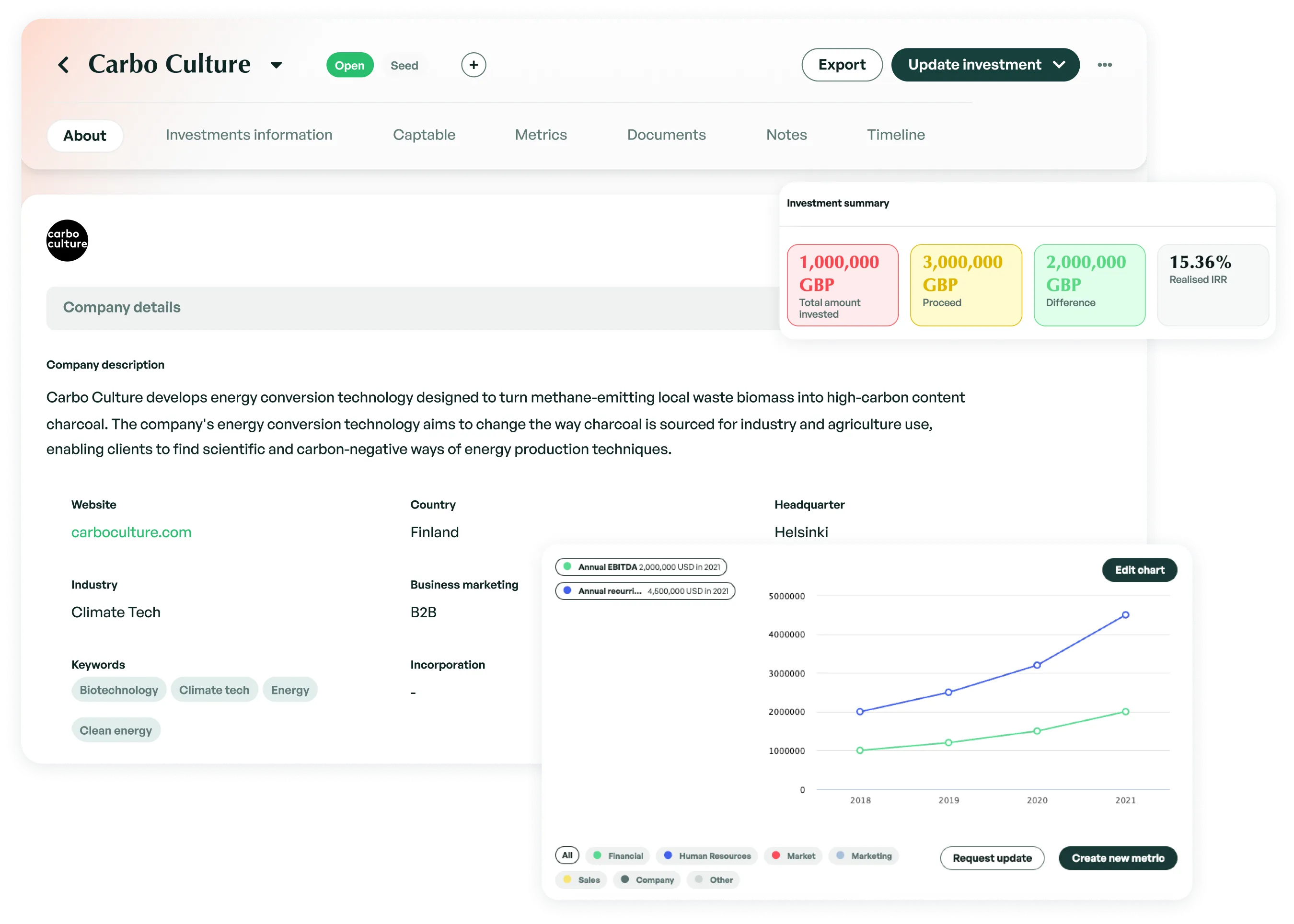

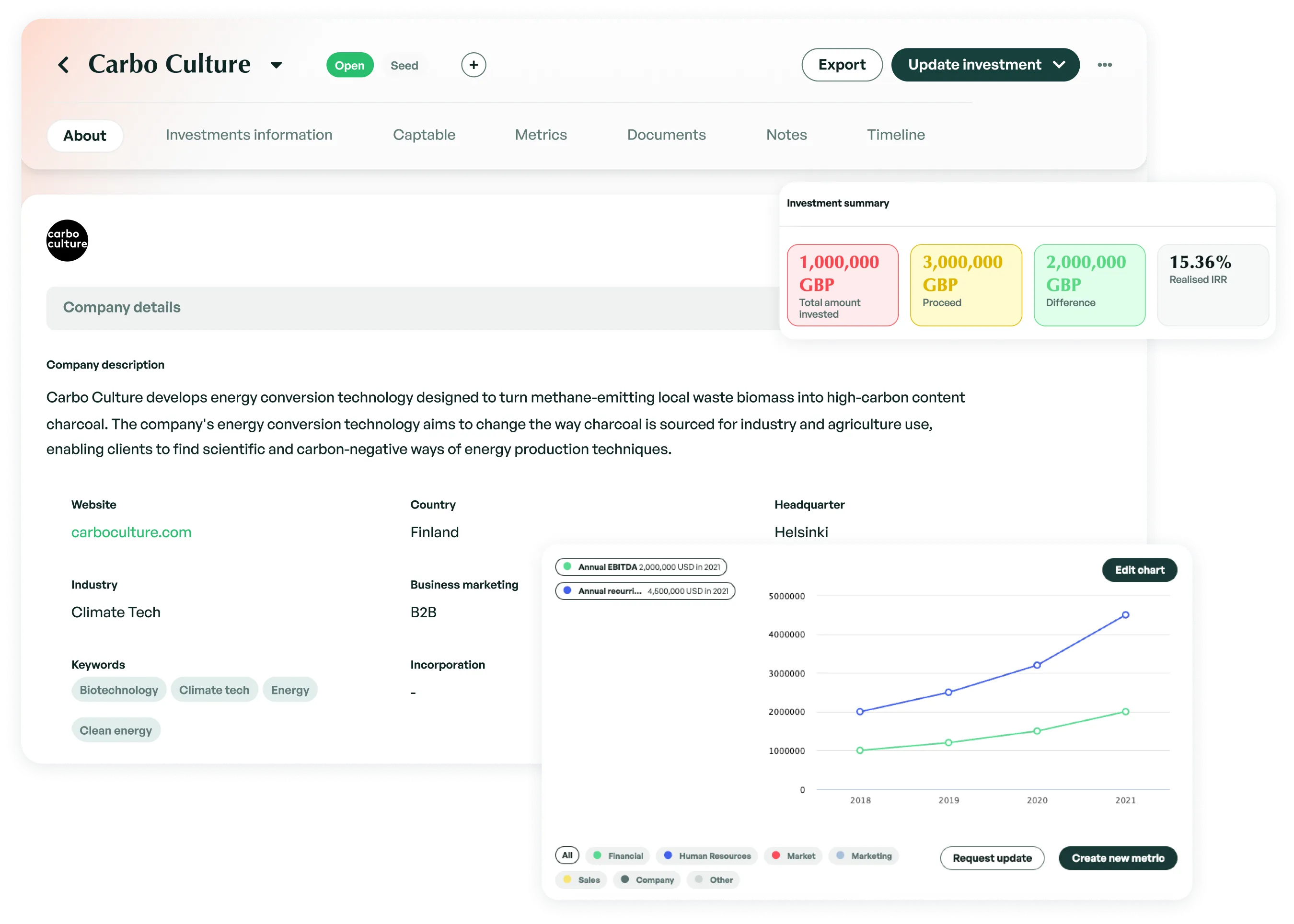

Key data for your portfolio companies is always on-hand: access every detail you need about a company and your associated investment activities through its profile.

