Edda or Affinity?

Which is the Better Private Equity Deal Management Software For Managing Your Deal Flow?

So, you’ve made the wise decision to ditch spreadsheets for deal flow management software. And you’ve narrowed down your search to Edda and the Affinity app. Clearly you’ve done your research! In this article, we’ll give you a comprehensive comparison of Edda and Affinity so that you can confidently select the best deal flow software for your needs.

First, Here’s an Overview of Edda and Affinity Software

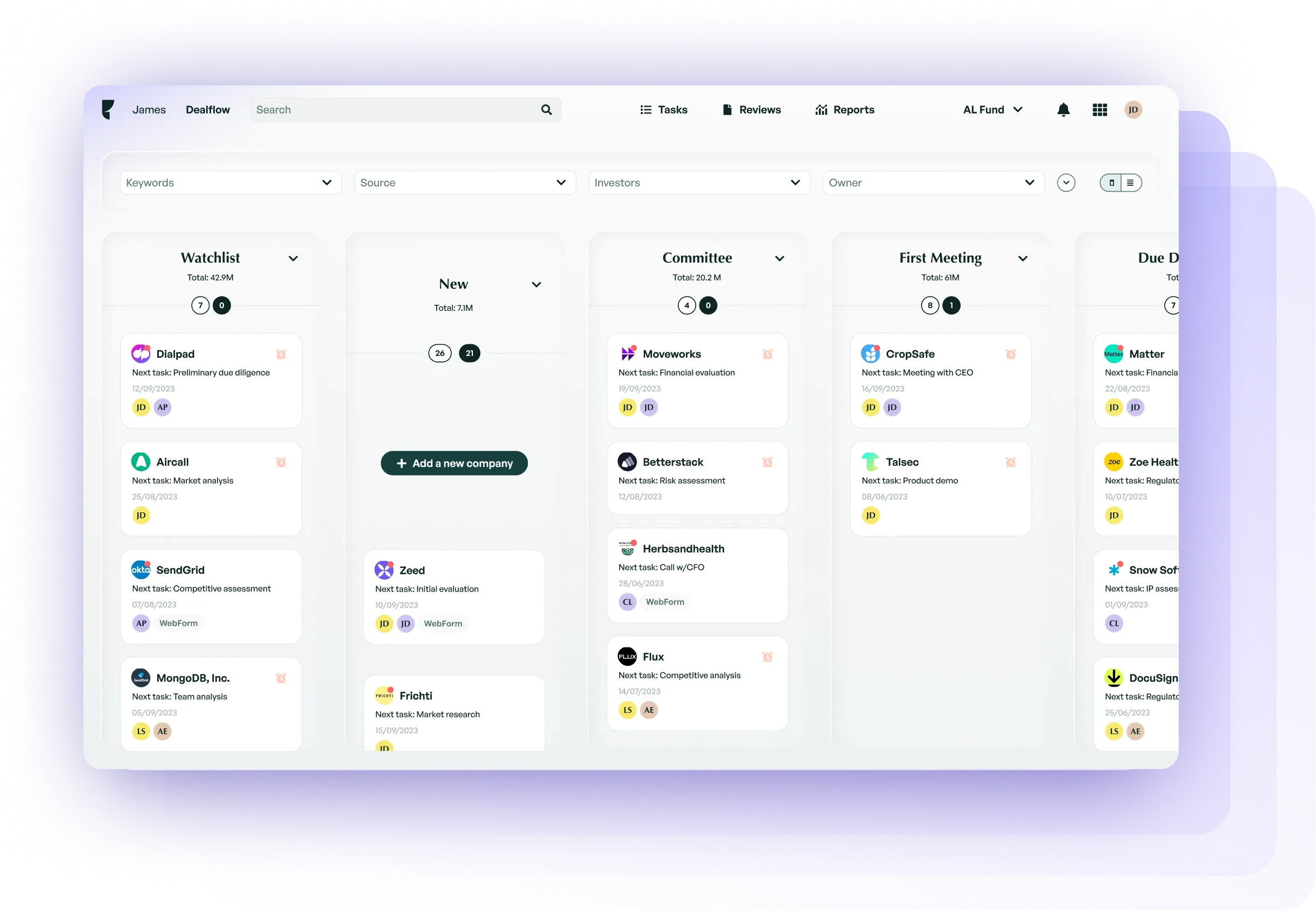

Edda Dealflow Management Software

Edda consolidates the entire investment process into a unified platform, enhancing your team's ability to manage deals and relationships while fostering seamless day-to-day collaboration. Built on the philosophy that increased visibility at every stage of the investment process leads to stronger relationships and better outcomes, Edda is designed to be the comprehensive deal software for your firm. Covering deal origination, pipeline management, due diligence, portfolio management, and investor CRM, Edda streamlines your operational and investment processes.

As a testament to its end-to-end capabilities, over $170 billion is currently managed through the platform by leading private equity and VC firms in 40+ countries. Beyond optimizing investment strategies, Edda's deal software also streamlines daily workflows and operations, promoting enhanced collaboration.

Affinity CRM for Private Equity

Affinity CRM for Private Equity recognizes that investing is fundamentally built on relationships. Positioned as a "360-degree Rolodex" for your firm, the Affinity app serves as a CRM for private equity, allowing better management and capitalization of your network. If your focus is on simplifying contact management, accessing your network, and relationship management, Affinity CRM may be the private equity technology for you. However, if robust dealflow and portfolio management functionality are top priorities, other solutions like Edda offer a more comprehensive approach, covering deal sourcing, tracking, portfolio management, and CRM investor relations functionality.

Edda and Affinity Software Features Side by Side

When it comes to selecting a deal flow management tool, features are the No.1 factor behind the decision you make. Simply, you need to know for certain that the deal management software you select has all the features your team needs most. With this in mind, let’s take a high-level look at the features Edda and Affinity tool features side by side. Note: We’ll dig into each feature in-depth in the next section.

FEATURES

Edda Software

Affinity Software

What our users say about us

