Edda or Allvue?

Which Private Equity Deal Management Software Best Suits Your Deal Flow Management Needs?

Congratulations on your strategic move to transition from spreadsheets to a specialized deal flow management tool. With Edda and Allvue as your top contenders, you're already on the right track! In this article, we’ll provide an in-depth analysis comparing Edda and Allvue, aiding you in making an informed decision on the optimal deal flow platform tailored to your requirements.

First, Here’s an Overview of Edda and Allvue Systems

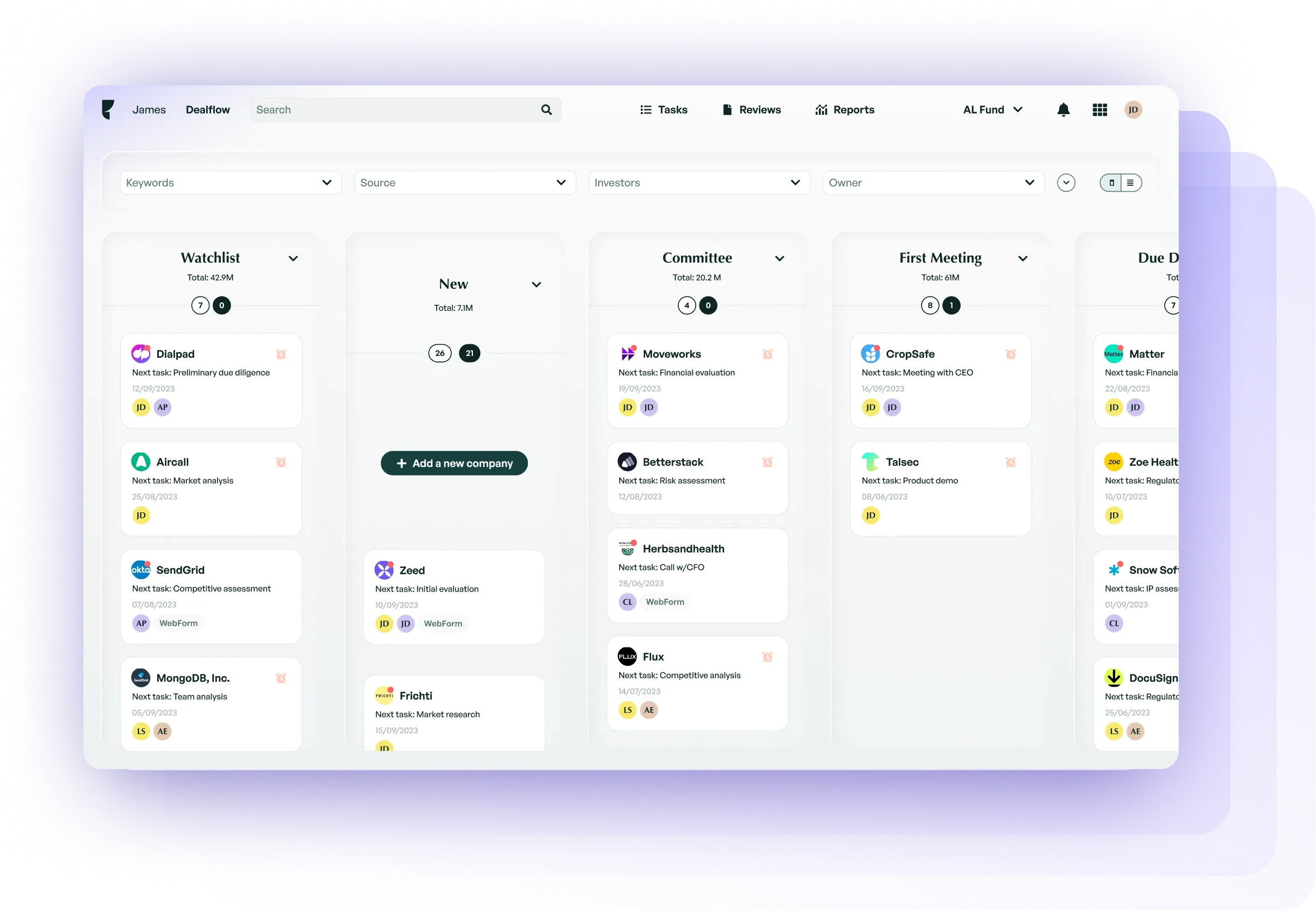

Edda Deal flow Management Software

Edda consolidates the entire investment process, providing an all-in-one platform for effective deal and relationship management. Built on the belief that enhanced visibility throughout the investment stages fosters stronger relationships and superior outcomes, Edda serves as the comprehensive deal software for your firm. Managing deal origination, pipeline, due diligence, portfolio, and investor CRM, Edda streamlines operations for leading private equity and VC firms across 40+ countries, currently overseeing over $170 billion in assets. It not only improves investment practices but also optimizes daily workflows for enhanced collaboration.

Allvue's Investment Software for Private Equity

Allvue, born from the merger of Black Mountain Systems and AltaReturn, is a versatile tool for managing, nurturing, and capitalizing on networks. It's known as a "holistic suite" for investment needs, excelling in fund accounting, financial reporting, and back-office operations.

If you prioritize streamlined fund management, detailed financial reporting, and comprehensive back-office tasks, Allvue is a good choice. However, for those focusing solely on relationship management, other platforms with a CRM focus may be more suitable.

What makes Allvue stand out is its approach to private equity. Beyond relationship management, it offers robust features like fund accounting, investment management, and portfolio monitoring, providing a good solution for modern private equity firms.

Edda and Allvue Software Features Side by Side

When choosing a dealflow management solution, focus on its features. Ensure that the chosen platform has all the functions your whole team needs.

Let’s take a high-level look at the features Edda and Allvue tool features side by side. We’ll dig into each feature in-depth in the next section.

FEATURES

Edda Software

Allvue Software

What our users say about us

