Edda or Zapflow?

Which Deal Management Software Best Suits Your Deal Flow and Portfolio Needs?

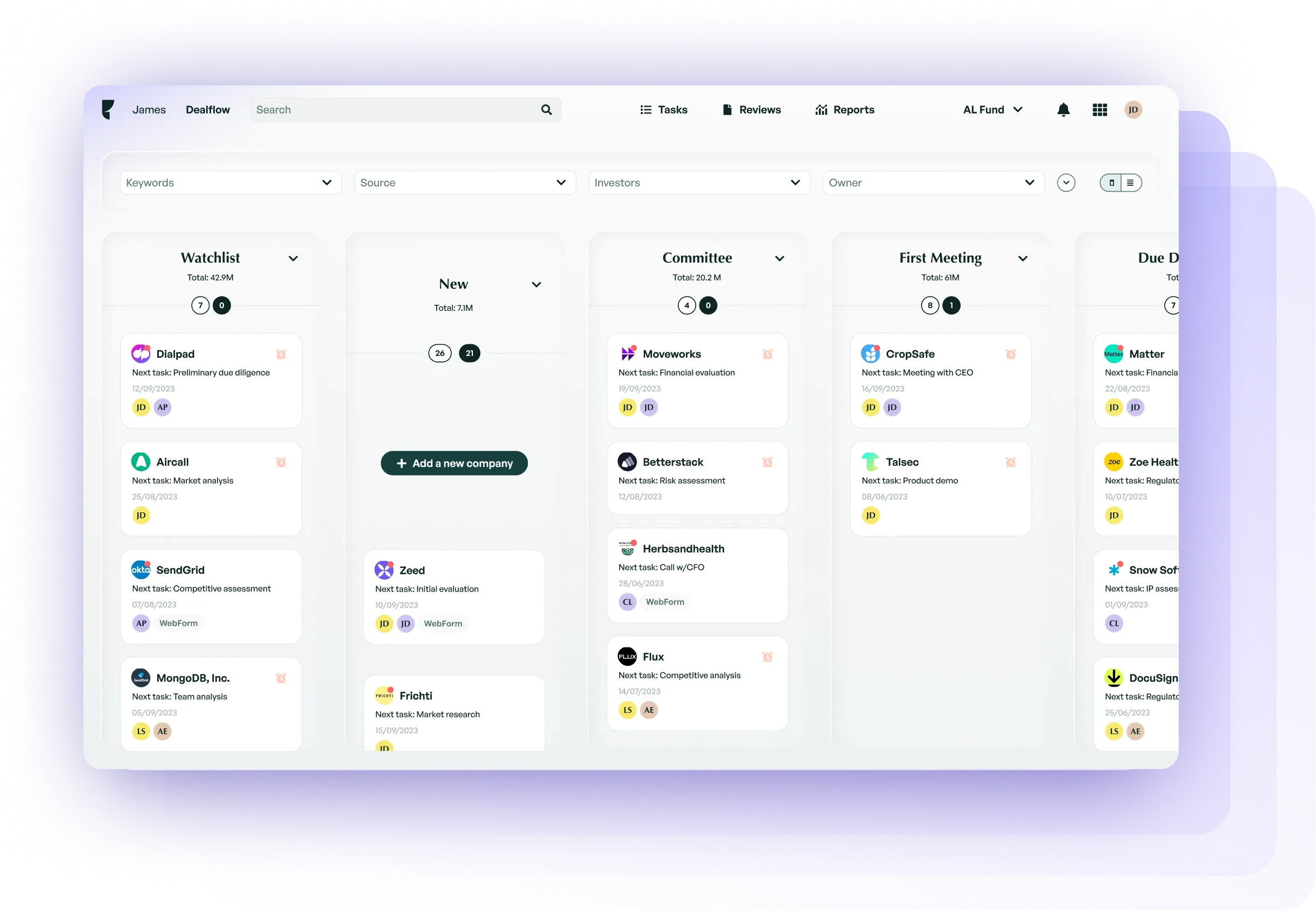

Steering away from traditional methods and into the domain of specialized investment management software? With Edda and Zapflow’s deal platforms emerging as leading choices, you're certainly advancing towards modern efficiency. In this guide, we’ll delve into a detailed comparison between Edda and Zapflow, two venture capital portfolio management software solutions, equipping you with the insights required to pinpoint the platform that aligns seamlessly with your unique investment management necessities.

First, Here’s an Overview of Edda and Zapflow Deal Flow Management Tool

Edda Deal Flow Management Software

Edda consolidates the entire investment process in one place, enhancing your team's ability to oversee deals, nurture relationships, and optimize day-to-day collaboration. Built on the belief that heightened visibility throughout the investment process fosters stronger relationships and better results, Edda serves as the comprehensive deal software for your firm.