“ The flexibility and customizations that Edda offers and fast response times from Support make this product great! ”

THE AFFINITY APP OR EDDA: HOW TO MAKE YOUR DECISION ?

The results you get from a deal flow management tool depend squarely on the features it has. What’s more, it’s critical to choose deal flow management software that has the features that align with your firm’s needs, structure, operations and investment approach. So, with this in mind, let’s now take a deep dive into the features that separate Edda and the Affinity app.

CRM platform

Edda is for you if...:

Edda is your choice if you seek a dealflow CRM seamlessly integrated into the broader investment landscape, linking relationships, dealflow, and portfolio data. Its robust private equity CRM functionality simplifies relationship management, offering comprehensive deal flow software.

Edda's private equity CRM software includes essential features like data capture, contact management, and relationship insights. Notably, it excels in direct in-app communication with LPs, eliminating cumbersome email exchanges.

Affinity is for you if...:

Affinity is tailored for those in search of a straightforward CRM for private equity focused on organizing and managing contacts.

As a dedicated CRM for private equity, Affinity excels in CRM functionality, making it easy to automatically capture contact information and manage relationships. Its streamlined onboarding process ensures a smooth CRM adoption.

Dealflow Management

Edda is for you if...:

Edda is your solution if you seek complete visibility in an end-to-end deal software, covering deal origination to close.

Edda streamlines your dealflow management, offering a unified platform for comprehensive oversight. Edda provides a clear view of your deal flow pipeline, optimizing efficiency from origination to close. It enables seamless collaboration by allowing you to share deals with partners and advisors within the platform.

Affinity is for you if...:

Affinity is the choice if you prioritize CRM-based dealflow management with a focus on relationship management.

Affinity's dealflow management is intertwined with its CRM functionality, automatically importing email and calendar interactions for active conversation monitoring. If your emphasis is on the relationship side of dealflow management, Affinity may be a suitable fit.

Relationship intelligence

Edda is for you if...:

Edda is the choice if you aim to automatically map connections, unveiling new opportunities and consolidating your entire network in one place.

Edda's deal tracking simplifies the process by automatically mapping connections among companies, LPs, and partners. This feature allows you to connect key players and discover hidden opportunities for introductions and investments.