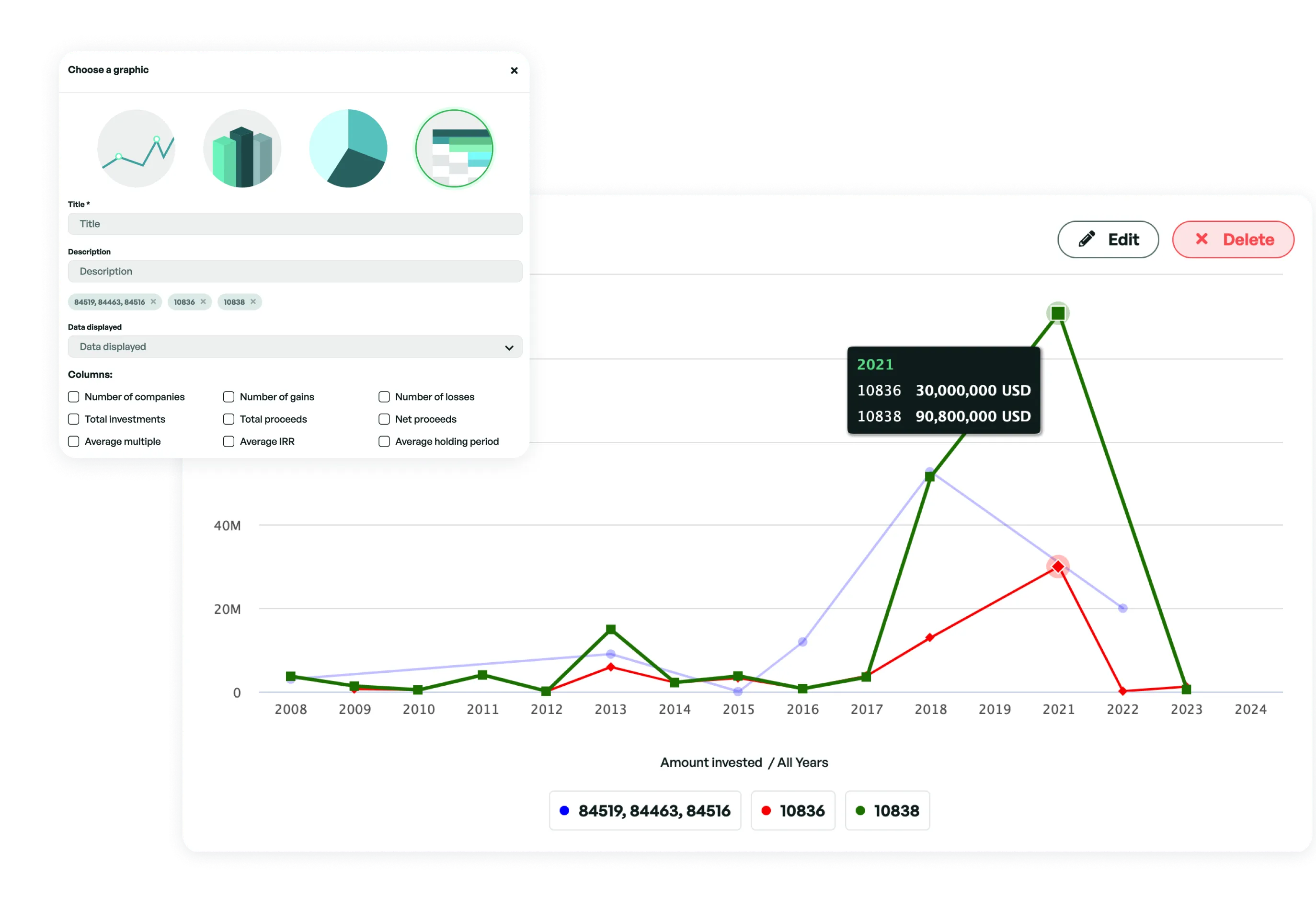

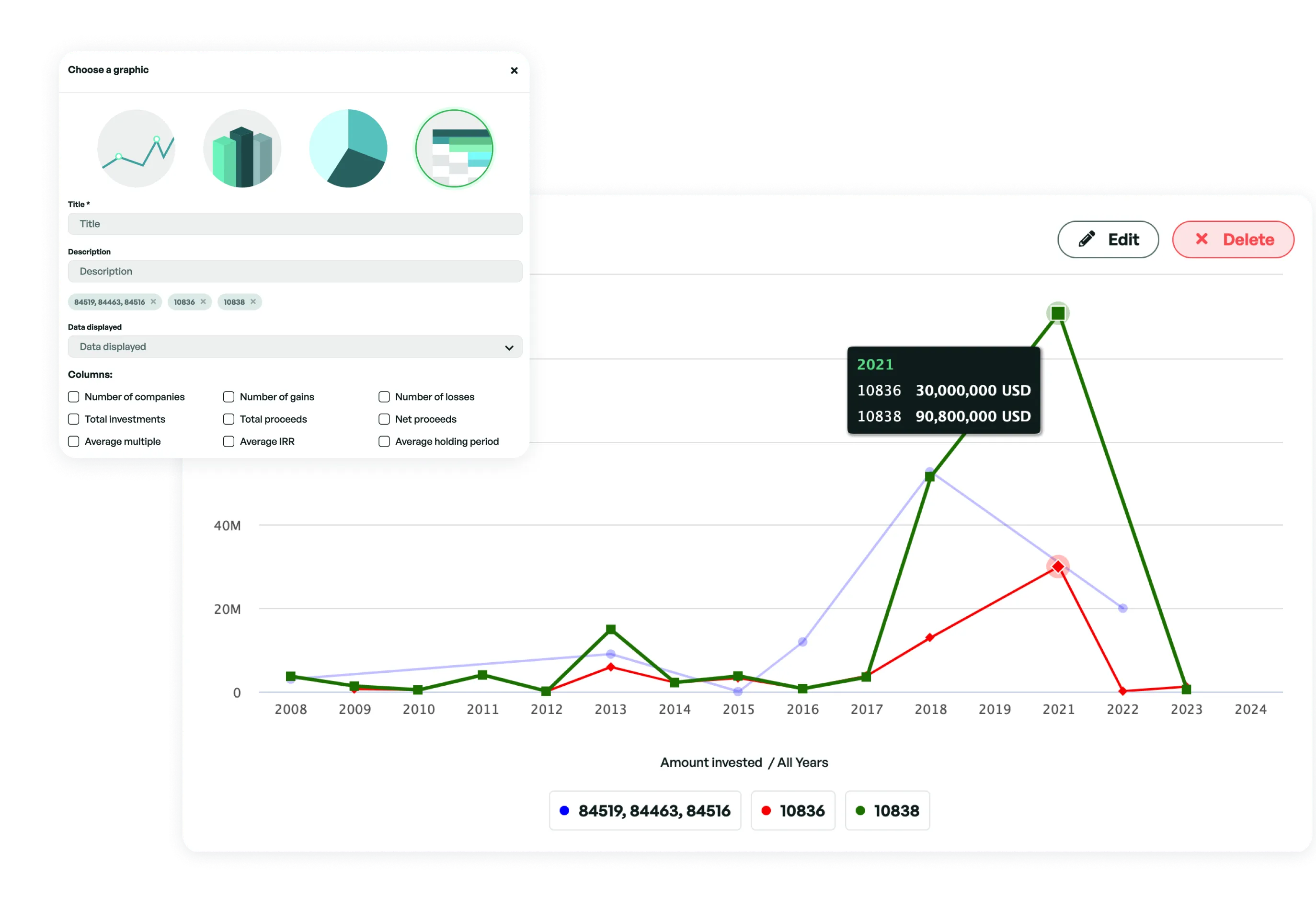

Automated reports for easier insights

Unlock portfolio insights by generating reports with data from your company profiles. These reports are easy to export and share with your LPs to communicate about your portfolio’s performance.

