Edda or eFront?

Which Investment Tracker Software is Right for You?

Kudos on your forward-thinking decision to shift from spreadsheets to a dedicated deal flow management system. With both Edda and eFront as leading options, you're well-positioned!

Here, we offer a detailed comparison between Edda and eFront, guiding you to choose the perfect platform that aligns with your needs.

First, Here’s an Overview of Edda and eFront

Edda Deal Flow Management Software

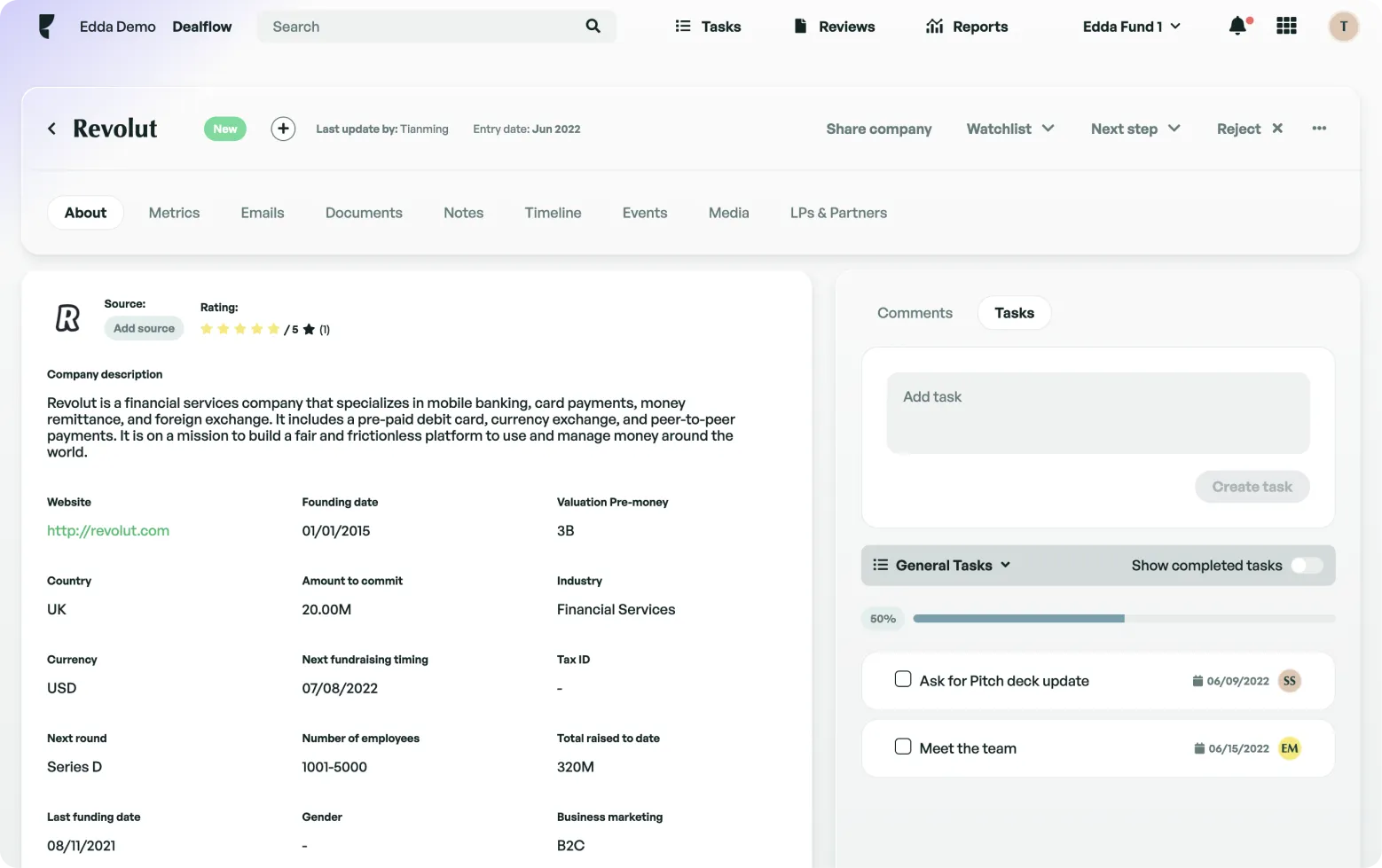

Edda, formerly known as Kushim, consolidates the entire investment tracking process into a user-friendly platform. It empowers your team to efficiently handle deals and relationships while enhancing daily collaboration. Edda's core belief is that increased visibility at every stage of the investment process leads to stronger relationships and better outcomes.

Tailored to be the comprehensive deal software for your firm, Edda covers deal origination, investment pipeline management, due diligence, portfolio management, and investor CRM. Managing over $170 billion for top private equity and VC firms in over 40 countries, Edda demonstrates its end-to-end capabilities. Beyond improving investment practices, Edda's software enhances daily workflows and operations, fostering better collaboration within your firm.

eFront Investment Software

With a rich history of innovation and leadership, eFront is a specialized alternative solution crafted for alternative investments. It seamlessly enables investors to harness, foster, and thrive on diverse portfolios, standing out as an "all-encompassing suite" aligned with your firm's investment aspirations.

