Edda or Venture360?

Stepping beyond the confines of conventional platforms to explore the zenith of venture capital deal flow software?

With Edda and Venture360, you're unquestionably on the cusp of modern-day operational excellence.

In this guide, we’ll delve deeply into a side-by-side analysis of Edda and Venture360, two powerhouses in the venture capital software arena. This exploration will empower you with nuanced insights, enabling a discerning choice that impeccably aligns with your specific venture operations and investment management needs.

First, Here’s an Overview of Edda vs. Venture360 Deal Flow Software

Edda Deal Management Software

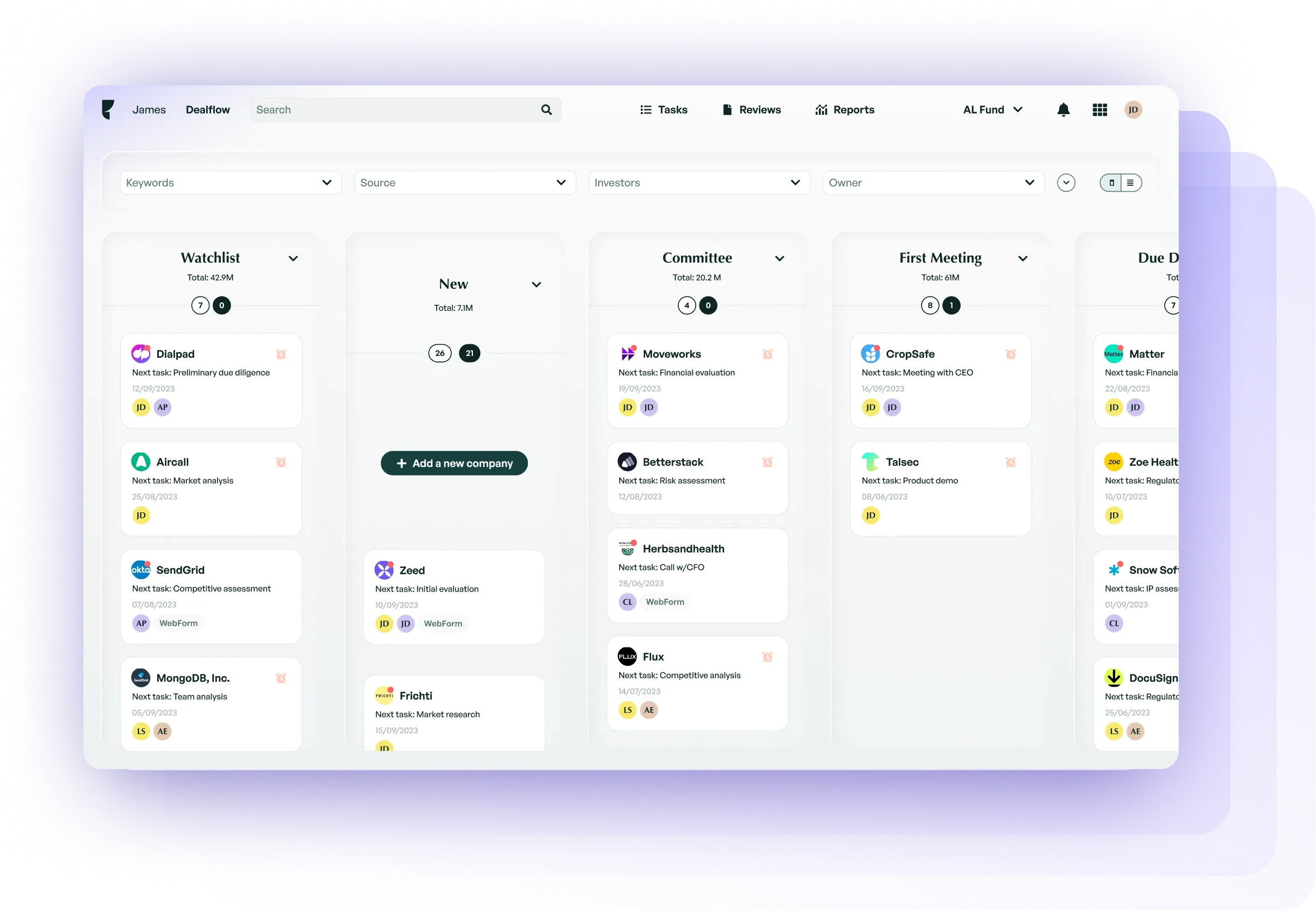

Edda's deal flow management software seamlessly merges holistic business procedures with robust relationship management, all under one digital canopy. The platform enhances team coordination, orchestrates deals, and provides relational insights, fostering unparalleled collaboration. Edda asserts that in-depth visibility across business dynamics leads to fortified relationships and enhanced results. Positioned as the quintessential tool for deal flow management, Edda navigates every facet of operations, from venture capital procurement and deal flow pipeline progression to meticulous VC vetting and portfolio monitoring, revolutionizing how ventures connect and function. With a staggering $170 billion currently channeled via Edda by elite private equity and VC firms in over 40 countries, it not only shapes investment blueprints but also recalibrates daily operational rhythms, fostering enhanced team coherence.