Affinity is for you if...:

Affinity is the solution if you seek to neatly manage relationships and track connections for easier introductions

Affinity assists in finding opportunities for warm introductions by tracking connections between founders, investors, and other stakeholders. This functionality facilitates warm intros, moving away from reliance on cold approaches.

Dealmaking Insights & Updates

Edda is for you if...:

Edda is the right choice if you require data-backed insights to enhance investment decisions and returns.

Edda provides comprehensive dealmaking insights and updates, eliminating the need for manual processes. It enables instant calculations of company and fund IRR, offers customizable reporting for valuable insights, and automatically computes metrics such as NAV, DPI, TVPI, and more.

Affinity is for you if...:

Affinity is suitable if you are content with relationship-based reporting that offers insights related to interactions.

Affinity's dealmaking insights are closely tied to its CRM features, displaying information like outreach activity, team composition, and previous funding rounds. If you seek high-level, relationship-related deal insights, the Affinity software is designed to provide this.

Portfolio Management

Edda is for you if...:

Edda is the right choice if comprehensive portfolio management is a crucial requirement for your dealflow software.

Edda simplifies and enhances portfolio management by providing access to metrics and cap tables, monitoring portfolio company news, facilitating direct communication with founders, conducting side-by-side valuation comparisons, and more.

Affinity is for you if...:

Affinity is suitable if your top priority is relationship management, and deeper portfolio data and insights are not crucial.

Affinity's portfolio management capabilities are integrated into its CRM features, allowing you to manage your portfolio from a communication and relationship standpoint, making it convenient to contact and record interactions with portfolio companies.

Workflow Automations

Edda is for you if...:

Edda is the ideal choice if you aim to enhance the efficiency and effectiveness of your internal processes to support your fund's performance.

The platform simplifies portfolio management with features such as access to metrics and cap tables, browsing portfolio company news, direct communication with founders, and side-by-side valuation comparisons.

Affinity is for you if...:

Affinity is suitable if your primary focus is on managing relationships and the external-facing aspects of deal flow management

Edda is the preferred choice if you want to expedite your due diligence process with in-depth analysis, data, and automation, facilitating quicker and accurate decision-making

Accelerated Due Diligence

Edda is for you if...:

Edda is the preferred choice if you want to expedite your due diligence process with in-depth analysis, data, and automation, facilitating quicker and accurate decision-making.

It streamlines private equity and venture capital due diligence by providing instant access to company metrics, industry data, and insights into founders and teams, enabling a quick screening of a larger volume of deals.

Affinity is for you if...:

Affinity is suitable if you prefer a more manual approach to source and consolidate company information as part of your current due diligence processes.

Using the Affinity CRM, you can manage the human side of due diligence through company profiles and communication, allowing you to request and consolidate the necessary information during your due diligence process.

LP Portal

Edda is for you if...:

Edda is the ideal choice if you want to enhance visibility and streamline interactions with your partners, by providing easy access to all the necessary data.

Edda’s LP Portal serves as a centralized dealroom.

Affinity is for you if...:

Affinity is suitable if you are comfortable managing aspects of your partner relationships through email and other platforms in more of an adhoc manner

Affinity does not provide a dedicated portal functionality; instead, communication and reporting are managed within its CRM platform.

Edda Pricing vs Affinity CRM Pricing

Naturally, when it comes to private equity deal tracking software, price is a consideration. And the cost of your private equity deal flow software must be weighed against the features it provides. The cost of Edda and the Affinity CRM cost are customized depending on your team’s size and needs. Given this, it’s not possible to go into detail about Edda and Affinity CRM pricing in this article. This can be attained by requesting a demo of Edda or Affinity.

The key considerations in choosing a deal flow software include:

End-to-End Deal Management:

Are you looking for a comprehensive software that covers the entire deal management process, including a robust investor CRM?

Straightforward Private Equity CRM:

Or, is your primary focus on a concise private equity CRM designed for relationship management?

If your goal is a holistic solution for managing your deal flow pipeline, workflows, and investments, rather than just a standalone deal flow CRM, then Edda stands out as the best deal management software. Edda provides all the investor CRM functionalities of Affinity, with additional in-depth features for seamless deal origination, pipeline management, tracking, and relationship management within a single management tool.

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.