Intuitive portfolio overview

Your portfolio overview is intuitive and clear with Edda. Visualize a summary of your investments with auto-generated graphs and highlighted metrics.

Effortlessly add a new company

Save time adding companies to your portfolio using Edda’s integrations with leading data providers, Dealroom, Crunchbase, and Pitchbook.

Manage exits mindfully

Edda’s Exit Manager provides clarity and context to your divestments. Get auto-calculated share values based on real-time FX rates available for 33 currencies.

Comprehensive company profiles

Key data for your portfolio companies is always on-hand: access every detail you need about a company and your associated investment activities through its profile.

Automated reports for easier insights

Unlock portfolio insights by generating reports with data from your company profiles. These reports are easy to export and share with your LPs to communicate about your portfolio’s performance.

Intuitive portfolio overview

Your portfolio overview is intuitive and clear with Edda. Visualize a summary of your investments with auto-generated graphs and highlighted metrics.

Push your investments to the next level

What our users say about us

“What sets it apart from other tools is that there are an unbelievable number of KPIs which we could choose from, which is then also combined with the possibility to customise. This is this is how we could really fit those KPIs and the structures to meet our needs.”

RICARDA SCHULTE

Chemovator - Germany

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.

Discover more about Edda

What is PE and VC Portfolio Management?

For any investor, private equity or venture capital portfolio management is part art, part science. With thousands of moving pieces, data points, decisions and market machinations, managing a portfolio of companies is complex.

VC and private equity portfolio monitoring is a strategic process that involves identifying, assessing, investing in, and managing a collection of companies. And all of this must be done in line with a fund’s overall strategy, investment horizon and risk tolerance, to deliver maximum returns for LPs and GPs. It’s a careful balance of maintenance and proactive change to maximize return on investment.

Simply, the way in which a portfolio is managed has a sizable impact on overall fund performance. In other words, it’s not simply the choice of companies that are invested in that determines investment returns; it’s just as much about the oversight, management and communication with them that happens after an investment is made. This is the art of private equity and venture capital portfolio management.

How Exactly do PE and VC Portfolio Management Work?

Historically, much of the process of portfolio management has happened through a combination of spreadsheets, emails, data analysis and experience-gained decision making. However, as we’ll discuss in this article, there are now PE and VC portfolio management tools that streamline this previously manual process, making VC and private equity portfolio monitoring much more efficient and effective. Complicating things further, the true success of portfolio management is only fully understood at the completion of a fund’s cycle—that is, when the investment period has elapsed and results can be definitively calculated.

It goes without saying that private equity and venture capital portfolio management is a sophisticated task. And the level of sophistication only grows with the size and scope of a fund. Primarily, the process of portfolio management involves:

Maintaining a real-time understanding of portfolio company performance.

Tracking fund portfolio performance, including IRR, NAV, DPI and TVPI.

Managing asset allocation to understand how capital is being utilized and calculate expected returns.

Tracking portfolio company funding, including who has enough, who requires more and what future funding needs will be.

Communicate with and get updates from portfolio companies.

Risk profiling and management to balance exposure and align with fund goals.

Benchmark portfolio companies against competition and the market.

Perform due diligence on companies in an investment pipeline.

These are the core functions of portfolio management. But this is by no means an exhaustive list. The task is complex, multifaceted and ever-shifting. Which, in large part, is why we have seen a dramatic rise in PE and VC portfolio management tools in recent years, which streamline the process.

What's the Difference Between PE and VC Portfolio Management?

The general principles of private equity and venture capital portfolio management are fundamentally the same. However, due to the different nature and stage of the investments that private equity and venture capital focus on, there are some practices distinct to each. Let’s look at these now.

When it comes to private equity, investors focus on a wide variety of investment vehicles, including leveraged buyouts, real estate, venture capital, growth equity, securities, and more. Often all within a single fund. Because of the varied types of investment vehicles, investment decisions and private equity portfolio management relies on an equally diverse set of inputs that influence decision making, including P&Ls, market research, historical performance, market cap, and more.

On the other hand, venture capital investing is focused more on early or growth stage investments in private companies. This means, especially when it comes to early-stage investments, that venture capital investors have to rely on company visions, projections and team composition to make decisions, rather than more concrete economic data that is typically available to PE investors.

The 8 Fundamentals of Private Equity and Venture Capital Portfolio Management

So, now we’ve covered the nuances of venture capital and private equity portfolio management, let’s dig more deeply into the fundamental aspects of portfolio management that apply to both forms of investing.

Asset Allocation & Diversification

Asset allocation and diversification are fundamental pillars of private equity and venture capital portfolio management. How capital is allocated across company types and stages, industries, regions and vehicles is central to fund strategy. How assets are allocated is influenced by fund objectives and plays a big part in risk exposure. Diversification, in particular, helps ensure a fund isn’t overly exposed to a single risk factor.

As well as being a core part of venture capital and private equity portfolio monitoring, allocation and diversification are also the backbone of a fund's Private Placement Memorandum (PPM), which is presented to prospective investors during the capital raise process.