If you're seeking adept deal flow optimization, dynamic fundraising capabilities, and a centralized approach to investor engagement, eFront's software could be the alternative investment management tool for you.

What sets eFront apart is its holistic grasp on alternative investments. While proficient in nurturing investor relationships, its scope extends further. With robust features like analytical dashboards, regulatory compliance tools, and comprehensive investment monitoring, eFront stands as a multi-dimensional solution suited for the evolving needs of today's alternative investment managers. However, Edda's end-to-end capabilities and focus on seamless collaboration make it the superior choice for comprehensive deal management.

Edda and eFront Software Features Side by Side

When selecting a deal flow management system, its features stand out as the primary consideration. It's vital that the deal software you choose has all the critical capabilities your team needs.

Considering this, let's compare the features of Edda and eFront at a glance. Please note: We'll delve deeper into each feature in later sections.

FEATURES

Edda Software

eFront Software

CHOOSING BETWEEN THE EFRONT AND EDDA: WHAT'S BEST FOR YOU?

The results you garner from a deal flow management system hinge on its functionalities. It's crucial to select a solution that aligns with your firm's needs, organizational structure, operational approach, and investment strategy. With this perspective, let's delve into the unique attributes that differentiate Edda from eFront.

CRM Platform

Edda is for you if...:

You're looking for a CRM that integrates seamlessly with the wider investment ecosystem, connecting your relationship networks, deal trajectories, and portfolio nuances.

Edda presents a robust CRM for venture capital specifically designed for private equity, streamlining the nuances of relationship management. Edda's CRM tailored for private equity covers essential venture capital CRM functionalities like data acquisition, contact management, and relationship insight data. Its standout feature is the in-app communication with LPs, bypassing the clutter of email exchanges.

eFront is for you if...:

You're in pursuit of a robust solution for alternative investments, particularly private equity, that simplifies processes and amplifies investor engagement.

eFront stands as a pinnacle in the alternative investment landscape. As a product of profound industry expertise and innovation, eFront provides a wide range of solutions laser-focused on the private equity sector. eFront's platform boasts an integrated approach, from CRM capabilities that align flawlessly with accounting and investor interfaces, to deal flow and analytical dashboards engineered for optimal management and insight. Built on a user-friendly infrastructure, adopting eFront ensures seamless integration into your team's workflow.

Dealflow Management

Edda is for you if...:

Consider Edda if you appreciate a seamless perspective of your deal's progression on a single platform.

Edda offers a comprehensive view of your entire deal pipeline, ensuring efficient management and facilitating smooth collaboration with associates and consultants on deals. Its user-friendly interface and streamlined approach contribute to an enhanced deal management experience.

eFront is for you if...:

If you're exploring an all-inclusive alternative investment management software, there are options like eFront.

With a focus on deal flow, portfolio oversight, and stakeholder engagement, such platforms provide a comprehensive toolkit. However, for those valuing a more tailored and focused approach to deal progression, an intriguing choice emerges, offering specialised features for efficient collaboration and clarity throughout the deal lifecycle

Relationship Intelligence

Edda is for you if...:

Consider Edda if your goal is to effortlessly identify connections, revealing hidden opportunities and consolidating your entire professional network

Edda's deal platform simplifies mapping relationships between firms, LPs, and partners, offering a user-friendly and focused approach. With this, you can seamlessly connect key stakeholders and discover untapped potentials for introductions and investments. Edda subtly stands out as an efficient and tailored choice for those prioritizing a streamlined way to navigate professional connections.

eFront is for you if...:

On the other hand, if you're looking to unravel the complex network of relationships and engagements within the alternative investment industry, platforms like eFront may be worth considering

eFront's offering provides profound insight into the nexus among stakeholders, potential investors, and existing partners. While exploring comprehensive options like eFront, individuals valuing a more specialized and focused approach to relationship mapping may find Edda an intriguing and efficient choice for their specific needs.

Dealmaking Insights & Updates

Edda is for you if...:

Consider Edda if you desire analytics-driven insights that significantly amplify investment returns.

Edda takes a comprehensive approach to accessing vital updates and insights, eliminating the need for laborious manual methods of gathering intelligence. The system instantly evaluates company and fund IRRs, generates customized reports for deeper understanding, and effortlessly calculates essential metrics such as NAV, DPI, TVPI, and more. Edda emerges as the stronger tool for those prioritizing efficient and data-driven investment insights.

eFront is for you if...:

Alternatively, in your quest for a comprehensive perspective at the intersection of data-driven decision-making and investor engagement, explore platforms like eFront.

Insight GP, renowned for its multifaceted capabilities, provides meticulous investment assessments seamlessly woven into its cutting-edge investor engagement platform. While eFront offers comprehensive features, individuals valuing efficient and impactful analytics-driven insights tailored to enhance investment returns may find a solution that aligns seamlessly with their goals.