Covering deal origination, pipeline management, due diligence, and VC portfolio monitoring and management, Edda simplifies your operational and investment processes. Over $170 billion is currently managed through the platform by leading private equity and VC firms in 40+ countries, attesting to its end-to-end capabilities. Beyond transforming investment practices, Edda's deal software streamlines daily workflows and operations, promoting improved collaboration.

Zapflow Deal Flow Management Software

Zapflow unifies the entire investment cycle in one platform, empowering effective oversight of deals, relationships, and daily collaboration. It's crafted on the belief that transparency in the investment cycle cultivates strong partnerships and superior outcomes.

Designed as your firm's all-in-one deal software, Zapflow covers deal initiation, pipeline management, due diligence, portfolio oversight, and investor CRM, streamlining both operational and investment processes. Currently managing over $170 billion for top-tier private equity and VC entities in 40+ countries, Zapflow not only elevates investment strategies but also simplifies daily tasks, fostering improved teamwork.

Edda and Zapflow Software Features Side by Side

When selecting a deal flow management tool, the most critical consideration is its capabilities. It's vital to choose a system that integrates all the necessary features your team needs. Considering this, let's compare the functionalities of Edda and Zapflow at a glance. Note: We'll delve deeper into each feature in the subsequent section.

FEATURES

Edda Software

Zapflow Software

What our users say about us

“ Edda has improved and organized my teams daily work activities including analyzing portfolio and investment performance, presenting data to our partners and communicating with our companies.”

CHOOSING BETWEEN ZAPFLOW AND EDDA: WHAT'S BEST FOR YOU?

The results you garner from a deal flow management tool hinge on its capabilities. It's vital to choose software that aligns with your firm's needs, organizational structure, operational approaches, and investment strategies. With this perspective, let's delve into the unique features that differentiate Edda from Zapflow.

CRM platform

Edda is for you if...:

Choose Edda for your CRM needs in deal flow if you want seamless integration with the broader investment landscape, connecting relational dynamics, deal progress, and portfolio specifics.

Edda covers all essential CRM features, including data capture, contact management, and relationship insights. Its standout feature is the streamlined in-app interactions with Limited Partners (LPs), eliminating the need for complex email conversations.

Zapflow is for you if...:

On the other hand, opt for Zapflow if you're looking for a comprehensive CRM solution customized for alternative investments, ensuring improved stakeholder communication and streamlined operations

Zapflow, designed for the unique intricacies of the investment sector, prioritizes efficient operations and clear communication among stakeholders. By emphasizing stakeholder engagement and simplifying investment workflows, Zapflow equips your team to manage investments effectively.

Dealflow Management

Edda is for you if...:

Choose Edda if you want a seamless perspective on your deal's entire journey, from initiation to conclusion, all within one platform.

Edda offers a comprehensive view of your entire deal pipeline, mapping its progress from start to finish for maximum efficiency. Collaborating on deals with colleagues and advisors is effortless with Edda.

Zapflow is for you if...:

Opt for Zapflow if you seek a solution that excels in managing alternative investments, especially in private equity.

Zapflow streamlines operations and enhances stakeholder communication, providing a dedicated approach to deal flow management. The platform ensures all stakeholders are well-informed, and every deal is transparently managed, equipping professionals with the ne

Relationship intelligence

Edda is for you if...:

Choose Edda if you want to effortlessly map connections, revealing hidden opportunities and consolidating your entire professional network.

Edda's deal system simplifies identifying connections between firms, LPs, and partners, allowing you to seamlessly connect key players and discover untapped pathways for introductions and capital ventures.

Zapflow is for you if...:

Opt for Zapflow if you seek a comprehensive platform providing insights into your investment network while ensuring efficient relationship management.

Zapflow's CRM capabilities not only ensure multivariable associations and network management but also enrich your data for a clear view of your investment landscape. By focusing on these details, Zapflow allows you to move beyond basic interactions, creating a networked ecosystem that fosters growth and successful investments.

Dealmaking Insights & Updates

Edda is for you if...:

Opt for Edda if you seek superior analytics-backed insights to enhance investment results and returns.

Edda provides a comprehensive approach to accessing pivotal updates and insights for maximizing gains. Bid farewell to manual data efforts as Edda instantly evaluates company and fund IRR, tailors reports for key understandings, and effortlessly calculates vital figures such as NAV, DPI, TVPI, and more.