Portfolio Performance, Metrics & Reporting

The returns generated by a fund ultimately rest on the performance of its investments. That’s why performance measurement and reporting are a critical part of portfolio management.

Private equity and venture capital firms both use many of the same core markers for performance, including Internal Rate of Return (IRR) and the multiple of invested capital (MOIC). As part of these performance assessments, it’s common for firms to benchmark portfolio companies against one another and competitors in the wider market.

IRR measures the annualized effective compounded return rate of investment. This core metric reveals in plain terms a fund’s returns relative to the amount invested. MOIC adds further insight into fund performance by representing performance relative to an investment’s initial cost.

On top of this, VC firms will often rely on additional metrics, given the high-risk, high-return nature of venture funding. For example, venture capital firms often use metrics like “kill rate” (the percentage of failed investments) and “hit rate” (the percentage of investments that deliver a substantial return). The high-risk “barbell” nature of venture capital funding is that only a small percentage of investments, typically less than 20%, will cover the losses of failed investments and deliver positive returns.

Due Diligence

Due diligence is the cornerstone of private equity and venture portfolio management. While due diligence happens prior to an investment decision being made, it is still a core part of portfolio management.

In simple terms, due diligence involves seeking data, information and insights about an investment that’s being considered before making a final decision on whether to invest. These decision-influencing inputs are varied, making due diligence a multi-pronged approach.

Due diligence can be broken into multiple categories, including:

Financial due diligence - the assessment of company financials, profits and losses, revenue, assets, debt and more.

Market due diligence - assessment of a company’s market position, competition, growth potential, and overall market landscape.

Legal due diligence - the evaluation of any legal liabilities, for instance pending liens, torts or claims against a company.

Technical due diligence - a review of a company’s operational health, including productivity, staffing and IT.

The findings of each of the different forms of due diligence will be combined and assessed to make a decision on whether to invest, playing a fundamental role in

portfolio management.

Market Research & Comparative Analysis

Taking the time to benchmark portfolio companies as part of comparative analysis is a valuable act of portfolio management. In doing so, not only do investors get an understanding of the best performers in a fund, they can also use this information to inform future investment decisions and strategies. For instance, if a certain investment is over indexing when it comes to returns, this may become a preferred investment strategy for future funds.

When investors benchmark venture capital portfolio or a PE portfolio, this allows them to run side-by-side comparisons of company valuations, calculating the IRR for each company and and for the fund as a whole.

Monitoring and Oversight

Once an investment has been made, maintaining oversight is a core function of PE and VC portfolio management. It’s the process of ensuring the capital allocated is used optimally and that the company invested in is operating in a way that produces the highest level of returns for the PE or VC firm that has funded it.

Regular reporting and performance tracking make up a big part of this monitoring process. This includes regular updates on things like ownership and cap table data

financials and cash position. More broadly, oversight of a portfolio as a whole enables investors to constantly assess how their portfolio aligns with their overarching investment focus.

These days, oversight is very much the domain of PE and the VC portfolio management tools available. This type of purpose-built technology enables investors to gain real-time visibility into portfolio performance.

Value Creation

A major part—and competitive advantage—of PE and venture capital portfolio management is the value creation they can bring to their portfolio companies. Put simply, value creation is the actions firms can make, and the support they can provide, to portfolio companies to increase their performance, and thus the investment returns they deliver.

Private equity firms often take an active role in managing their portfolio companies. To improve a company’s operations and financial performance, a PE firm will take actions like bringing in new senior executives, strategic advising and cost-cutting. In the event of a leveraged buyout, a PE firm may install an entirely new board and management team with the goal of dramatic value creation.

While driven by the same underlying principles, VC firms take a slightly different approach to value creation. Especially when it comes to early-stage investing. The companies that venture capital firms invest in are often at an early or growth stage, meaning they lack the level of management experience and infrastructure that established companies have. In this scenario, VC firms will often propel value creation by playing a hands-on role in company strategy, business development and recruitment.

Whatever the actions firms take, value creation is a pivotal part of private equity and venture capital portfolio management that can have an outsized impact on investment returns.

Risk Profiling and Management

Risk is an inherent part of investing—and a central component of private equity and venture portfolio management. As touched on early, the different investment approaches of private equity and venture capital come with a different set of risks that require unique risk management techniques.

For private equity, risk comes in many forms: interest rates, exchange rates, management issues, production issues, operational inefficiencies and more. And that’s only within the company itself. PE investments also have an increased exposure to systemic risks caused by changes in market and regional situations.

Venture capital is more homogeneous in that investors solely focus on investing in companies, rather than the diverse investment vehicles of private equity investing. However, given venture capital firms invest in private companies at all stages, this brings heightened risk because the chances of failure are higher.

In both VC and private equity portfolio monitoring, identifying risk, quantifying it, and assessing its potential impact is a vital part of the process. It influences fund structure and strategy. Firms will create mitigation strategies to prevent exposure to risk, including diversification, hedging, maintaining capital reserves and active involvement in company operation.

Exit Planning & Strategies

Until an exit is achieved for a company, investment returns remain unrealized. On paper, a company may have grown significantly, but an exit must be achieved before a firm and its investors gain the benefit of these “paper gains”. This is where exit planning and strategies come in as a part of PE and vc portfolio management.