“ We are truly happy with Edda and how it enables us to better monitor our performance and report to our stakeholders. Our Edda team also provides exceptional customer service and support, something we highly value. ”

CHOOSING BETWEEN THE ALLVUE APP AND EDDA: WHAT'S BEST FOR YOU?

The outcomes you achieve with a deal flow management tool are directly tied to its features. Moreover, it's essential to opt for software that matches your firm's requirements, organizational setup, operational strategies, and investment methodology. Bearing this in mind, let's explore the distinct features that set Edda apart from the Allvue app.

CRM platform

Edda is for you if...:

You need a dealflow CRM that effortlessly integrates with the investment landscape, connecting relationships, deal progress, and portfolio details

Edda's CRM offers core capabilities like data capture, contact management, and relationship insight. Its standout feature is in-app communication with LPs, streamlining email exchanges.

Allvue is for you if...:

You're looking for an efficient solution for alternative investments, particularly private equity. Allvue, born from the collaboration of Black Mountain Systems and AltaReturn, is a platform tailored for private equity.

It integrates CRM, accounting, investor portals, pipeline, and research management tools within an intuitive Microsoft-based framework, ensuring a smooth transition for your team.

Dealflow Management

Edda is for you if...:

Choose Edda if you prioritize a seamless view of your deal trajectory from initiation to conclusion, all in one platform.

Edda offers a consolidated perspective on your entire deal pipeline, supporting efficient streamlining and collaboration within your team.

Allvue is for you if...:

Opt for Allvue if you seek a comprehensive alternative investment platform integrating dealflow, portfolio management, and relationship oversight.

With Allvue you can manage relationships, fund accounting, investor & investment management, and financial reporting, ensuring transparent management within a single system.

Relationship intelligence

Edda is for you if...:

Consider Edda if you want to easily view and organize your professional network, allowing you to find new opportunities.

Edda's deal platform simplifies tracing the relationships among firms, LPs, and partners, helping you connect stakeholders and discover potential introductions and investments.

Allvue is for you if...:

Choose Allvue if you want to manage investments and understand relationships in private equity.