Zapflow is for you if...:

In contrast, consider Zapflow if you're looking for a platform that combines investment activities with relationship management

However, for an advanced and superior choice, Edda stands out with its unparalleled analytics and comprehensive dealmaking capabilities, ensuring that each decision is well-informed and results in strengthened relationships.

Portfolio Management

Edda is for you if...:

Choose Edda if you consider comprehensive asset oversight crucial for your transaction software needs.

Edda delivers refined and elevated portfolio management, allowing you to delve into crucial metrics and cap tables, stay updated on portfolio entities, interact effortlessly with company founders, conduct comparative value assessments, and explore even further. Edda simplifies and enriches the entire spectrum of portfolio management software.

Zapflow is for you if...:

Opt for Zapflow if your priority is stakeholder communication within the private equity sector. While explicit capabilities around relationship intelligence are not confirmed for Zapflow, its platform is designed with a focus on alternative investments.

This ensures streamlined operations and enhanced stakeholder communication, providing a robust foundation for relationship management in the investment landscape. However, for superior and comprehensive portfolio management, Edda stands out with its enriched features and refined capabilities.

Workflow Automations

Edda is for you if...:

Choose Edda if your objective is to enhance and streamline internal processes, elevating your fund's success. Edda simplifies portfolio management complexities, providing a suite of tools that make oversight effortless.

Gain insights from vital metrics and cap tables, stay updated on news from portfolio companies, communicate directly with founders, and conduct comparative valuation studies. Edda sets the stage for a more efficient workflow, making it the superior choice for optimizing internal processes.

Zapflow is for you if...:

On the other hand, consider Zapflow if your priority is seamless stakeholder communication within the realm of alternative investments.

While Zapflow's platform emphasizes stakeholder relationships in the alternative investment sector and enhances communication channels in the private equity landscape, it's crucial to note that Edda offers a more comprehensive suite of tools for streamlined portfolio management, making it the preferred choice for elevating fund success through internal process enhancements.

Accelerated Due Diligence

Edda is for you if...:

Choose Edda if your aim is to expedite due diligence tasks, leveraging in-depth data analysis and automated processes to make accurate decisions quickly.

Due diligence in private equity and venture capital can be time-consuming, but Edda streamlines the process by providing instant access to company metrics, industry-related data, and comprehensive reviews of founders and their teams. This enables you to assess a broader range of deals more efficiently, making Edda the superior choice for accelerated due diligence.

Zapflow is for you if...:

On the other hand, consider Zapflow if you're seeking a holistic tool that effortlessly integrates various aspects of the investment process into one cohesive platform

While Zapflow enhances daily collaboration efforts and emphasizes transparency throughout the investment cycle, it's important to note that Edda offers a more specialized and efficient solution for accelerating due diligence with its focus on in-depth data analysis and automated processes. Edda stands out as the preferred choice for making quick and accurate decisions during the due diligence process

LP Portal

Edda is for you if...:

Choose Edda for heightened transparency and simplified interactions with partners through its LP Portal.

This central gateway offers unmatched visibility, strengthened monitoring, simplified report generation, and centralized communication and document sharing. Edda's focus on clear communication makes it the superior choice for seamless partner interactions.

Zapflow is for you if...:

Consider Zapflow if you prioritize nurturing the GP & LP relationship with an emphasis on direct engagement and real-time data access.

Zapflow's LP Portal serves as a comprehensive hub for all LP necessities, championing transparency, simplifying reporting, and bolstering communication. While both options have valuable features, Edda's LP Portal stands out for its focus on transparency and streamlined partner interactions.

Edda vs Zapflow Deal Flow Software Pricing Comparison

Certainly, pricing plays a pivotal role when selecting deal flow management software. It's crucial to balance the cost of your private equity deal flow software with the benefits it offers. The pricing for both Edda and Zapflow is tailored based on your team’s specific size and requirements. Due to this, we can't delve deep into the exact costs of Edda and Zapflow in this piece. For more detailed information, it's recommended to request a demo for either Edda or Zapflow.

Are you in search of a comprehensive solution like Edda? Edda meticulously integrates investor relations CRM with crucial functionalities, covering deal origination, pipeline management, and refined investor relations, all within a unified platform.

On the other hand, if you lean towards a platform like Zapflow, grounded in transparency throughout the investment cycle, it prioritizes not only CRM but also emphasizes fostering strong partnerships and maximizing investment outcomes.

For a consolidated platform that enhances everything from deal initiation to robust CRM relationship intelligence, Edda emerges as a distinguished contender. Its excellence extends beyond CRM, embodying a nexus of features designed to finesse deal orchestration, streamline pipeline navigation, and amplify relationship insights.

Interested? Get started with

Take control of your deals, collaborate with your team, and invest to create greatness.