Naturally, both private equity and venture capital firms aim for profitable exits for all their investments. But how they typically achieve them varies. For venture capital firms, exits usually come via initial public offerings (IPOs) or through an acquisition by a larger company. Both these exit routes are also on the table for PR firms, but they also take a different approach as part of exit planning, by also including how they will improve operations and company profits as part of their involvement in their investments.

While both types of firms aim for profitable exits, VC firms often target exits via IPO or acquisition by a larger company in the industry. On the other hand, PE firms, especially those focused on buyouts, often seek to improve the operations of an established company and might exit via a sale to another PE firm or a strategic buyer, or via IPO.

When it comes to private equity and venture portfolio management, exit planning and strategies will be considered at the point of initial investment and throughout the lifecycle of the investment, to ensure the optimal exit approach is taken to achieve maximum ROI.

The Role of Technology in Investing: Portfolio Management Software

As evidenced above, private equity and venture capital portfolio management is at times a herculean task. In fact, how well it is performed is a major driver in fund performance.

Thankfully, what once was a largely manual, disparate process can now be done in a more efficient and streamlined way using PE and VC portfolio management software. Venture capital and private equity portfolio monitoring software allows firms to see in real time the true dimension of their investments and the value and impact they create.

It's important to note that while PE and VC portfolio management tools greatly enhance portfolio management, it doesn't replace the need for human judgment and expertise. In short, private equity and venture capital software aid better decisions through greater visibility and more data, however investors must still define strategies and interpret the data.

With that said, venture capital and private equity deal tracking software is a must-have for any firm today. Let’s take a look at some of the ways these portfolio management tools simplify and enhance portfolio management.

Data analytics and machine learning - Private equity and venture capital software tools enable portfolio managers to process vast amounts of data quickly. They help investors identify patterns, analyze market trends, track company performance, and more to make better, data-driven decisions.

Communicate with portfolio companies - A steady stream of communication is critical to managing and overseeing portfolio companies. Portfolio management software allows investors to do this within the platform itself, in the process consolidating all communication in one place. In this way, this kind of technology acts as a portfolio CRM.

Reporting and updates - Portfolio and deal management software allows for real-time tracking and visualization of portfolio performance. Investors and managers can use dashboards to quickly get an overview of their portfolio's performance and drill down for more detailed information. This includes the ability to request and receive updated metrics and captables directly from founders or internal team members

Track company and fund metrics - Effective portfolio management depends on always “knowing the numbers”. Venture capital and private equity deal tracking software makes it easier to do this by automatically calculating IRR, MOIC, NAV, DPI, TVPI, and more.

Real-time visibility - With the real-time updates and metrics for portfolio companies available via private equity and venture capital software, firms and their LPs and GPs gain unmatched visibility. This transparency aids portfolio management as it allows investors to assess where additional input—be it financial, operational or otherwise—may be required for a portfolio company.

Edda PE and VC Portfolio Management Software

Edda PE and VC portfolio management software is purpose-built by industry veterans to help firms more efficiently and effectively manage their portfolios. Investors depend on Edda at all stages of investing to improve their portfolio monitoring, reporting and due diligence processes.

Edda is an all-in-one portfolio management software and deal flow software. Used by hundreds of companies to manage $170 billion-plus in investments, it’s the leading private equity deal tracking software, deal flow pipeline softwareand portfolio CRM.

What is PE and VC Portfolio Management?

For any investor, private equity or venture capital portfolio management is part art, part science. With thousands of moving pieces, data points, decisions and market machinations, managing a portfolio of companies is complex.

VC and private equity portfolio monitoring is a strategic process that involves identifying, assessing, investing in, and managing a collection of companies. And all of this must be done in line with a fund’s overall strategy, investment horizon and risk tolerance, to deliver maximum returns for LPs and GPs. It’s a careful balance of maintenance and proactive change to maximize return on investment.

Simply, the way in which a portfolio is managed has a sizable impact on overall fund performance. In other words, it’s not simply the choice of companies that are invested in that determines investment returns; it’s just as much about the oversight, management and communication with them that happens after an investment is made. This is the art of private equity and venture capital portfolio management.

How Exactly do PE and VC Portfolio Management Work?

Historically, much of the process of portfolio management has happened through a combination of spreadsheets, emails, data analysis and experience-gained decision making. However, as we’ll discuss in this article, there are now PE and VC portfolio management tools that streamline this previously manual process, making VC and private equity portfolio monitoring much more efficient and effective. Complicating things further, the true success of portfolio management is only fully understood at the completion of a fund’s cycle—that is, when the investment period has elapsed and results can be definitively calculated.

It goes without saying that private equity and venture capital portfolio management is a sophisticated task. And the level of sophistication only grows with the size and scope of a fund. Primarily, the process of portfolio management involves:

Maintaining a real-time understanding of portfolio company performance.

Tracking fund portfolio performance, including IRR, NAV, DPI and TVPI.

Managing asset allocation to understand how capital is being utilized and calculate expected returns.

Tracking portfolio company funding, including who has enough, who requires more and what future funding needs will be.

Communicate with and get updates from portfolio companies.

Risk profiling and management to balance exposure and align with fund goals.

Benchmark portfolio companies against competition and the market.

Perform due diligence on companies in an investment pipeline.