Venture360 Deal Flow Management Tool

Venture360's Deal Flow Management Tool seamlessly integrates relationship management and the unique nuances of venture capital operations into a unified, VC-centric platform. Meticulously crafted to smoothen every step of the investment journey, from pipeline initiation to exit, it ensures peak efficiency in cultivating relationships and refining daily operations. What sets Venture360 apart is its holistic approach to venture capital dynamics. Beyond facilitating real-time teamwork, the platform offers adaptability and robust analytical tools tailored to a venture's distinct needs and rhythms. However, Venture360's most distinguishing asset is its team—a collection of professionals deeply rooted in the venture capital landscape, always ready to provide invaluable insights and guidance. Serving both budding startups and established enterprises, their expertise has won trust globally, managing investments in over 50 countries and exceeding $210 billion in value. This vast experience underscores their unmatched capability in orchestrating deal flow and ensuring a synchronized and harmonious organizational climate

Edda and Venture360 Features Side by Side

When selecting a CRM and deal flow software, it's vital to grasp its features and potential. Your chosen software should cover all the necessary functionalities tailored to your team's needs.

In light of this, let's lay out the features of Edda and Venture360 side by side. Note: We will delve deeper into each feature in the following sections.

FEATURES

Edda Software

Venture360 Software

CHOOSING BETWEEN EDDA AND VENTURE 360 VC TECH: WHAT'S BEST FOR YOU?

The outcomes you reap from VC portfolio management software are profoundly influenced by its intrinsic capabilities. It's paramount to choose a platform that harmonizes with your organization's unique demands, structural nuances, process strategies, and investment principles. With this perspective, let's unravel the specific features that distinguish Edda from Venture360.

CRM Platform

Edda is for you if...:

Choose Edda if you're seeking a CRM system that seamlessly integrates with the investment landscape, bridging gaps between relationship intricacies, deal progressions, and portfolio nuances

Edda's refined deal flow architecture provides a powerful and user-friendly CRM designed for private equity, simplifying relationship management. It integrates all essential CRM functionalities, from data acquisition to contact oversight and relationship insights, with a notable highlight being seamless in-app interactions, reducing reliance on cumbersome email exchanges.

Venture360 is for you if...:

Opt for Venture360 if you value a comprehensive tool that, while not strictly a CRM, streamlines your entire investment process from start to finish.

Venture360 offers tools ranging from deal pipeline customization, portfolio tracking, integrated deal closing, to automated reporting, ensuring efficient management of every investment opportunity and investor relations. Recognized by numerous VC funds and individuals, Venture360's trusted global back-end workflow process emphasizes both the venture back office and the front end of the investment journey. Combined with an expert service team, this ensures you have both the tools and support necessary for success in the venture capital landscape.

Dealflow Management

Edda is for you if...:

Choose Edda if you desire a comprehensive vantage point on the lifecycle of your deals, from initiation to culmination, all within one unified system.

Edda’s venture capital software offers all-encompassing insight into your entire deal pipeline, charting its journey from inception to closure for optimum streamlining and heightened productivity. With Edda, collaborating on deals with teammates and consultants is effortlessly streamlined.

Venture360 is for you if...:

Choose Venture360 if you're in pursuit of an advanced solution dedicated to refining your deal flow management, ensuring seamless deal tracking, and providing expert support.

Venture360, built by seasoned ex-VCs specifically for VC firms, angel investor networks, and family offices, stands as a testament to expertise. Central to its design is the emphasis on deal flow, offering a complete view over your deal progression—from automating investor relations and integrating deal closures to portfolio oversight and real-time analytics.

Relationship Intelligence

Edda is for you if...:

Choose Edda if you're striving to effortlessly traverse and decipher complex links, revealing hidden potentials and unifying your complete business network

Edda's platform illuminates intricate relationships among various stakeholders, such as firms, LPs, and partners. Armed with these insights, you can seamlessly connect essential contacts and discover fresh pathways for capital initiatives and networking opportunities.

Venture360 is for you if...:

Choose Venture360 if you're seeking an all-encompassing platform built by industry insiders, ensuring a firm grip over every nuance of venture capital relations

By streamlining the entire investment process, from deal pipeline to portfolio tracking, Venture360 keeps you consistently informed and engaged with your investors. This enables you to cultivate and manage relationships with a level of acuity and precision that only industry veterans can provide, ensuring you never miss out on a vital connection or investment opportunity.

Dealmaking Insights & Updates

Edda is for you if...:

Choose Edda if you value an analytic-driven approach to optimize your investment strategies and maximize returns

Edda's platform provides a bird's-eye view of essential updates and insights to enhance your investment decisions. Their sophisticated system promptly evaluates company and fund IRR, crafts bespoke reports to unearth crucial intelligence, and rapidly calculates essential metrics such as NAV, DPI, TVPI, and more.