Allvue's platform gives insights into connections among founders, investors, and stakeholders, allowing for strategic introductions and engagements, moving away from cold pitches

Dealmaking Insights & Updates

Edda is for you if...:

Choose Edda if you want data-driven intelligence to improve investment outcomes. Edda provides a comprehensive solution for obtaining crucial insights and updates to optimize returns.

It eliminates the need for tedious manual work, offering instantaneous company and fund IRR evaluations, tailored reporting, and effortless computation of critical metrics like NAV, DPI, TVPI, amongst others.

Allvue is for you if...:

Opt for Allvue if you desire insights from the intersections of relationships and investment data.

Allvue, with its diverse functionalities offers investment analysis, outreach efforts, team composition, and historical funding stages, delivering an in-depth overview of investment activities.

Portfolio Management

Edda is for you if...:

Choose Edda if holistic asset management is crucial for your chosen software.

Edda streamlines and enhances your portfolio oversight, offering a management system that enables you to see key metrics, cap tables, portfolio company news, engagement with founders, comparative valuation analyses, and more.

Allvue is for you if...:

Opt for Allvue if you prioritize relationship-centric management, as Allvue's alternative investment solutions focus on managing relationships in the investment landscape.

Allvue excels in seamlessly connecting relationships and investment data, allowing users to effortlessly communicate and document interactions involving their investments

Workflow Automations

Edda is for you if...:

Choose Edda if you want to refine and optimize your internal operations to enhance your fund's success. Edda simplifies portfolio management by providing the key tools for oversight.

This includes insights into key metrics, cap tables, updates on portfolio company developments, engaging directly with entrepreneurs, and conducting comparative valuation analyses.

Allvue is for you if...:

Opt for Allvue if you're interested in merging relationship management with your investment operations

Allvue offers features like cloud-based fund accounting, multi-currency general ledgers, and complex process standardizations whilst also providing relationship data. Allvue therefore provides a blend of relationship focus and investment proficiency.

Accelerated Due Diligence

Edda is for you if...:

Choose Edda if you want to expedite due diligence using comprehensive data analysis and automated procedures to reach quick and precise conclusions.

Edda streamlines private equity and venture capital due diligence, providing immediate insights into company metrics, sector-specific data, and in-depth perspectives on founders and their teams. Edda enables a thorough evaluation of a greater volume of deals in a shorter timeframe.

Allvue is for you if...:

Opt for Allvue for an integrated platform that combines manual interactions and comprehensive data solutions for due diligence.

The platform's suite ensures that data from fund performance metrics to portfolio monitoring, is readily available for detailed analysis, making the due diligence process efficient.

LP Portal

Edda is for you if...:

Choose Edda for enhanced transparency and seamless engagements through straightforward access to your essential data.

Edda's LP Portal serves as a hub for external deal flow management, providing associates with in-depth insight, streamlined oversight, consolidated communication and document submissions in one place.

Allvue is for you if...:

Opt for Allvue if you prioritize an integrated experience for investors.

Allvue's Investor Portal centralizes crucial data, offering a solution for investor needs, ensuring transparency, streamlining reporting processes, and enhancing communication for effortless access and interpretation of data.

Edda vs Allvue Systems

Naturally, when it comes to a private equity deal sourcing platform, price is a consideration. And the cost of your private equity deal flow software must be weighed against the features it provides. The cost of Edda and Allvue is customized depending on your team’s size and needs. Given this, it’s not possible to go into detail about Edda and Allvue in this article. This can be attained by requesting a demo of Edda or Allvue.

When embarking on the journey of selecting the ideal deal flow software, consider these questions: Are you in pursuit of a comprehensive platform, such as Edda, which seamlessly integrates CRM with other core functionalities like deal origination, deal pipeline management, and investor relations, all housed within a single system? Or are you leaning towards a more specialized tool, akin to Allvue, which was birthed from a merger of two giants in the private equity space, and emphasizes not just CRM, but a multifarious suite of investment functionalities? As you delve deeper, if your objective is a unified software that streamlines everything from deal origination to relationship management, Edda emerges as a formidable choice. Its prowess isn't just confined to CRM; Edda serves as an intelligent confluence of features designed to optimize deal origination, pipeline management, and relationship insights.

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.