These are the core functions of portfolio management. But this is by no means an exhaustive list. The task is complex, multifaceted and ever-shifting. Which, in large part, is why we have seen a dramatic rise in PE and VC portfolio management tools in recent years, which streamline the process.

What's the Difference Between PE and VC Portfolio Management?

The general principles of private equity and venture capital portfolio management are fundamentally the same. However, due to the different nature and stage of the investments that private equity and venture capital focus on, there are some practices distinct to each. Let’s look at these now.

When it comes to private equity, investors focus on a wide variety of investment vehicles, including leveraged buyouts, real estate, venture capital, growth equity, securities, and more. Often all within a single fund. Because of the varied types of investment vehicles, investment decisions and private equity portfolio management relies on an equally diverse set of inputs that influence decision making, including P&Ls, market research, historical performance, market cap, and more.

On the other hand, venture capital investing is focused more on early or growth stage investments in private companies. This means, especially when it comes to early-stage investments, that venture capital investors have to rely on company visions, projections and team composition to make decisions, rather than more concrete economic data that is typically available to PE investors.

The 8 Fundamentals of Private Equity and Venture Capital Portfolio Management

So, now we’ve covered the nuances of venture capital and private equity portfolio management, let’s dig more deeply into the fundamental aspects of portfolio management that apply to both forms of investing.

Asset Allocation & Diversification

Asset allocation and diversification are fundamental pillars of private equity and venture capital portfolio management. How capital is allocated across company types and stages, industries, regions and vehicles is central to fund strategy. How assets are allocated is influenced by fund objectives and plays a big part in risk exposure. Diversification, in particular, helps ensure a fund isn’t overly exposed to a single risk factor.

As well as being a core part of venture capital and private equity portfolio monitoring, allocation and diversification are also the backbone of a fund's Private Placement Memorandum (PPM), which is presented to prospective investors during the capital raise process.

Portfolio Performance, Metrics & Reporting

The returns generated by a fund ultimately rest on the performance of its investments. That’s why performance measurement and reporting are a critical part of portfolio management.

Private equity and venture capital firms both use many of the same core markers for performance, including Internal Rate of Return (IRR) and the multiple of invested capital (MOIC). As part of these performance assessments, it’s common for firms to benchmark portfolio companies against one another and competitors in the wider market.

IRR measures the annualized effective compounded return rate of investment. This core metric reveals in plain terms a fund’s returns relative to the amount invested. MOIC adds further insight into fund performance by representing performance relative to an investment’s initial cost.

On top of this, VC firms will often rely on additional metrics, given the high-risk, high-return nature of venture funding. For example, venture capital firms often use metrics like “kill rate” (the percentage of failed investments) and “hit rate” (the percentage of investments that deliver a substantial return). The high-risk “barbell” nature of venture capital funding is that only a small percentage of investments, typically less than 20%, will cover the losses of failed investments and deliver positive returns.

Due Diligence

Due diligence is the cornerstone of private equity and venture portfolio management. While due diligence happens prior to an investment decision being made, it is still a core part of portfolio management.

In simple terms, due diligence involves seeking data, information and insights about an investment that’s being considered before making a final decision on whether to invest. These decision-influencing inputs are varied, making due diligence a multi-pronged approach.

Due diligence can be broken into multiple categories, including:

Financial due diligence - the assessment of company financials, profits and losses, revenue, assets, debt and more.

Market due diligence - assessment of a company’s market position, competition, growth potential, and overall market landscape.

Legal due diligence - the evaluation of any legal liabilities, for instance pending liens, torts or claims against a company.

Technical due diligence - a review of a company’s operational health, including productivity, staffing and IT.

The findings of each of the different forms of due diligence will be combined and assessed to make a decision on whether to invest, playing a fundamental role in

portfolio management.

Market Research & Comparative Analysis

Taking the time to benchmark portfolio companies as part of comparative analysis is a valuable act of portfolio management. In doing so, not only do investors get an understanding of the best performers in a fund, they can also use this information to inform future investment decisions and strategies. For instance, if a certain investment is over indexing when it comes to returns, this may become a preferred investment strategy for future funds.

When investors benchmark venture capital portfolio or a PE portfolio, this allows them to run side-by-side comparisons of company valuations, calculating the IRR for each company and and for the fund as a whole.

Monitoring and Oversight

Once an investment has been made, maintaining oversight is a core function of PE and VC portfolio management. It’s the process of ensuring the capital allocated is used optimally and that the company invested in is operating in a way that produces the highest level of returns for the PE or VC firm that has funded it.

Regular reporting and performance tracking make up a big part of this monitoring process. This includes regular updates on things like ownership and cap table data

financials and cash position. More broadly, oversight of a portfolio as a whole enables investors to constantly assess how their portfolio aligns with their overarching investment focus.

These days, oversight is very much the domain of PE and the VC portfolio management tools available. This type of purpose-built technology enables investors to gain real-time visibility into portfolio performance.

Value Creation

A major part—and competitive advantage—of PE and venture capital portfolio management is the value creation they can bring to their portfolio companies. Put simply, value creation is the actions firms can make, and the support they can provide, to portfolio companies to increase their performance, and thus the investment returns they deliver.