Venture360 is for you if...:

Choose Venture360 if you seek a holistic solution that combines expert-driven insights with a comprehensive software suite, tailoring your deal-making process

Venture360 stands out as a 360-degree service firm dedicated to the venture capital landscape. With expertise in everything from fund formation and investor relations to integrated deal closing and automated reporting, they bring your entire investment process under one roof.

Portfolio Management

Edda is for you if...:

Choose Edda if you desire comprehensive asset oversight seamlessly integrated into your deal software.

Edda’s VC portfolio management tools offer an unparalleled venture capital portfolio management experience, facilitating deep dives into crucial metrics, real-time updates from portfolio companies, effortless engagement with entrepreneurs, relative value analyses, and more. Edda simplifies and enhances every dimension of portfolio oversight, ensuring you're always a step ahead.

Venture360 is for you if...:

Choose Venture360 if you're looking for a blend of cutting-edge technology and expert-driven insights to elevate your portfolio management

Venture360 provides a holistic solution to your VC portfolio management needs, allowing you to track investments, monitor performance, and automatically report information to LP's.

Workflow Automations

Edda is for you if...:

Choose Edda if you desire to refine your internal operations and hand over the routine facets of investment management to automation.

Edda demystifies and tackles the intricacies of deal oversight and private equity portfolio management. Through its sophisticated tools and automation capabilities, Edda ensures timely alerts, efficient communication with key parties, and straightforward evaluation of investment opportunities. Opt for Edda to automate your entire investment experience, saving time and mitigating the risk of human errors.

Venture360 is for you if...:

Choose Venture360 if Venture360 is not merely a software; it's an embodiment of deep industry insights and dedication.

From its all-encompassing services such as streamlined investor onboarding, continuous AML compliance monitoring, and integrated deal-closing mechanisms to robust portfolio tracking, Venture360 offers an end-to-end solution.

Accelerated Due Diligence

Edda is for you if...:

Choose Edda if you aim to expedite due diligence activities, tapping into a reservoir of rich data analytics and automated procedures to make timely and precise judgments.

Private equity and VC due diligence can often stretch timelines. Edda’s venture capital due diligence tools revolutionize this landscape by granting immediate insights into essential company metrics, data pertinent to specific industries, and exhaustive evaluations of founders and their respective teams. This capability allows you to traverse through a broader spectrum of deals with remarkable efficiency.

Venture360 is for you if...:

Choose Venture360 if you're seeking an all-encompassing platform that integrates superior tech capabilities with seasoned VC wisdom, offering a 360-degree service approach to refine every step of your due diligence.

Venture360 isn't just another software; it embodies a fusion of industry-leading tech solutions with a dedicated team of experts who've been in the VC trenches. From the formation of your next venture capital fund or SPV, ensuring seamless investor relations, to providing an integrated deal-closing framework, and guaranteeing pristine portfolio tracking - Venture360 ensures no stone is left unturned.

LP Portal

Edda is for you if...:

Choose Edda if you seek to enhance transparency and streamline communication with your partners by providing them with direct access to essential data. Edda's LP Portal acts as a primary hub for managing external deal flows.

Prioritizing transparent communication, the portal offers unparalleled visibility to your partners, bolsters oversight, eases the creation of reports, and consolidates communication and document exchange in a unified platform.

Venture360 is for you if...:

Choose Venture360 if you're looking for a comprehensive platform that effortlessly integrates the intricacies of LP management with state-of-the-art technology, bolstering transparency and facilitating seamless communication with your partners

Venture360’s LP management software is meticulously designed to serve as a beacon of transparency and ease of use. From real-time capital accounts, automated K-1s, financial statements, to a dedicated login portal for LPs and investors, every touchpoint is designed to offer visibility.

Edda vs Venture360 Pricing Comparison

Naturally, when it comes to private equity deal tracking software, price is a consideration. And the cost of your private equity deal flow software must be weighed against the features it provides. The cost of Edda and the Venture360 CRM cost are customized depending on your team’s size and needs. Given this, it’s not possible to go into detail about Edda and Affinity CRM pricing in this article. This can be attained by requesting a demo of Edda or Venture360.

When exploring venture capital deal flow software, consider the following: Are you inclined towards an integrated solution like Edda, seamlessly blending CRM functionalities with overarching business operations? Do you desire a platform offering a comprehensive suite, from deal initiation and pipeline management to a unified system for relationship insights and meticulous due diligence?

Alternatively, does Venture360's focus on real-time collaboration and adaptability better align with your vision? A platform not confined to traditional CRM boundaries but expanding them, enabling intricate customization and fostering a more dynamic rapport with data and deal flow management?

Digging deeper into specifics, if your aspirations center around a CRM system that not only consolidates diverse business tasks but also magnifies the essence of relationship management, Edda emerges as a formidable contender. It goes beyond CRM capabilities, presenting features meticulously curated to facilitate deal trajectories, bolster pipelines, and unveil deeper relational insights.

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.