Portfolio Management

Edda is for you if...:

Consider Edda if comprehensive asset management is crucial for your transaction software needs.

Edda offers superior portfolio tracking, allowing you to delve into essential metrics and cap tables, stay informed with updates from your portfolio firms, interact smoothly with company founders, conduct valuation comparisons, and much more. With Edda, you experience refined and elevated portfolio management that simplifies and enriches the entire spectrum of portfolio management software.

eFront is for you if...:

Alternatively, if you prioritize efficient portfolio oversight and value in-depth analysis of investment nuances, explore platforms like eFront.

At its core, eFront's portfolio management solutions emphasize unlocking the true potential of alternative investments. While eFront boasts a broad array of portfolio tools and functionalities, its essence lies in seamlessly merging data collection with investment analysis. This ensures that users can smoothly navigate and maintain a comprehensive understanding of their investment portfolios. For those valuing a refined and elevated approach to portfolio management, Edda may present itself as the preferred and superior tool for comprehensive asset management within transaction software.

Workflow Automations

Edda is for you if...:

Consider Edda if your goal is to enhance internal processes and elevate your fund's performance.

Edda simplifies the complexities of portfolio management, providing a comprehensive toolkit for portfolio supervision. It offers deep dives into vital metrics and cap tables, keeps you abreast of updates from portfolio entities, fosters smooth communication with founders, and facilitates valuation comparisons, among other features. With Edda, you can streamline and refine your workflow, ensuring efficient internal processes that contribute to the enhanced performance of your fund.

eFront is for you if...:

Alternatively, if you're focused on elevating the efficiency and accuracy of your alternative investment operations, explore platforms like eFront.

eFront revolutionizes every step of your workflow, particularly in portfolio monitoring and data analytics. Beyond mere automation, eFront showcases advanced functionalities like automated data collection, dynamic dashboards, and powerful analytical engines, ensuring that the core investment data remains central. Whether swiftly generating investor reports or enhancing operational efficiency, eFront guarantees a synergy of automated precision and investment expertise. For those seeking a refined and elevated approach to enhancing internal processes and fund performance, Edda may stand out as the preferred and stronger tool within the realm of workflow automations.

Accelerated Due Diligence

Edda is for you if...:

Consider Edda if your goal is to expedite your VC due diligence process through in-depth data analytics and automated methods for swift and accurate decision-making.

Edda simplifies the often time-consuming aspects of private equity and venture capital due diligence, providing instant access to crucial company metrics, industry-specific information, and comprehensive views on founders and their teams. This enables you to evaluate more deals effectively in less time, making it a powerful tool for those prioritizing accelerated due diligence processes.

eFront is for you if...:

Alternatively, if you place emphasis on a platform that streamlines both data-driven processes and comprehensive due diligence needs, explore platforms like eFront.

eFront, with its portfolio monitoring system, ensures comprehensive due diligence. Through its features, such as the Investee investment portal for automated data collection and the Analytical Engine, eFront provides all the essential data.

LP Portal

Edda is for you if...:

Consider Edda if you aim to enhance clarity and simplify interactions with your partners by granting them direct access to vital information.

Edda's LP Portal serves as the centralized platform for external deal flow coordination, prioritizing absolute transparency. The portal presents your partners with clear insights, improves supervision, simplifies reporting, and centralizes communication and document sharing in one cohesive space. With Edda's LP Portal, you can ensure a streamlined and transparent process for your partners, fostering efficient collaboration and communication.

eFront is for you if...:

Alternatively, if you prioritise ensuring that your investors have direct access to data whenever and wherever they need, explore platforms like eFront.

eFront's Investment Café is designed with this goal in mind. As a cloud-based portal, it aims to revolutionise investor relationship management. The platform offers a space for investors to access their information in real-time, regardless of device or location.

Edda vs eFront

In the realm of private equity software, budget plays a pivotal role. The value of your private equity deal flow software is often assessed in relation to its capabilities.

The pricing for Edda and eFront is tailored based on the unique requirements and size of your team. Due to this bespoke pricing model, specific details about Edda and eFront cannot be elaborated on in this article. For a more comprehensive understanding, it's recommended to schedule a demo for either Edda or eFront.

In choosing the optimal deal flow software, consider these things:

Are you seeking a comprehensive and holistic solution like Edda? Beyond seamlessly integrating CRM with essential functionalities like deal origination and pipeline management, Edda places a special emphasis on relationship intelligence. This ensures a profound, data-driven understanding of your investor relations, all encapsulated in one comprehensive system.

If you are drawn towards a platform rooted in the private equity domain, providing both CRM as well as an expansive set of investment tools, something like eFront could be explored.

As you explore your software needs, if prioritising relationship intelligence is crucial, Edda emerges as the preferred tool. Beyond being just a CRM, Edda represents a sophisticated array of features, supporting deal sourcing, pipeline strategy, and, most importantly, cultivate enriched, data-backed investor relations.

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.