Private equity firms often take an active role in managing their portfolio companies. To improve a company’s operations and financial performance, a PE firm will take actions like bringing in new senior executives, strategic advising and cost-cutting. In the event of a leveraged buyout, a PE firm may install an entirely new board and management team with the goal of dramatic value creation.

While driven by the same underlying principles, VC firms take a slightly different approach to value creation. Especially when it comes to early-stage investing. The companies that venture capital firms invest in are often at an early or growth stage, meaning they lack the level of management experience and infrastructure that established companies have. In this scenario, VC firms will often propel value creation by playing a hands-on role in company strategy, business development and recruitment.

Whatever the actions firms take, value creation is a pivotal part of private equity and venture capital portfolio management that can have an outsized impact on investment returns.

Risk Profiling and Management

Risk is an inherent part of investing—and a central component of private equity and venture portfolio management. As touched on early, the different investment approaches of private equity and venture capital come with a different set of risks that require unique risk management techniques.

For private equity, risk comes in many forms: interest rates, exchange rates, management issues, production issues, operational inefficiencies and more. And that’s only within the company itself. PE investments also have an increased exposure to systemic risks caused by changes in market and regional situations.

Venture capital is more homogeneous in that investors solely focus on investing in companies, rather than the diverse investment vehicles of private equity investing. However, given venture capital firms invest in private companies at all stages, this brings heightened risk because the chances of failure are higher.

In both VC and private equity portfolio monitoring, identifying risk, quantifying it, and assessing its potential impact is a vital part of the process. It influences fund structure and strategy. Firms will create mitigation strategies to prevent exposure to risk, including diversification, hedging, maintaining capital reserves and active involvement in company operation.

Exit Planning & Strategies

Until an exit is achieved for a company, investment returns remain unrealized. On paper, a company may have grown significantly, but an exit must be achieved before a firm and its investors gain the benefit of these “paper gains”. This is where exit planning and strategies come in as a part of PE and vc portfolio management.

Naturally, both private equity and venture capital firms aim for profitable exits for all their investments. But how they typically achieve them varies. For venture capital firms, exits usually come via initial public offerings (IPOs) or through an acquisition by a larger company. Both these exit routes are also on the table for PR firms, but they also take a different approach as part of exit planning, by also including how they will improve operations and company profits as part of their involvement in their investments.

While both types of firms aim for profitable exits, VC firms often target exits via IPO or acquisition by a larger company in the industry. On the other hand, PE firms, especially those focused on buyouts, often seek to improve the operations of an established company and might exit via a sale to another PE firm or a strategic buyer, or via IPO.

When it comes to private equity and venture portfolio management, exit planning and strategies will be considered at the point of initial investment and throughout the lifecycle of the investment, to ensure the optimal exit approach is taken to achieve maximum ROI.

The Role of Technology in Investing: Portfolio Management Software

As evidenced above, private equity and venture capital portfolio management is at times a herculean task. In fact, how well it is performed is a major driver in fund performance.

Thankfully, what once was a largely manual, disparate process can now be done in a more efficient and streamlined way using PE and VC portfolio management software. Venture capital and private equity portfolio monitoring software allows firms to see in real time the true dimension of their investments and the value and impact they create.

It's important to note that while PE and VC portfolio management tools greatly enhance portfolio management, it doesn't replace the need for human judgment and expertise. In short, private equity and venture capital software aid better decisions through greater visibility and more data, however investors must still define strategies and interpret the data.

With that said, venture capital and private equity deal tracking software is a must-have for any firm today. Let’s take a look at some of the ways these portfolio management tools simplify and enhance portfolio management.

Data analytics and machine learning - Private equity and venture capital software tools enable portfolio managers to process vast amounts of data quickly. They help investors identify patterns, analyze market trends, track company performance, and more to make better, data-driven decisions.

Communicate with portfolio companies - A steady stream of communication is critical to managing and overseeing portfolio companies. Portfolio management software allows investors to do this within the platform itself, in the process consolidating all communication in one place. In this way, this kind of technology acts as a portfolio CRM.

Reporting and updates - Portfolio and deal management software allows for real-time tracking and visualization of portfolio performance. Investors and managers can use dashboards to quickly get an overview of their portfolio's performance and drill down for more detailed information. This includes the ability to request and receive updated metrics and captables directly from founders or internal team members

Track company and fund metrics - Effective portfolio management depends on always “knowing the numbers”. Venture capital and private equity deal tracking software makes it easier to do this by automatically calculating IRR, MOIC, NAV, DPI, TVPI, and more.

Real-time visibility - With the real-time updates and metrics for portfolio companies available via private equity and venture capital software, firms and their LPs and GPs gain unmatched visibility. This transparency aids portfolio management as it allows investors to assess where additional input—be it financial, operational or otherwise—may be required for a portfolio company.

Edda PE and VC Portfolio Management Software

Edda PE and VC portfolio management software is purpose-built by industry veterans to help firms more efficiently and effectively manage their portfolios. Investors depend on Edda at all stages of investing to improve their portfolio monitoring, reporting and due diligence processes.

Edda is an all-in-one portfolio management software and deal flow software. Used by hundreds of companies to manage $170 billion-plus in investments, it’s the leading private equity deal tracking software, deal flow pipeline softwareand portfolio CRM.